Daily Market Outlook, July 03, 2023

Daily Market Outlook, July 03, 2023

Munnelly’s Market Commentary…

Asian equity markets started the new trading month on a positive note, drawing momentum from a rally on Wall Street. Market participants also digested key data releases, including an improved Tankan survey in Japan and better-than-expected Chinese Caixin Manufacturing PMI. The Nikkei 225 index rose by 1.7%, driven by the Bank of Japan's quarterly Tankan survey, which showed improved sentiment among large Japanese manufacturers for the first time in seven quarters. The Hang Seng index and Shanghai Composite index followed suit, supported by the positive Chinese Caixin Manufacturing PMI and the People's Bank of China's commitment to providing inclusive loan support for small and micro businesses. In other news, the US confirmed that Treasury Secretary Janet Yellen will visit China for meetings with senior officials, although expectations of a significant breakthrough are low.

Manufacturing PMI updates from major economies will be closely watched today. The US manufacturing ISM survey is expected to remain steady in June, indicating continuing contraction in the sector. In Europe, including the UK, final manufacturing PMI releases are expected to confirm the contractionary trend in the sector. The UK's manufacturing PMI is forecasted to remain below the key-50 level for the eleventh consecutive month, while the Eurozone's manufacturing PMI is expected to mark the twelfth consecutive month below 50.

Tomorrow, the Reserve Bank of Australia's decision on interest rates will be closely watched. It is anticipated to be a close call between a 25bps increase to 4.35% and leaving rates unchanged at 4.10%. Weaker-than-expected May CPI inflation in Australia may favour a hold, although the door for further tightening is likely to remain open.

Friday’s U.S. jobs report is the data point for the week, it is expected to have a significant impact on Federal Reserve expectations, especially as it precedes the Fed's policy decision at the end of July. According to a Reuters poll, the forecast for June's non-farm payrolls suggests a moderation to 225,000 from May's figure of 339,000. The unemployment rate is expected to remain steady at 3.7%. Average hourly earnings are projected to increase by 0.30% month-on-month, matching May's figure, and by 4.2% year-on-year, slightly lower than the 4.3% recorded in May. In addition to the jobs report, several other key U.S. economic indicators will be released, including ADP jobs, ISM manufacturing and non-manufacturing data, JOLTs job openings, trade figures, factory orders, and weekly jobless claims. These data points will provide further insights into the health of the U.S. economy and contribute to the overall assessment of the economic and interest rate landscape Stateside.

CFTC Data As Of 30-06-23

USD IMM net spec short in the Jun 21-27 reporting period; $IDX -0.02%

EUR$ +0.38% in period, specs stayed on sidelines +379 contracts now +145,028

$JPY rose 1.91%, specs -5,214 contracts now -112,870 as BoJ remains steady

Recent test of 145, tipped intervention area may stir long profit-taking

GBP$ -0.1%, specs +5,386 contracts now +51,994 on rising UK rate view

BTC rose 8.86%, specs sold 2,491 contracts into strength, flip to -2,094

$CAD -0.31% in period, specs +30,696 contracts short pared to -2,847

AUD$ -1.49% in period, specs +10,192 contracts now -39,424

BoC, RBA had been considering further rate hikes amid persistent inflation

Inflation stalling has weakened CAD and AUD since Jun 21, may see recent longs lighten(Source: Reuters)

FX Options Expiries For 10am New York Cut

(1BLN+ represent larger expiries, more magnetic when trading within daily ATR)

USD/JPY: 142.95-00 (990M), 144.05 (274M), 144.50 (480M), 145.00 (317M)

USD/CHF: 0.8840 (1BLN), 0.9040 (290M)

GBP/USD: 1.2650 (332M), 1.2700 (394M), 1.2720 (309M), 1.2750 (360M)

EUR/GBP: 0.8600 (455M), 0.8655 (353M)

AUD/USD: 0.6555 (251M), 0.6640-60 (537M, 0.6685-00 (313M)

0.6745-50 (323M). NZD/USD: 0.6105 (624M)

AUD/NZD: 1.0800 (596M), 1.0850-60 (897M), 1.0900 (700M), 1.0925 (346M)

1.0950 (1BLN), 1.1000 (1.1BLN)

USD/ZAR: 18.50 (681M). EUR/NOK: 11.70 (235M)

