Coinbase Shares Rally Following Q2 Beat

Coinbase Beats Q2 Forecasts

Shares in crypto broker Coinbase are trading higher ahead of the open today on the back of better-than-forecast Q2 results yesterday. The company has come under a lot of pressure recently amidst the ongoing SEC action against the company, as well as market speculation regarding the health and future of the company. However, yesterday’s results provided a solid counter argument to bears. EPS was reported as -$0.42 against the expected -$0.75 the market was looking for. Revenues also came in above expectations at $707.911 million vs $627.311 million expected.

Optimistic Over Q3 Results

Looking ahead, the firm was optimistic over its projected performance for the year as a whole. While trading volumes have decreased significantly recently, so too have the company’s costs due to labour reorganisation and other cost cutting initiatives. In terms of figures, the company expects to bring in at least 300 million in revenue over Q3.

The recent risk off tone to markets has weighed on Coinbase shares recently. The tech sector as a whole has been under pressure, adding to bearish sentiment. However, today’s US labour data holds the potential to drive a shift in sentiment if we see USD trading lower on the back of the results.

Technical Views

Coinbase

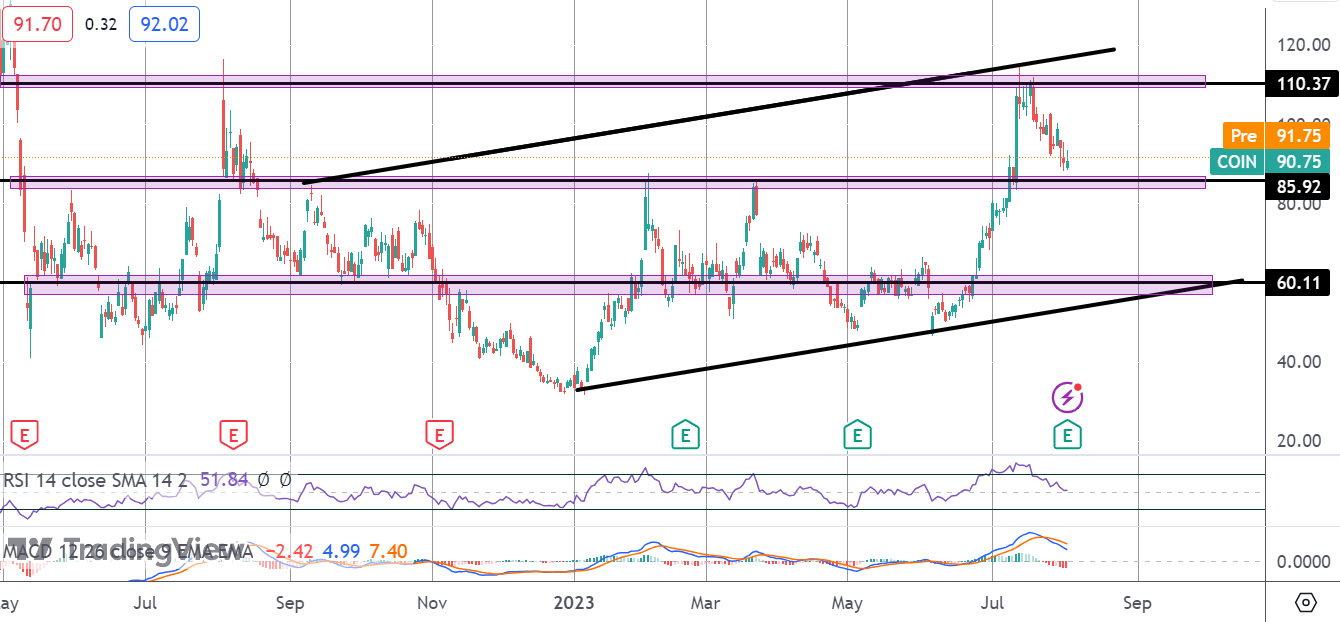

The failure at the 110.37 level has seen the market trading back down towards the 85.92 level. While still within the broad bullish channel, the focus remains on further upside while that support level holds. If we break back below there, 60.11 is the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.