Crude Rallying on Renewed Middle East Fears

Crude Back Above Key Level

Oil prices are turning higher today as uncertainty grows over a fresh escalation of violence in the Middle East. US airstrikes on Houthi rebel sites in Yemen over the weekend mark a more aggressive approach from the US with Trump vowing the strikes will continue until the Houthis stop their attacks on ships in the Red Sea. In a more worrying sign, Trump wrote on social media this week that Iran will be held responsible for any further attacks on Red Sea shipping routes and will suffer dire consequences accordingly.

Fresh Gaza Violence

Alongside that situation, an Israeli airstrike on Gaza overnight has put an end to the weeks long ceasefire between Israel and Hamas with at least 330 killed in the attacks. Oil prices have been lower over recent weeks, helped in part by the ceasefire which was seen as reducing supply risks. However, in light of the attacks, and the heightened risk of Hamas retaliation, oil prices are now pushing higher as traders move to once again price in a higher threat to distribution in the region.

Improving China Demand Expectations

Better data out of China this week along with news of fresh stimulus measures is also helping lift crude sentiment. Better industrial production and retail sales figures in the world’s second largest economy are feeding into an improved demand outlook. Furthermore, with the government announcing its ‘special action plan’ over the weekend, aimed at bolstering incomes and supporting consumers, bulls are hopeful of a continue pickup in demand expectations, feeding into higher prices.

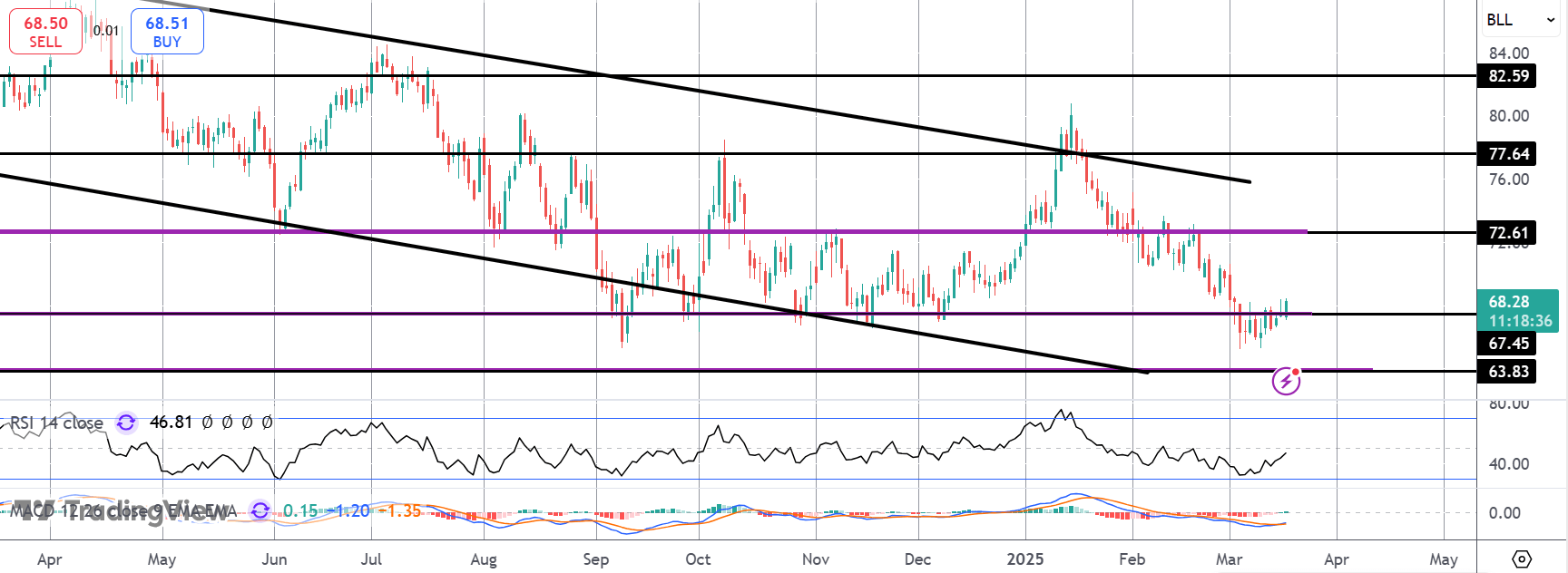

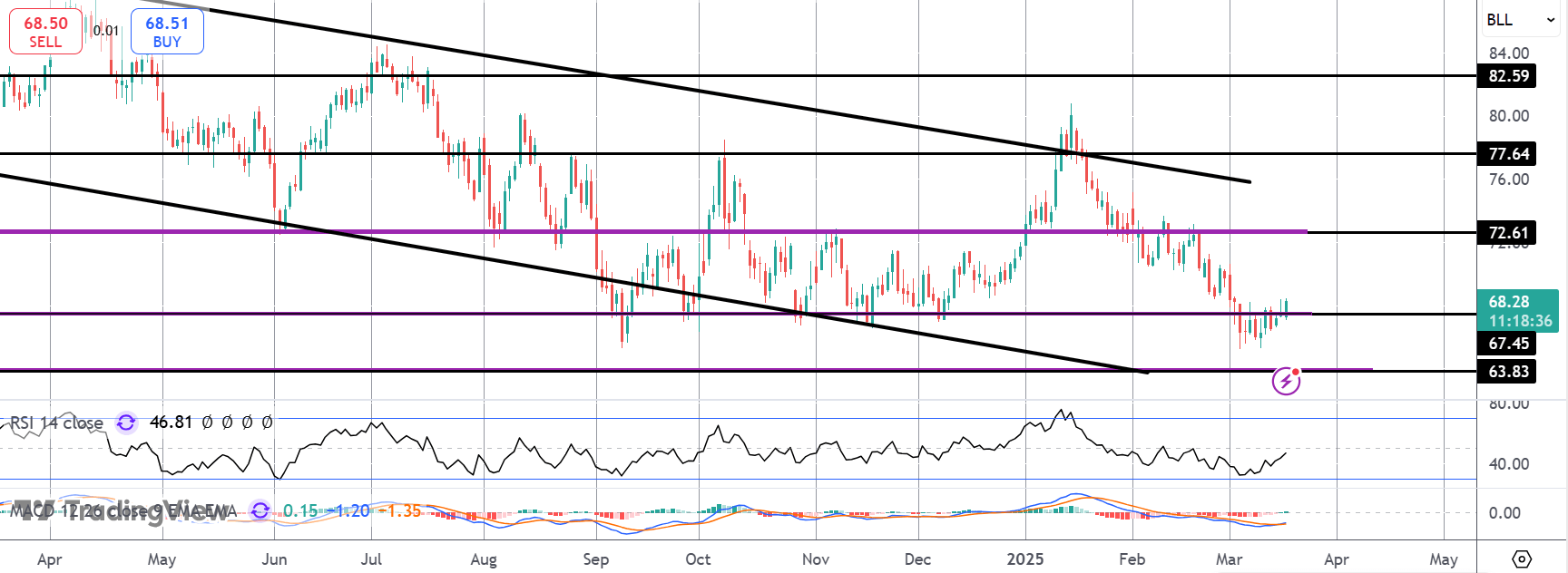

Technical Views

Crude

Crude prices are now trading back above the 67.45 level offering hopes for a fuller rebound. This is a key, multi-year support zone for the market and while prices hold here, focus is on a move back up to the 72.61 level next. With momentum studies turning higher, focus remains on a recovery for now with the bear channel highs and the 77.64 level, the higher target for bulls to consider.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.