Crude Rallying on Fresh Russia/Ukraine Fears

Geopolitical Uncertainty Increasing

Oil prices are turning higher this week amidst fresh fears over the conflict between Russia and Ukraine. A massive drone strike by Ukraine, destroying around 40 Russian jets has sparked fears that Russia could pull out of upcoming peace talks. Linked to reports that Russia is amassing tanks, there is growing anticipation of an escalation in the conflict from Russia in response to the moves from Kiev. While speculation over a counter-attacks grows, oil prices look likely to continue higher near-term. Indeed, with the risk that upcoming talks in Istanbul breakdown, oil prices could be seen firmly higher near-term. Only an unexpectedly positive development in those talks is likely to curtail these near-term fears.

OPEC+ Hikes Output Again

The rally in crude this week comes despite news that OPEC+ has hiked its projected oil output once again. The target for July output was raised to 411k bpd. This was significantly higher than the initially projected increase of 134k bpd with the group citing the need to adjust its strategy in response to a “steady global economic outlook and healthy market fundamentals”. However, the statement issued alongside the forecasts noted that these increases could be altered or reversed in line with economic developments.

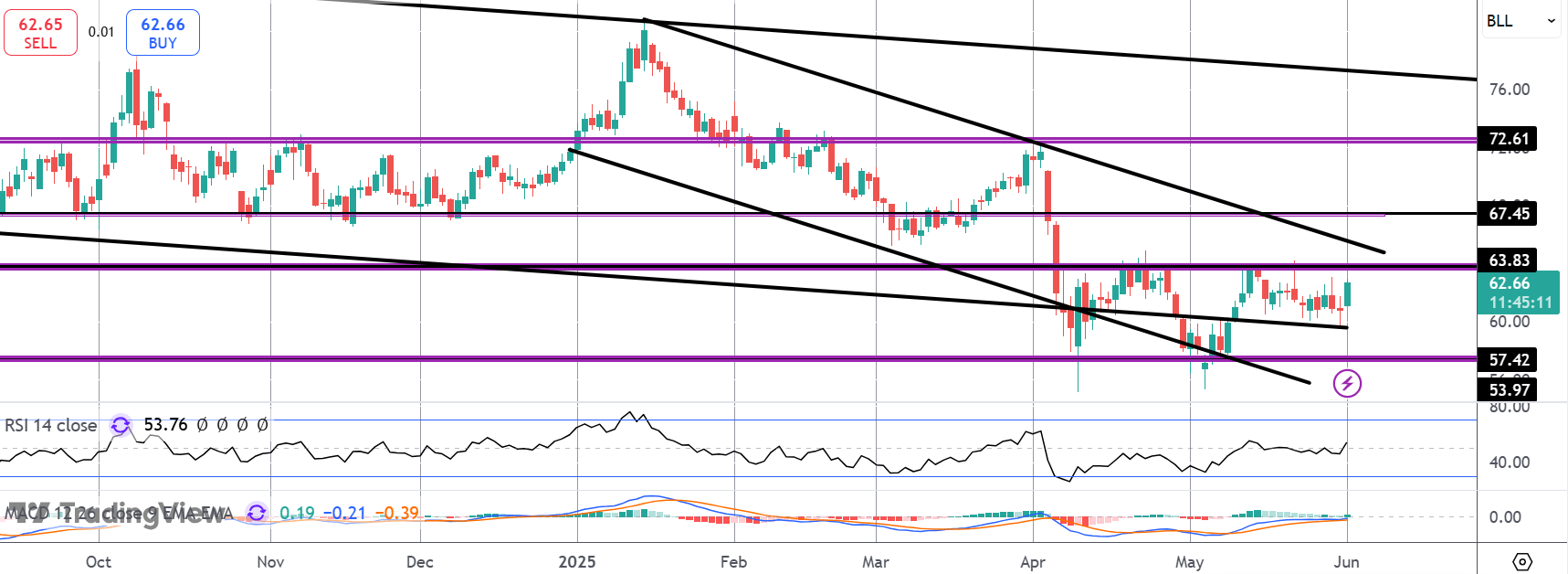

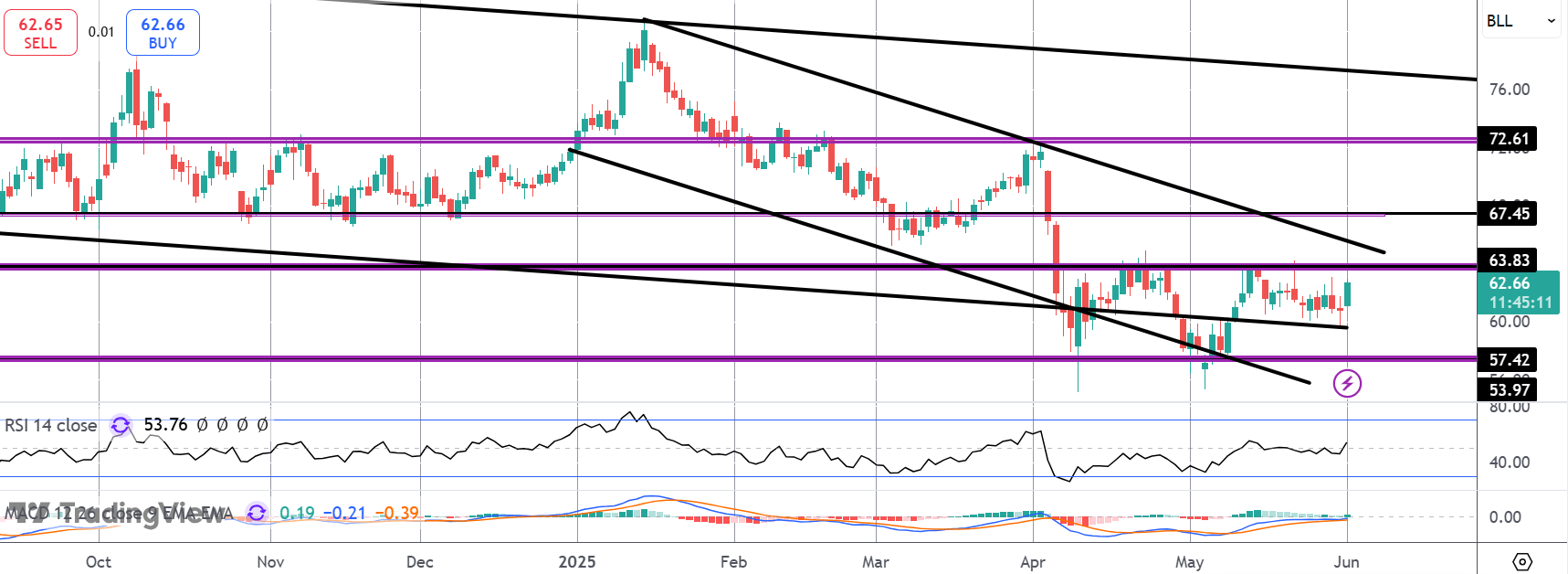

Technical Views

Crude

Crude prices are now once again coming up against the 63.83 level resistance with the bear channel highs just above. This is now a key pivot for the market with a break of that region turning focus to higher levels at 67.45 and 72.61 above.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.