BTC Reversing Lower

Following a strong start to the week (and year) as BTC gapped higher on Monday, the futures market is now reversing lower and has closed that gap. The selling comes amidst weaker risk sentiment generally as traders monitor various geopolitical uncertainties early in 2026. The latest ETF flow data reflects this uncertainty among investors with net outflows of just under half a billion Dollars from BTC ETFs yesterday. While this selling continues, BTC should remain under pressure near-term as USD continues to push higher on safe-haven demand.

Fed Outlook & Risk Appetite

Looking ahead, the near-term outlook for BTC looks murky. With the Fed widely expected to keep rates on hold until at least March, and global geopolitical risks continuing to dominate news-flow, there is room for BTC to drift lower if we see deeper risk aversion setting in. However, any dovish repricing in the US rates outlook could quickly see risk assets spiking higher again. Tomorrow’s NFP release will be the first key input to monitor with any downside surprise likely to see Fed easing expectations lifting higher. Additionally, any easing in geopolitical tensions should also feed into better demand for BTC and risk assets generally, with USD likely to soften in such a scenario. With that in mind, incoming news flow will be closely watched near-term. Obviously, any uptick in tensions raises the risk of a deeper push lower as traders scale back riskier positions.

Technical Views

BTC

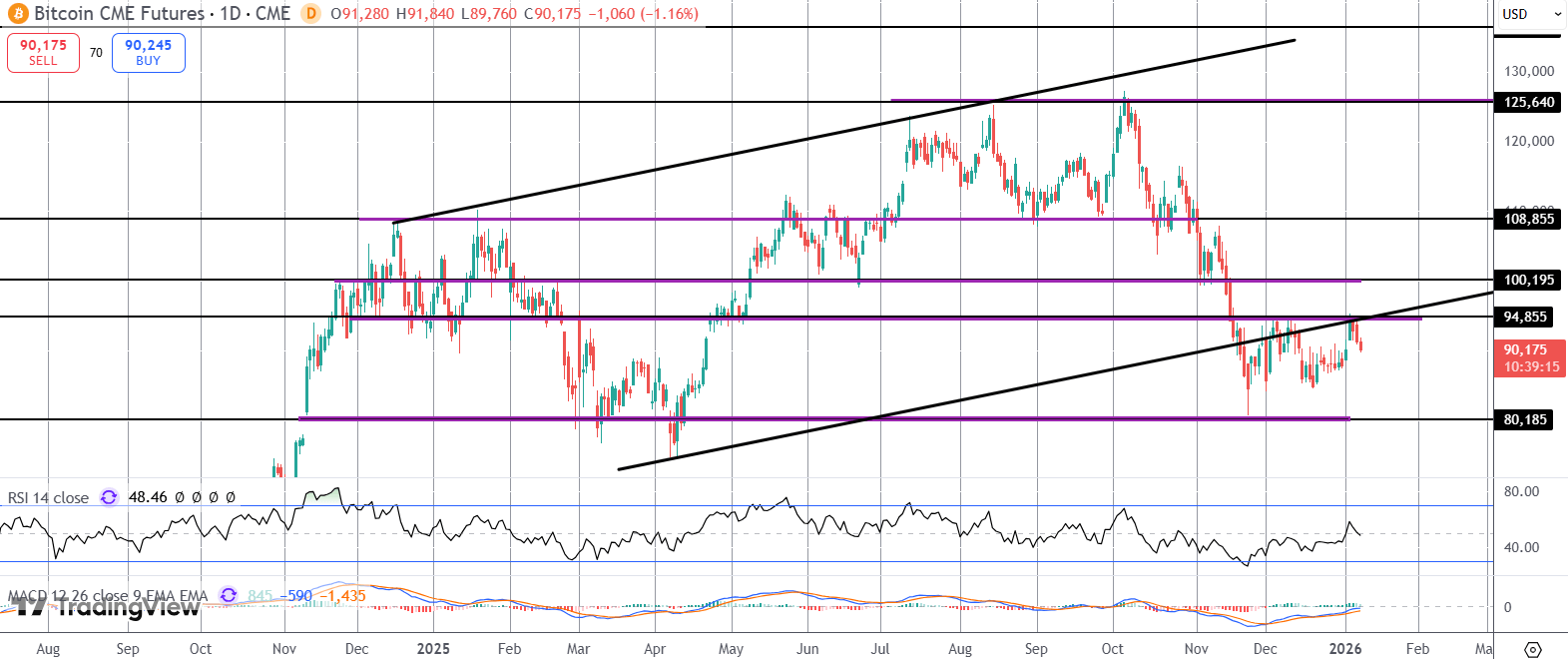

For now, the market remains capped by the broken bull channel lows and $94,855 resistance. While this area holds, risks of a fresh push lower are seen with the $80,185 level the main support zone to note. Topside, a break back above the channel lows will turn the focus to a retest of the $100 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.