Copper Slips on US/China Trade Comments

Copper On Watch Near Highs

Copper prices are back in the green so far today, following a pullback from the April highs yesterday. The metal has rebounded firmly in recent weeks with the futures market surging by more than 20% off the April lows. The recovery this month has come despite soaring US tariffs on China and subsequent countermeasure moves and has been largely linked to supply shortages out of Chile as well as soaring US premiums ahead of tariffs coming into play. A heavily weakened US Dollar has also helped underpin demand, creating further pressure on supply chains.

US/China Trade in Focus

This week, we’ve seen a pause in the copper rally due to uncertainty over US/China trade relations. Comments from Trump and Bessent earlier in the week, suggesting that tariffs on China could soon come down, saw a fresh rise in risk appetite leading copper prices to highs. The potential for a scaling of back of US/China tariffs is seen as a major bullish catalyst for copper prices. However, subsequent comments from China (that it is only willing to negotiate if Trump stops all future threats) were seen as less encouraging.

Flip Flopping From US

Furthermore, on the back of the positive market reaction, Bessent clarified that no tariff reductions had yet been discussed and no formal proposals were in place. These comments were seen dampening the bullish tone leading to the decline we saw from yesterdays highs. Looking ahead, copper prices look vulnerable to a further pullback if rhetoric from Trump turns more hostile again. However, if Trump remains calm and we start to hear more from the US on the prospect of cutting China tariffs, this should drive copper back up.

Technical Views

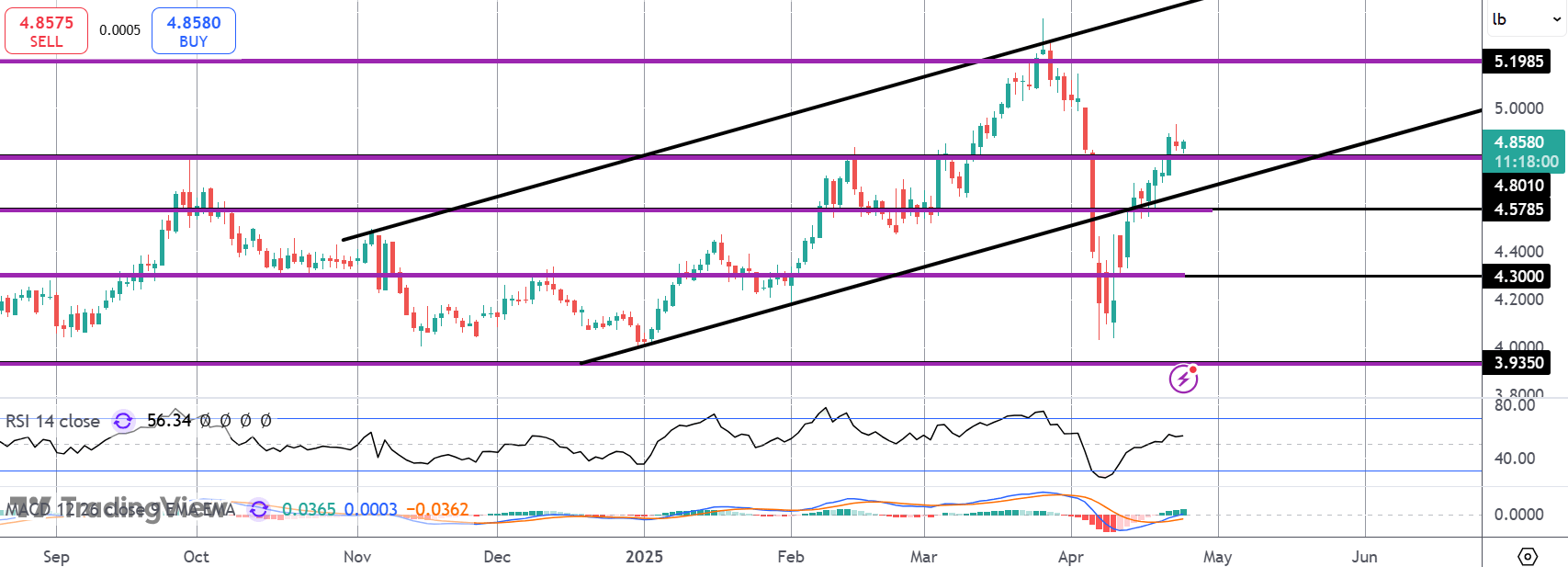

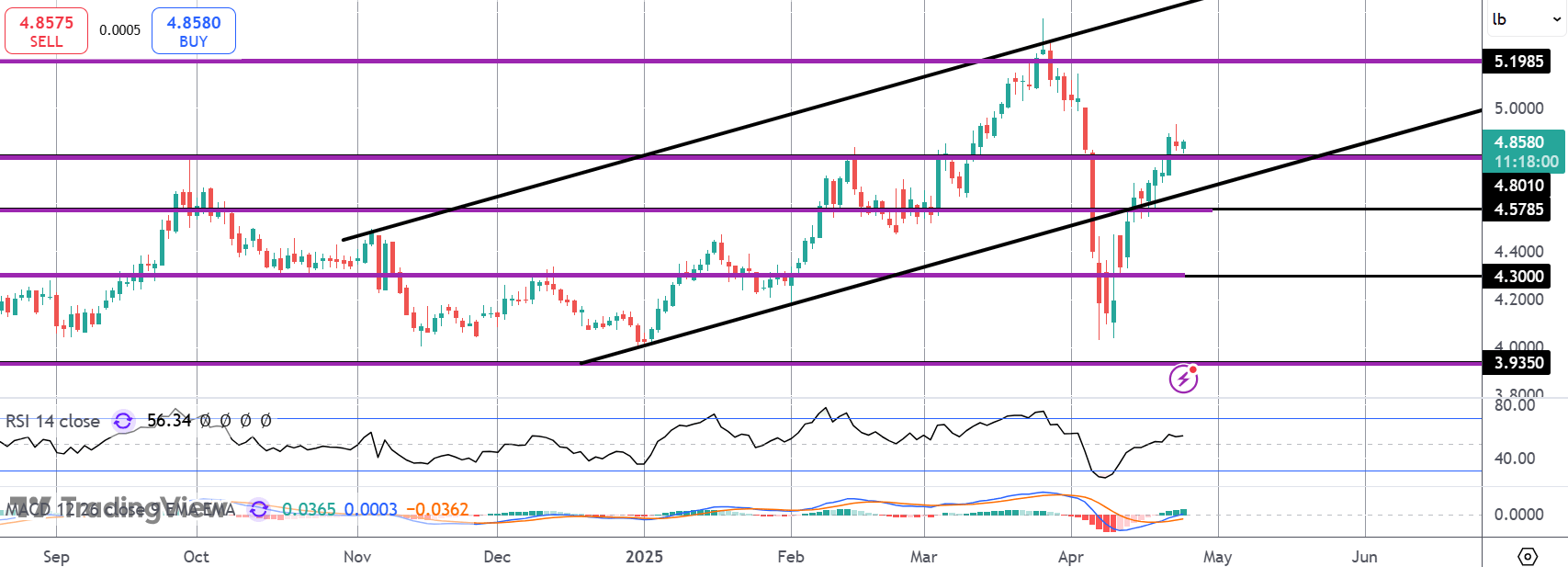

Copper

The rally in copper has seen the market breaking back into the bull channel and above the 4.8010 level. With momentum studies bullish, focus is on a return to the 5.1985 highs while price stays in the bull channel. Below there, 4.5785 is the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.