Overnight News of Note

China's June Factory Activity Slows As Conditions Weaken

China New Home Prices Edge Down In June For 2nd Month

China’s Central Bank Appoints New Top Communist Party Official

Yellen Heads To China This Week, Furthering US Move To Mend Ties

BoJ Tankan Survey: Japan Business Sentiment Improves In Q2

Australia Watchers Split On RBA Rate Path As Inflation Lingers

Australia Building Approvals Surge Higher, Smashing Exp. In May

EU Free Trade Deal Still A ‘Way Off,’ Australian Minister Says

EU Considers Russian Bank Concession To Safeguard Black Sea Grain Deal

UK To Breach Iran Nuclear Deal With Refusal To Lift Sanctions

Pimco Prepares For ‘Harder Landing’ For Global Economy

Yen Tentative, Dollar Soft As Traders Weigh Fed Rate Hike Path

Oil Steadies After Record Losing Run As Traders Eye Second Half

China Is Buying Gas As If Their Is Still An Energy Crisis

Asian Shares Extend Global Rally On Signs Of Moderating Inflation

Apple Forced To Make Major Cuts To Vision Pro Headset Production Plans

Tesla Tops Expectations As Price Cuts Lift Deliveries To Record

(Sourced from Bloomberg, Reuters and other reliable financial news outlets)

