ECB Increases Focus on the Side-effects of NIRP, Warranting new Depths in Negative Rates

ECB’s statement and Draghi’s remarks at the press conference on Thursday set the stage for exploring new bottoms of NIRP, QE and other mitigation measures. But not surprisingly, they did not justify the wildest expectations of euro bears.

Overnight interest rate swaps gave a 50% chance of a rate cut yesterday, but the ECB opted to put off active operations until September. Exploring new depths of negative rates is associated with a rise in imbalances, marginal costs, side effects and possibly unknown surprises, so the ECB needs time to “cover its back” with a thought-out package of measures, rather than acting straightforwardly by cutting rates.

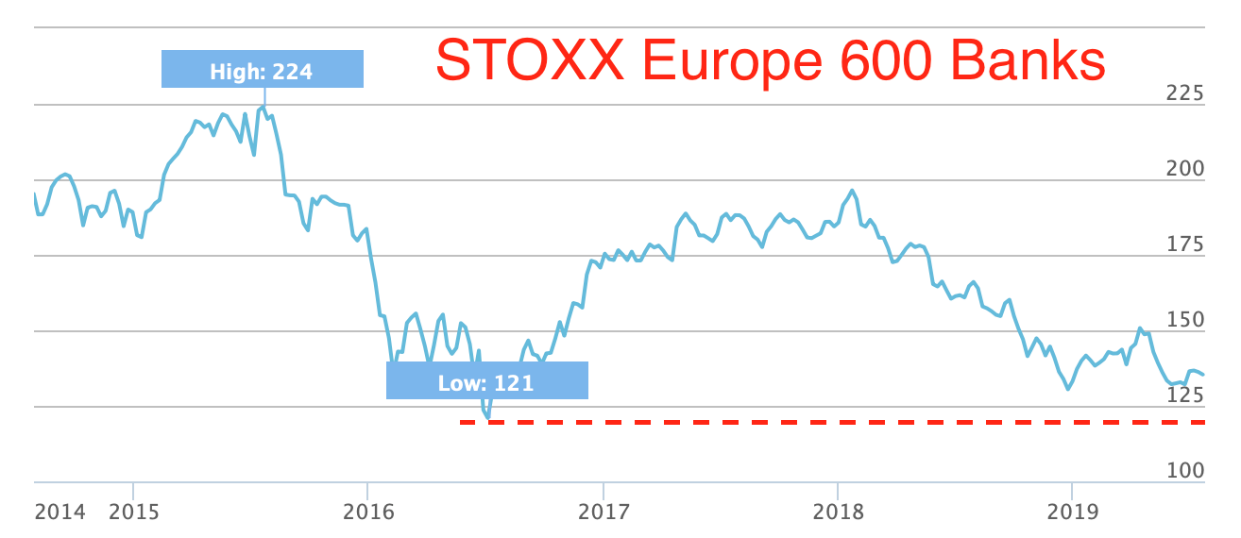

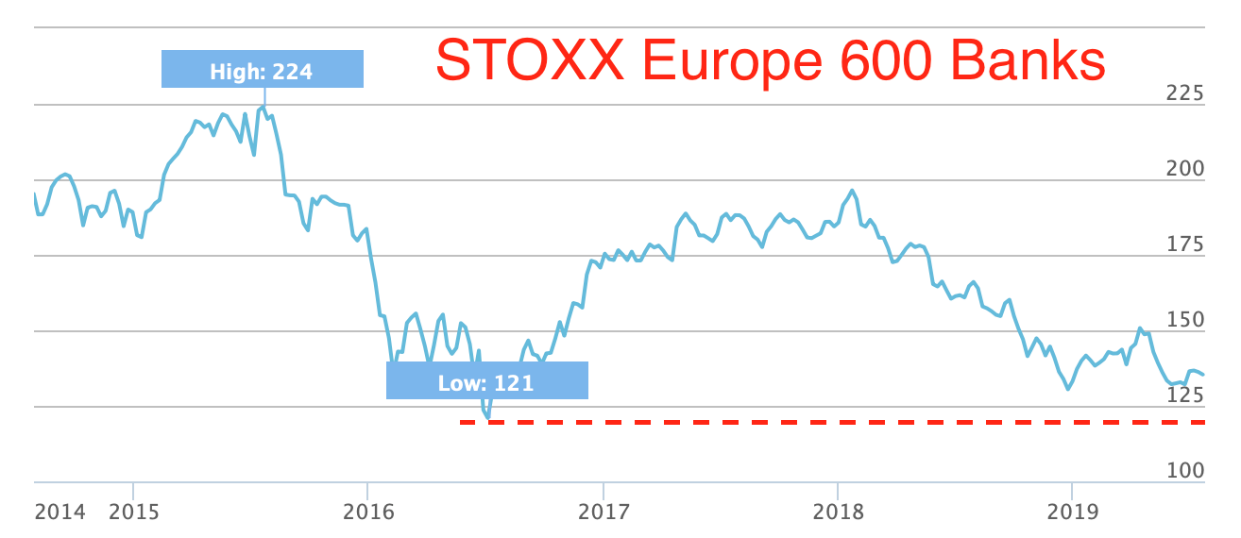

The key side effect is of course greatly reduced profitability of the banking sector. Although banks' ROE rose from 3% in 2016 to 6% in 2018, profitability is below the long-term cost of capital, estimated by banks at about 8-10%. There were costs of immediate rate cut like further pressure of the yield curve and banks’ net interest margin and they are likely exceeding the costs of "delay" of rate cuts till September. Otherwise, the