Copper Poised to Breakout?

Copper Rebounds

Price action in the copper futures market is looking interesting here with the strong reversal off yesterday’s lows and subsequent rally today, suggesting that we could be on the verge of a bullish breakout here. Prices had been lower this week initially, linked to weak US and Chinese manufacturing data as well as fresh uncertainty over trade negotiations between the two countries, before the recovery yesterday. Part of this looks likely driven by stronger US jobs data (JOLTS jobs beat estimates) and the speculation now that we might be in for an upside surprise in the NFP data on Friday. A better near-term outlook on the US economy should help copper prices here, particularly given the fresh uncertainty around the US trade war.

Tariff Fears Driving Copper Higher

Indeed, similar to the dynamic we saw earlier in the year, it seems that this trade uncertainty is helping to drive copper prices higher. Fears of fresh supply strain amidst higher tariffs, as well as front running of demand ahead of any news tariffs, means that copper prices have plenty of room to move higher here. News this week that the Trump plans to double steel and aluminium tariffs as of today, should put greater strain on supply chains in the metals industry, keeping copper prices supported into Friday’s US jobs data.

Technical Views

Copper

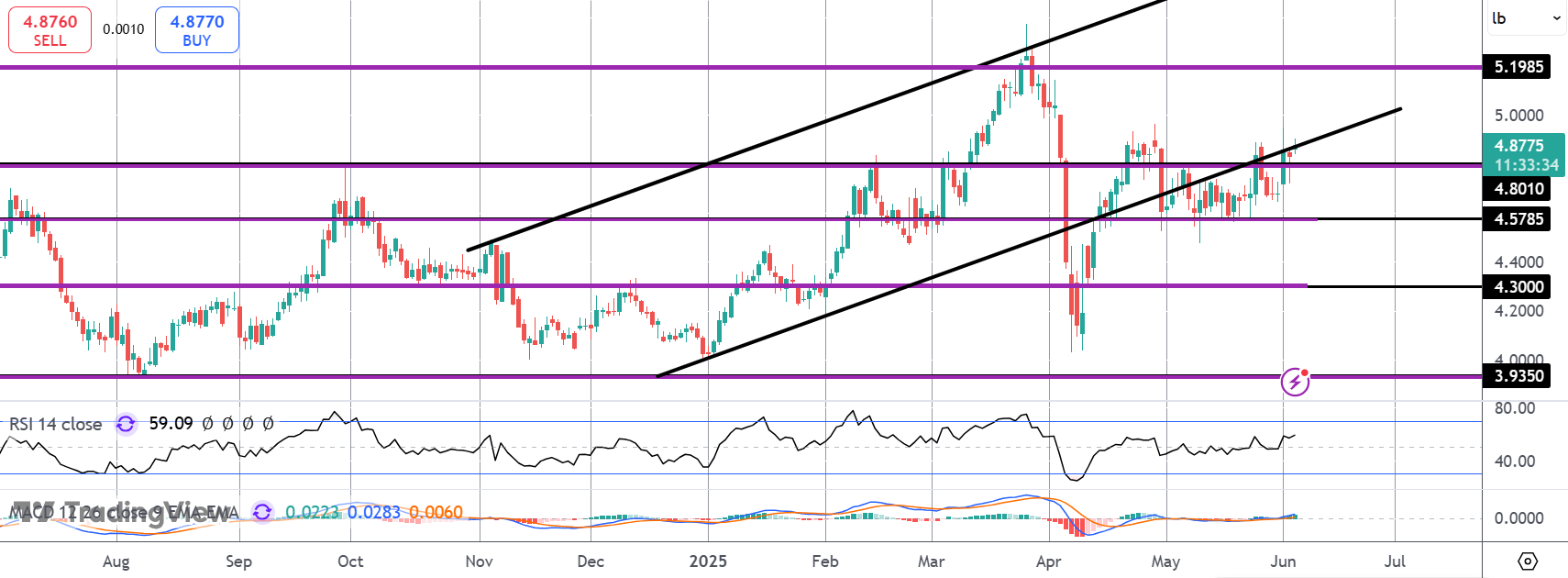

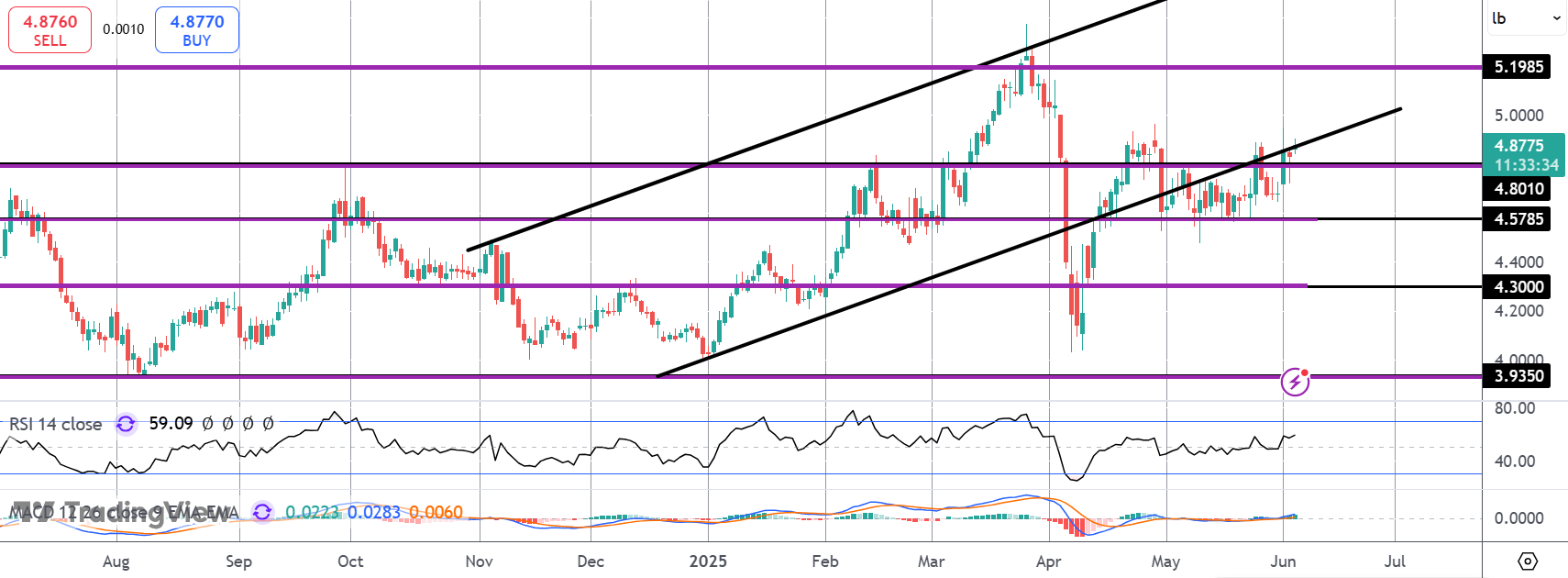

Copper prices have broken back above the 4.8010 level midweek with price now retesting the underside of the broken bull channel. With momentum studies pushing higher, focus is now on a continuation higher and a fresh test of the 5.1985 level next. To the downside, 4.5785 remains the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.