Technical & Trade Views

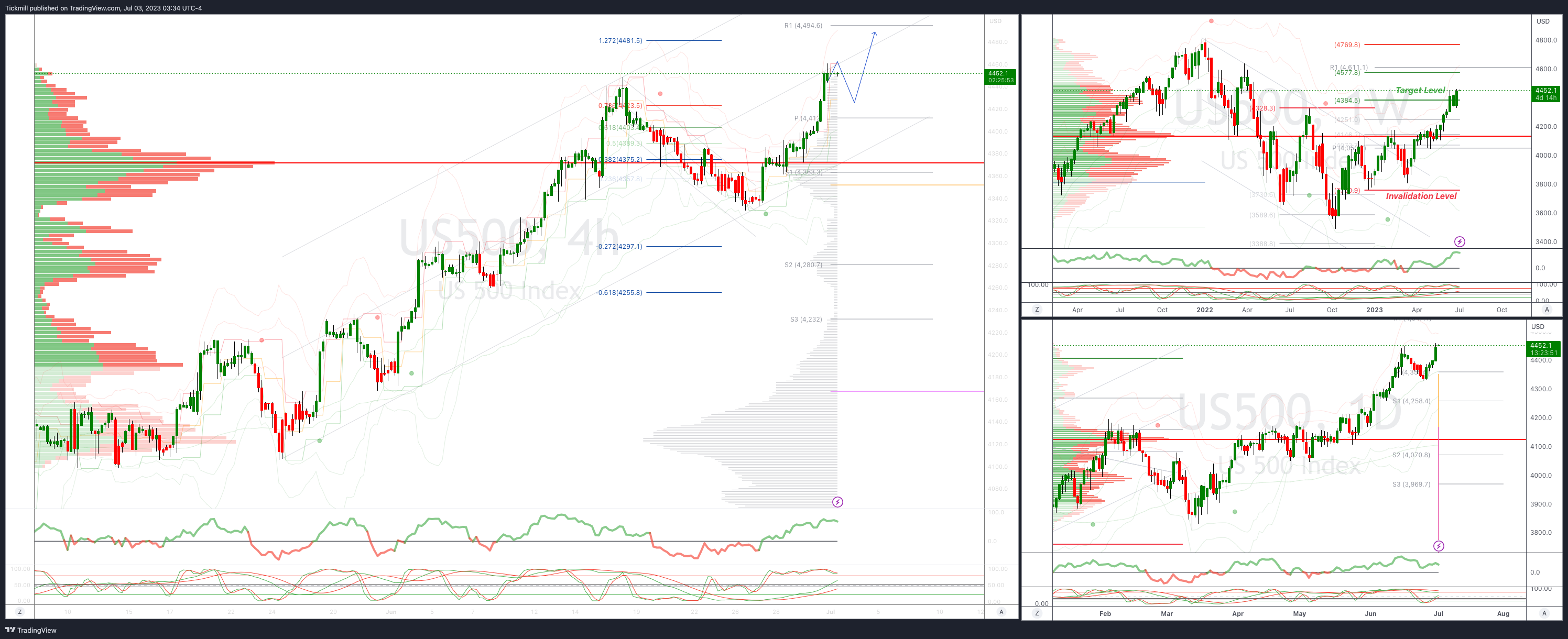

SP500 Bias: Intraday Bullish Above Bearish Below 4412

Below 4400 opens 4370

Primary support is 4300

Primary objective is 4580

20 Day VWAP bullish, 5 Day VWAP bullish

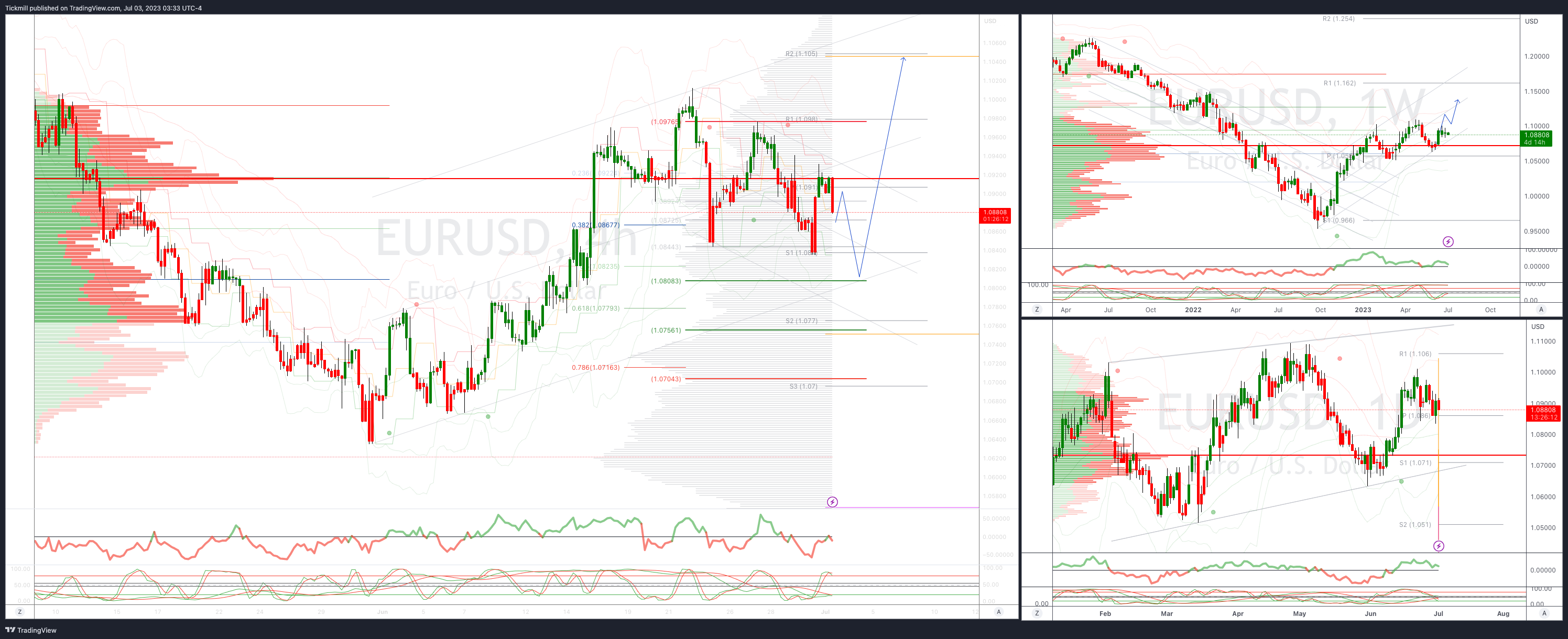

EURUSD Intraday Bullish Above Bearsih Below 1.0840

Below 1.0840 opens 1.08

Primary support is 1.0666

Primary objective is 1.1050

