Crude Plunges on Weak China Demand & Trump Fears

Crude Collapsing

Oil markets are turning heavily lower as we kick of the new week with crude futures down sharply through early European trading on Monday. A strong US Dollar and the prospect of renewed trade wars under Trump 2.0 are fuelling a bearish shift in sentiment among crude traders. News of a sharp drop in demand from China is adding to bearish pressure on Monday. Saudi crude delivered to China is forecast to fall to around 36 million barrels in December. This marks a second consecutive month of declines in that data which is now at its lowest level since July. On the back of the recent wave of Chinese stimulus seen, the weakness in demand is a worrying sign that near-term prospects remain skewed to the downside.

USD On Watch

Looking ahead this week, movements in the US Dollar will be key for oil. With the greenback rallying in response to Trump’s re-election, traders will be watching incoming US inflation data on Wednesday. Any stickiness or fresh upside should see Fed easing expectations weakening heavily, further supporting USD and pulling crude lower. Additionally, any headlines regarding Trump’s proposed trade policies and tariff plans are likely to see oil prices come under heavier selling pressure as the market prepares for Trump to resume office in January.

Technical Views

Crude

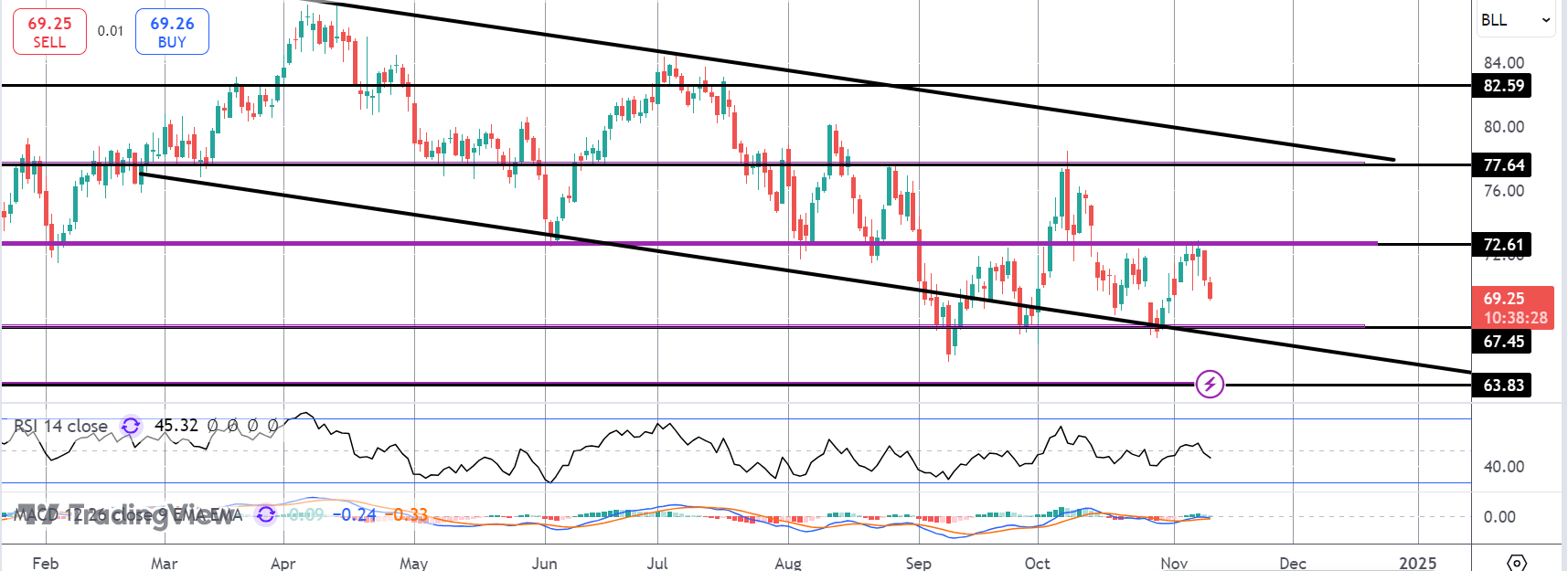

The rally in crude has failed again into the 72.61 area which continues to be a firm local barrier. Price is now turning lower, putting fresh focus on the 67.45 level and the bear channel lows. Below there, 63.83 is the next support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.