US/Iran Threat Driving Crude

Crude prices continue to push higher midweek with bullish momentum starting to build firmly here. The bullish channel break has seen price reversing above the December highs, signalling potential for a much higher push near-term if the backdrop remains supportive. On that front, the key driver behind current buying is the growing geopolitical risk around Iran and the threat of a US military strike. Trump has warned repeatedly that the US will use military force if conditions don’t improve and with state violence against protesters continuing, despite US sanctions this week, the threat of military action remains high. Iran has warned that any US strike will be met with counter action against nearby US bases and, as such, a full scale conflict cannot be ruled out.

Near-Term Volatility Risks

For now, the situation in Iran remains the key driver for oil prices and the rally is expected to continue while tensions remain elevated. Any news of an uptick in violence or that the US is preparing to use military force should see oil firmly higher near-term and as such, traders should be wary of volatility risks. Given Iran’s status as one of OPEC’s top producers, the threat of major supply disruption is a significant upside risks for prices near-term.

Technical Views

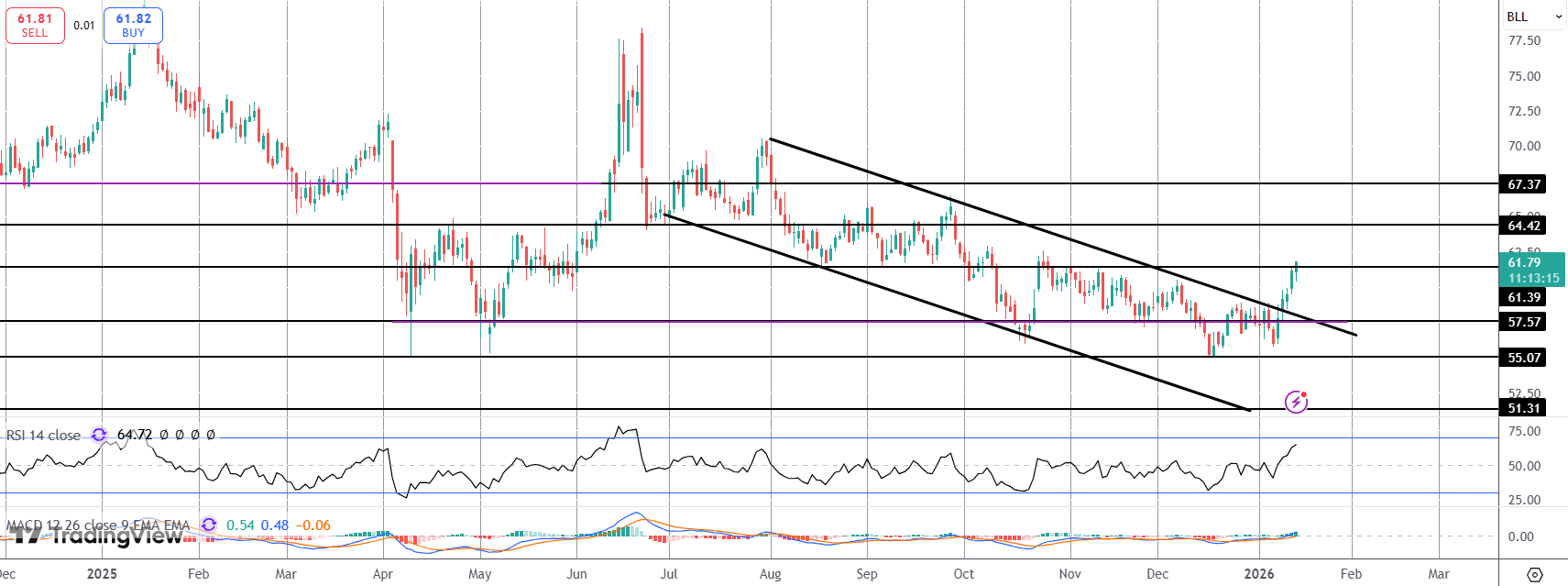

Crude

The rally in crude has seen price breaking out above the bear channel from summer 2025 highs and above the local December highs. Price is now probing above 61.39 and with momentum studies bullish, focus is on a continuation higher here with 64.41 the next bull target to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.