Daily Market Outlook, September 30, 2020

Daily Market Outlook, September 30, 2020

Asian equity markets are mixed this morning. Initial opinion polls suggest that Democratic candidate Biden continues to hold a lead in the US Presidential race after his first debate with President Trump.

Covid-19 cases have risen further in Europe and Germany and the Netherlands have announced new restrictions. The House of Commons voted to approve the UK Internal Market Bill. China’s official PMI data rose by more- than-forecast in September. However, the unofficial Caixin manufacturing measure slipped modestly.

In the UK, the Lloyds Business Barometer posted a fourth successive monthly improvement in September reflecting increases in own business expectations and confidence about the wider economy. However, the measure is still below its long run average. The data was collected prior to the recent announcements of tighter restrictions. UK Q2 GDP drop was revised to -19.8% from -20.4%.

UK PM Johnson is scheduled to give a press conference today on the latest developments regarding the Covid-19 pandemic. Given recent press reports that further restrictions may be imminent, particularly in London where new coronavirus cases have picked up sharply, there may be speculation that further moves may be announced soon.

After yesterday’s lower than expected September CPI inflation in Spain and Germany today’s estimates for Italy and France will be watched for further indications whether Friday’s Eurozone report may surprise on the downside. Current expectations are for an annual fall for the region as a whole of 0.2% the same as last month. In Germany, the latest reading for the unemployment rate is likely to show that the government's support scheme is continuing to help prevent a more substantial shake out in the labour market. The unemployment rate has moved up only relatively modestly to 6.4% from 5.0% prior to the pandemic. It is expected to have held at 6.4% in September.

The ADP’s estimate of September US private sector employment will be watched for clues on Friday’s official labour market report. Despite concerns that the summer acceleration of Covid cases would lead to a slowdown in the economy, so far at least activity has held up relatively well. However, there have been indications that the rebound in employment is slowing and we expect that to be reflected in Friday’s data. Nevertheless, the risk for today’s ADP number, which has been lower than the official data for the last two months is skewed to the upside. The third update of Q2 GDP, which will also be released today is not expected to be revised from the previous estimate.

There are a number of speakers scheduled for the day from both the ECB and the Fed. Possibly of most interest may be ECB President Lagarde and ECB Chief Economist Lane whose remarks will be watched for any further comments on the implications of the recent strength of the euro

CitiFX Quants Month-End FX Hedge Rebalancing: September 2020 Preliminary Estimate

· The preliminary estimate of hedge rebalancing flows points to USD buying at the September month-end. The signal is strong by historical standards, exceeding two standard deviations in most crosses.

· Following five months of gains, equity markets weakened again in September with US equities the clear under-performer among major markets. The -7.54% month-to-date loss in MSCI United States is the worst since March. While global bond markets have gained, the FTSE US GBI also stands out as lagging other markets this month.

· Under-performance of US assets tilts this month’s hedge rebalancing flows strongly in favour of foreigners’ needs to buy USD in order to reduce outstanding hedges. We estimate both bond and equity investors to be net USD buyers this month-end but equity hedge rebalancing flows drive 97% of the signal.

· Markets will probably also be paying attention to the ECB Watchers Conference taking place on 30 September as a potential source of volatility.

Today’s Options Expiries for 10AM New York Cut (notable size in bold)

- EURUSD: 1.1650 (887M), 1.1705-10 (750M), 1.1725 (690M) 1.1750 (626M), 1.1800 (401M)

- USDJPY: 105.00-15 (1.3BLN), 105.45-50 (500M), 105.60-70 (1.1BLN)

- GBPUSD: 1.2800 (245M)

Technical & Trade Views

EURUSD Bias: Bearish below 1.1750 Bullish above

EURUSD From a technical and trading perspective,test of 1.1750 trendline attracted fresh bids, as 1.18 now acts as interim support look for a test of offers and stops above 1.1950 UPDATE as 1.1700/50 acts as support expect continued rotation in 1.17/1.19 range, a breach of 1.17 would suggest a deeper correction underway to challenge bids at 1.16. UPDATE as 1.1750 now acts as resistance look a challenge of bids and stops below 1.16

Flow reports suggest downside bids limited through the 1.1620 area opening the downside through to the 1.1480-1.1500 level in the short, Topside offers likely to be limited now through the 1.1760 level but increasing in resistance into the 1.1780-1.1800 area with weak stops likely on a push through the 1.1820-30 area for a quick stab towards the 1.1850 area

