Dollar Rises Ahead of JOLTS Jobs Data

USD Higher on Tuesday

The US Dollar looks a little firmer through early European trading on Tuesday, this despite softer US data yesterday and renewed concerns over the US trade war. The US ISM manufacturing reading yesterday was seen falling to 48.5 from 48.7 prior, below the 49.3 level the market was looking for, marking a further fall into contractionary territory. Given the fresh uncertainty over US trade, including Trump’s legal bad with the US ICT and threats of fresh tariff increases, the near-term outlook has turned become more obscured.

Powell Reaffirms CPI Target

Alongside US data yesterday, traders were monitoring comments from Fed chair Powell who was speaking at a scheduled event. Powell was heard reaffirming the Fed’s commitment to its 2% inflation target and noted the importance of anchored inflation expectations in achieving price stability.

US Jobs on Watch

Looking ahead today, traders will be watching the latest US JOLTS job openings number, ahead of the headline NFP print at the top of the week. The forecast is for a slight cooling to 7.11 million jobs down from 7.19 million prior. If seen, this should curtail USD upside for now while any meaningful downside surprise could revive the USD sell off. On the other hand, an upside surprise today could see USD push higher as traders cover shorts ahead of Friday’s headline data.

Technical Views

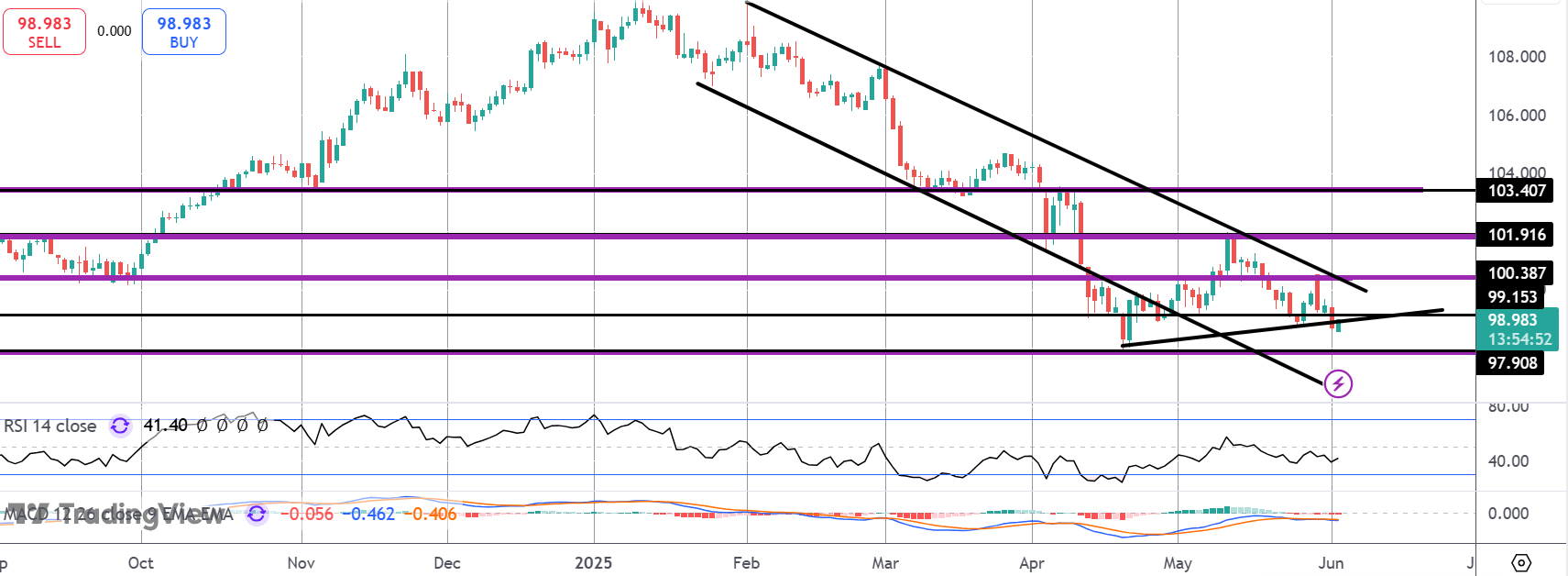

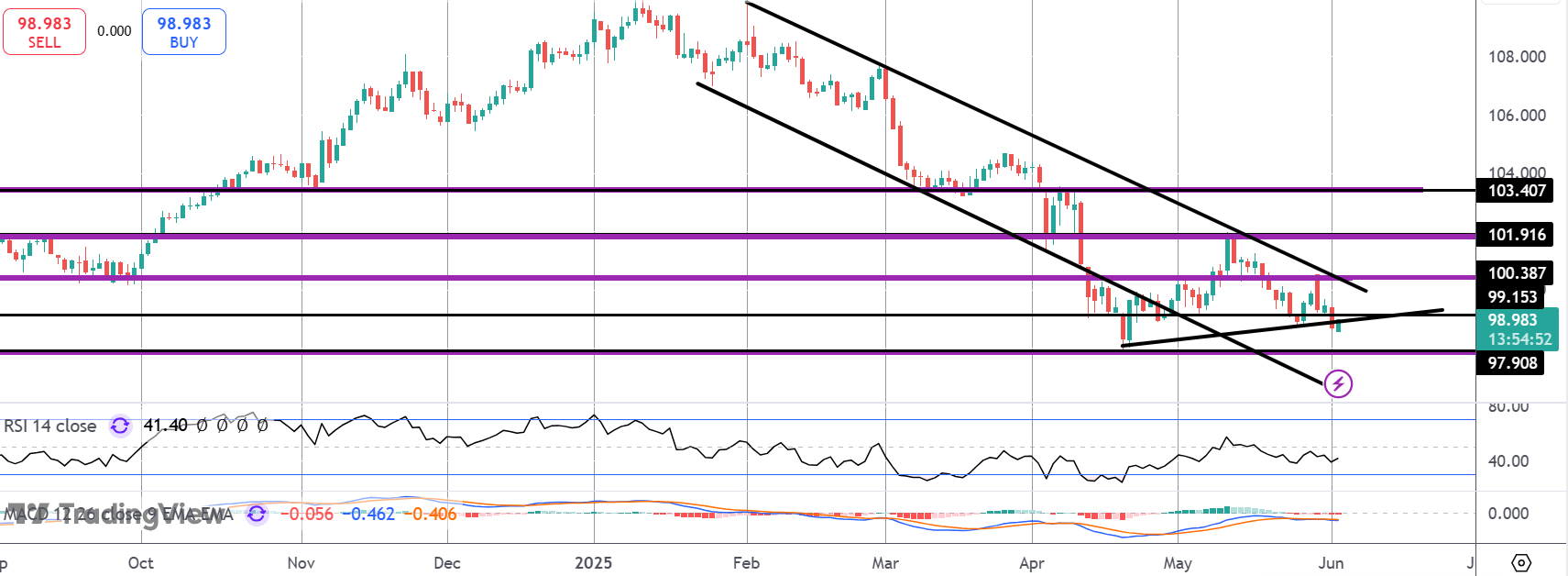

DXY

Following a downside break yesterday, DXY is today trying to reclaim the rising trend line from YTD lows and the 99.15 level. If seen back above this level, focus is on a fresh test of the $100k mark next. To the downside, 97.90 remains the key support to watch.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.