20 Day VWAP bullish, 5 Day VWAP bearish

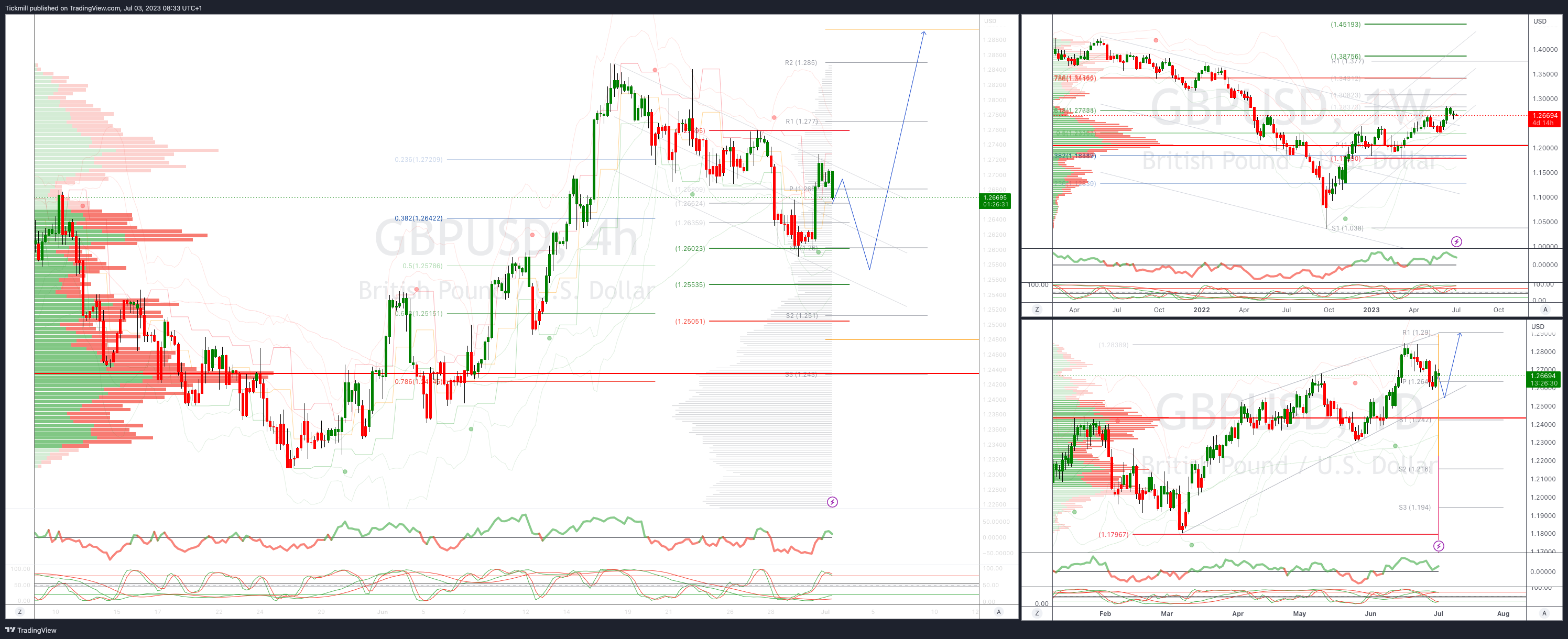

GBPUSD Bias: Intraday Bullish Above Bearish Below 1.2650

Below 1.26 opens 1.2550

Primary support is 1.2680

Primary objective 1.2880

20 Day VWAP bullish, 5 Day VWAP bearish

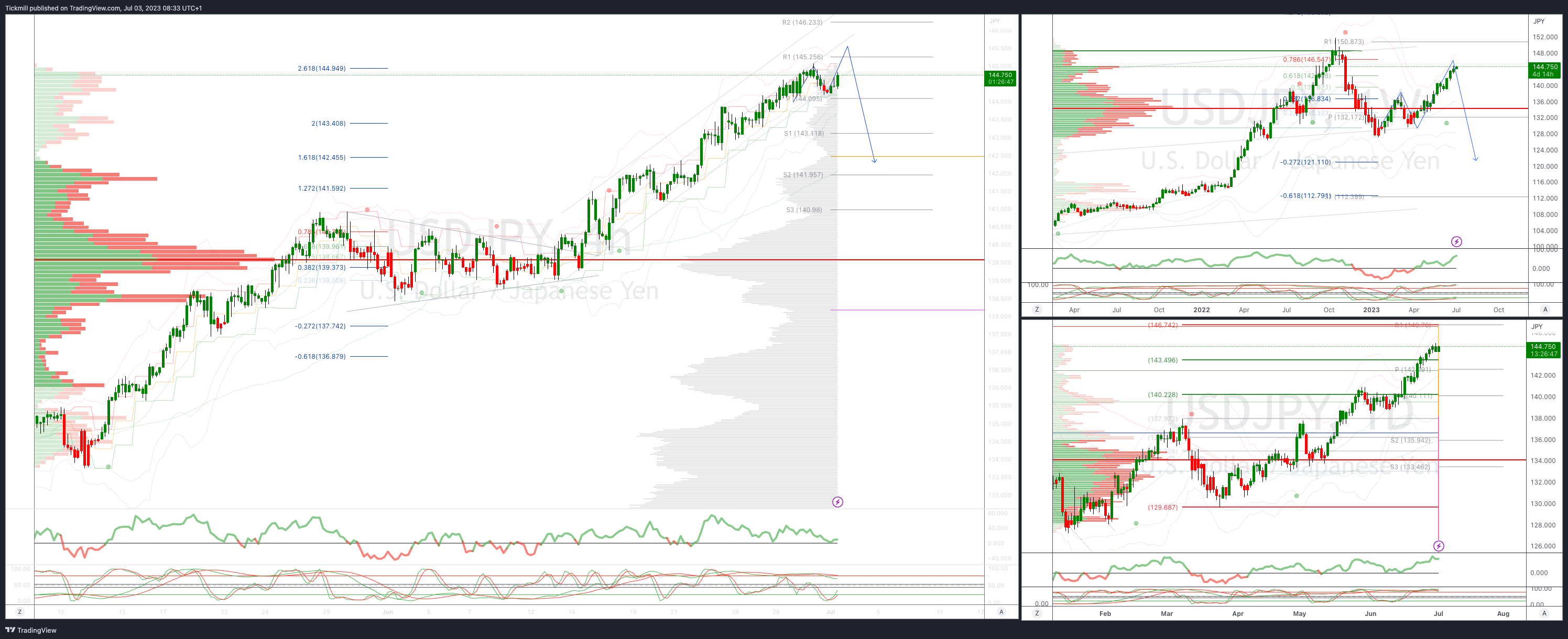

USDJPY Bullish Above Bearish Below 143.50

Below 143 opens 142.30

Primary support is 141

Primary objective is 145.50

20 Day VWAP bullish, 5 Day VWAP bullish