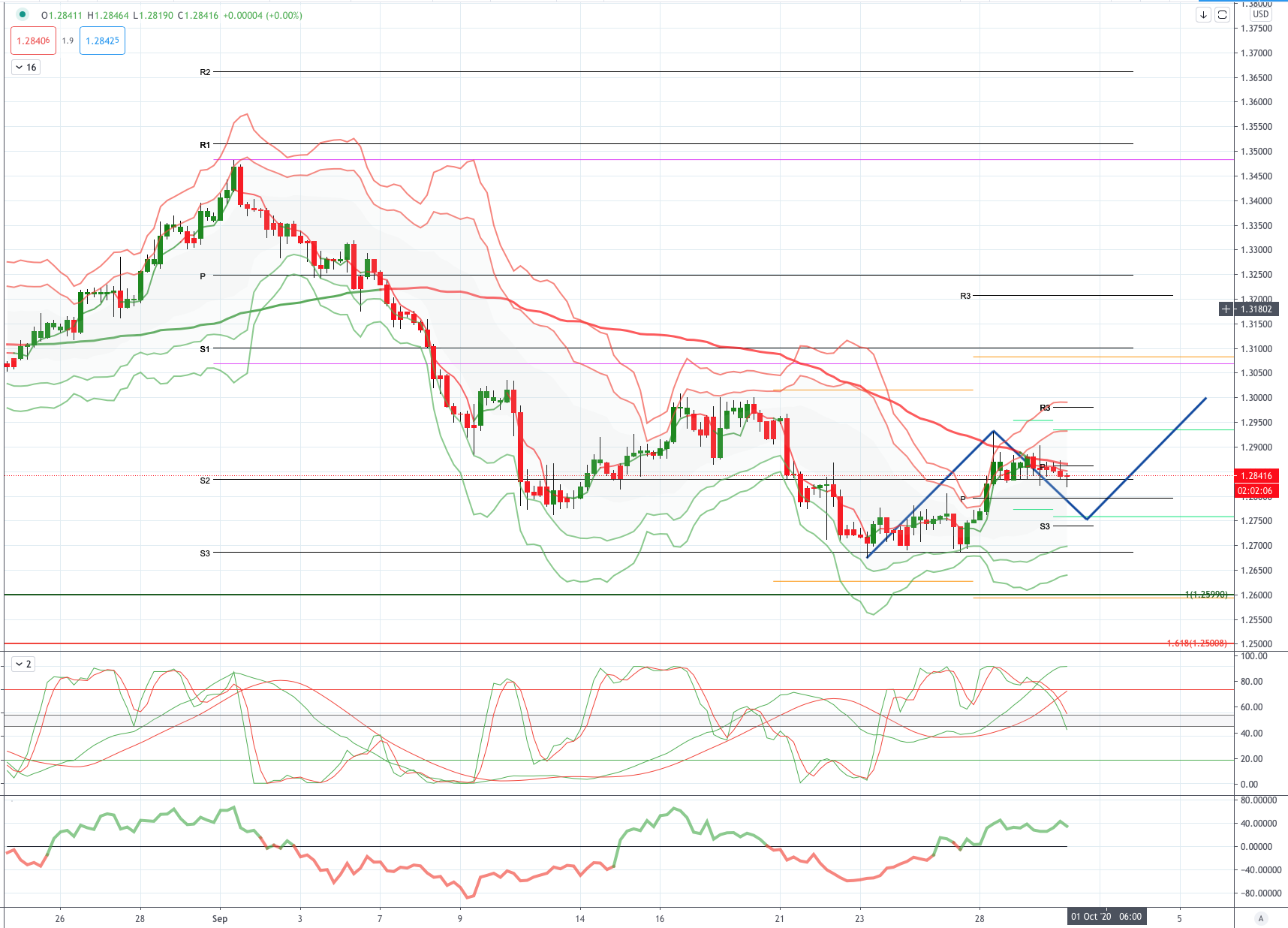

GBPUSD Bias: Bearish below 1.2850 Bullish above

GBPUSD From a technical and trading perspective, test of the pivotal primary trendline support at 1.2830/50 stalls downside for now, however as 1.3000 acts as resistance look for renewed downside to target 1.2650 next UPDATE as 1.2850 acts as resistance look for a test of bids to 1.26/1.2570 UPDATE as 1.28 now acts as support lok for a test of 1.30, a breach of 1.2750 would suggest a false upside break and resumption of downtrend

Flow reports suggest topside offers light through to the 1.2900 level with offers congested through to the 1.2930 area before lighter offers begin to appear into the sentimental 1.2950 area stronger offers are then likely on any approach to the 1.3000 area with strong stops through the level and the market then opening for further gains. Downside bids light through the 1.2800 area with weak stops on a move through likely to be light and quickly absorbed on any dip through to the congested 1.2750 areas with stronger bids into the 1.2700 level.

USDJPY Bias: Bearish below 105.50 Bullish above

USDJPY From a technical and trading perspective, as 106.50 acts as resistance look for another test of support at 105.50 failure to find sufficient bids here will expose 104.18 again. UPDATE as 105.50 now acts as resistance look for a test of bids towards 103.80 as the next downside objective. NOTE Massive 3-billion USD/JPY between 104.90-105.10 expire Thursday NY cut UPDATE lo0k for test of 105.80 to see profit taking on first test, however, as 105.10 supports look for a test of 106

Flow reports suggest offers strong into 106.00 area with stops on a break through the 106.20-30 area, offers remain into the 107.00-20 area with congestion likely to be mixed with weak stops on a break of the level and that congestion likely to continue on any move into the 107.60 area where stronger offers are likely to appear, maybe another round of stops before stronger offers then appearing through to the 108.00 level. Downside bids into the 104.20 light and then increasing on any dips to the 104.00 level and stronger stops through the 103.80 level, any break here opens the chance of a deeper move through to the 103.00 level before stronger bids start to appear with possible option related buyers.

AUDUSD Bias: Bullish above .7150 Bearish below

AUDUSD From a technical and trading perspective, as .7220 now acts as support, look for a test of psychological .7500. Only a daily closing breach of .7220 would concern the bullish thesis opening a retest of .7100. UPDATE as .7220 now acts as resistance look for a test of bids to .7050 UPDATE as .7150 acts as resistance look for a test of bids and stops below .7000

Flow reports suggest downside light bids through to the 0.7020 area with stronger bids starting to make an appearance and possible option related bids coming into play, a push through the 0.6980 level should see weak stops appearing and the market running into congestion on any push to the sentimental 0.6950 area and likely to continue through to 69 cents area, Topside offers light through to the 0.7160 level before sufficient offers appear to slow any further rise however, strong offers through to the 72 cents level are likely to stymie any further movement however, weak stops through the 0.7220 level could help it run a little higher.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 76% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!