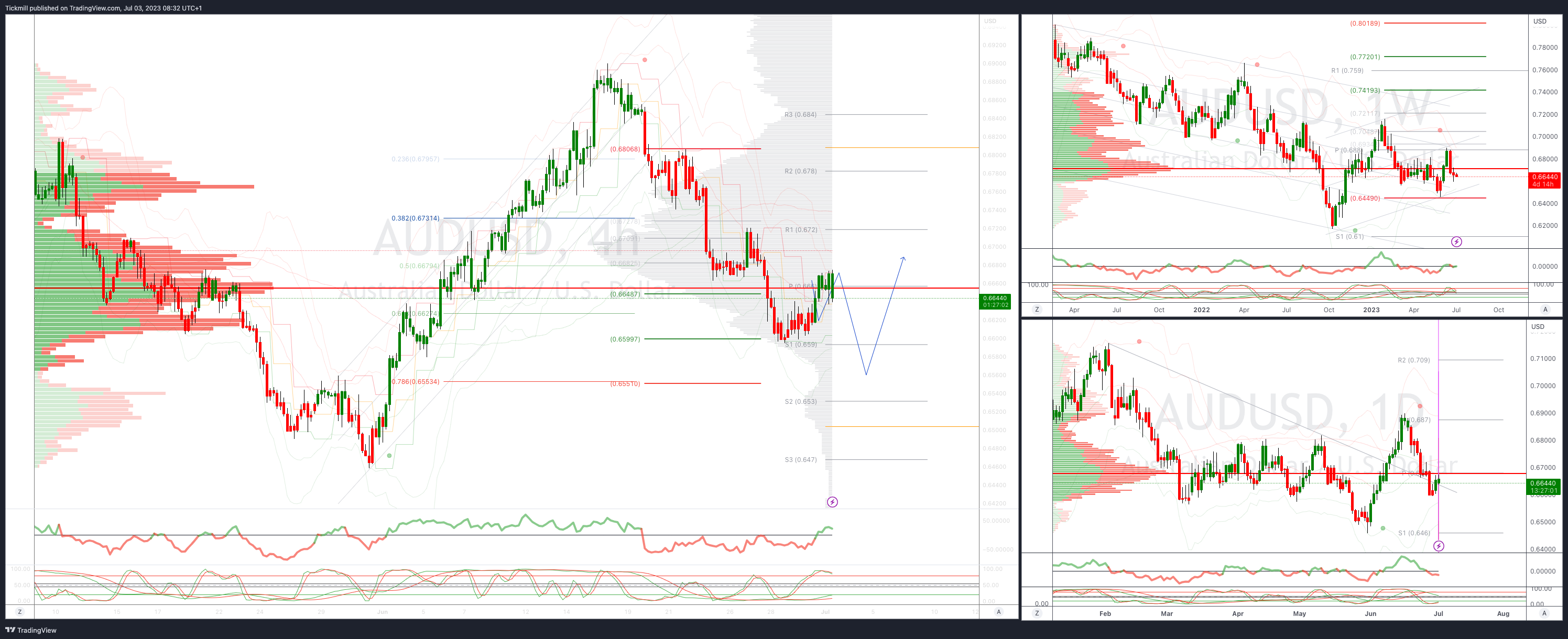

AUDUSD Bias:Intraday Bullish Above Bearish Below .6660

Below .6600 opens .6550

Primary support is .6448

Primary objective is .6917

20 Day VWAP bearish, 5 Day VWAP bearish

BTCUSD Intraday Bullish Above Bearish below 29500

Below 28000 opens 26900

Primary resistance is 27400

Primary objective is 32750

20 Day VWAP bullish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!