ECB would follow the Fed’s path, which is expected to preemptively cut the rate by 0.25% next week. The same conclusion can be drawn from the stock index of the banking sector STOXX 600, which, in case of ECB tepid attitude to banks profitability issues, is ready to retest the multi-year bottom:

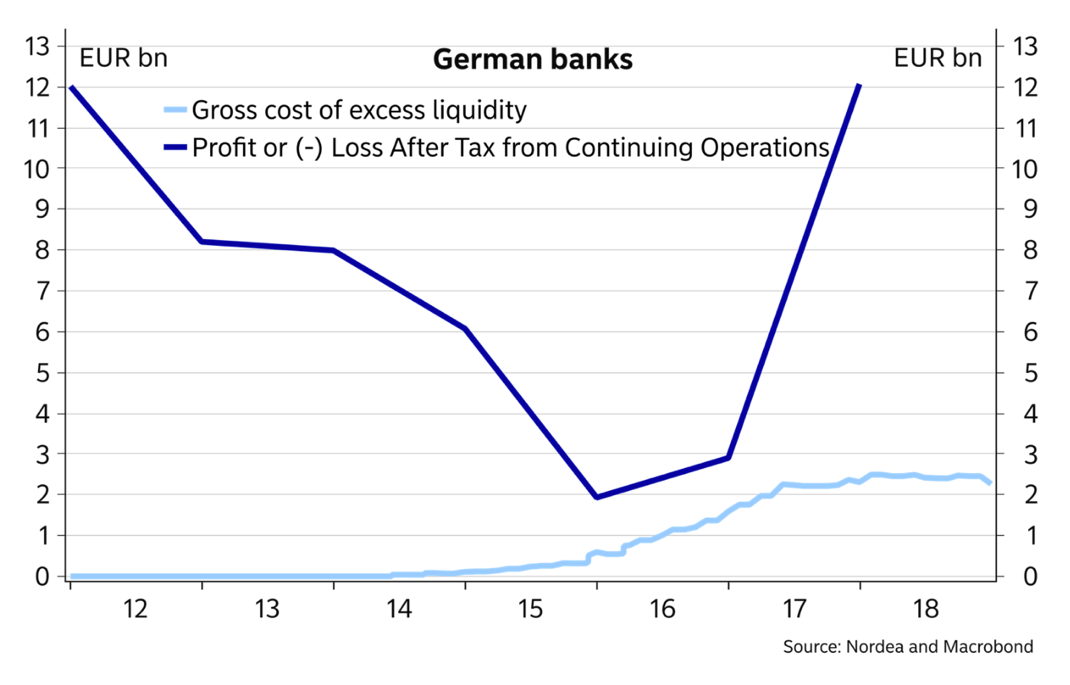

The package to ease pressure on the banking sector is likely to include a progressive deposit rate (tiering), a new QE package, which can “strengthen” the assets of banks holding bonds on their balance sheets. Exempting a portion of bank reserves from the ECB “deposit tax” may be needed for those countries where costs of maintaining excess reserves are quite high relative to net profits, such as in the case of Germany:

According to the ECB, rates will remain at current levels or below at least until the second half of 2020. “A considerable mass of inflation expectations is moving towards lower inflation”, Draghi said at a press conference. “We don’t like it, so we are determined to act.” Discussions about deposit tiering, which the ECB brings up to the public knowledge indicate that the rates can go much lower, since the only thing holding back the Central Bank in this way are side effects.

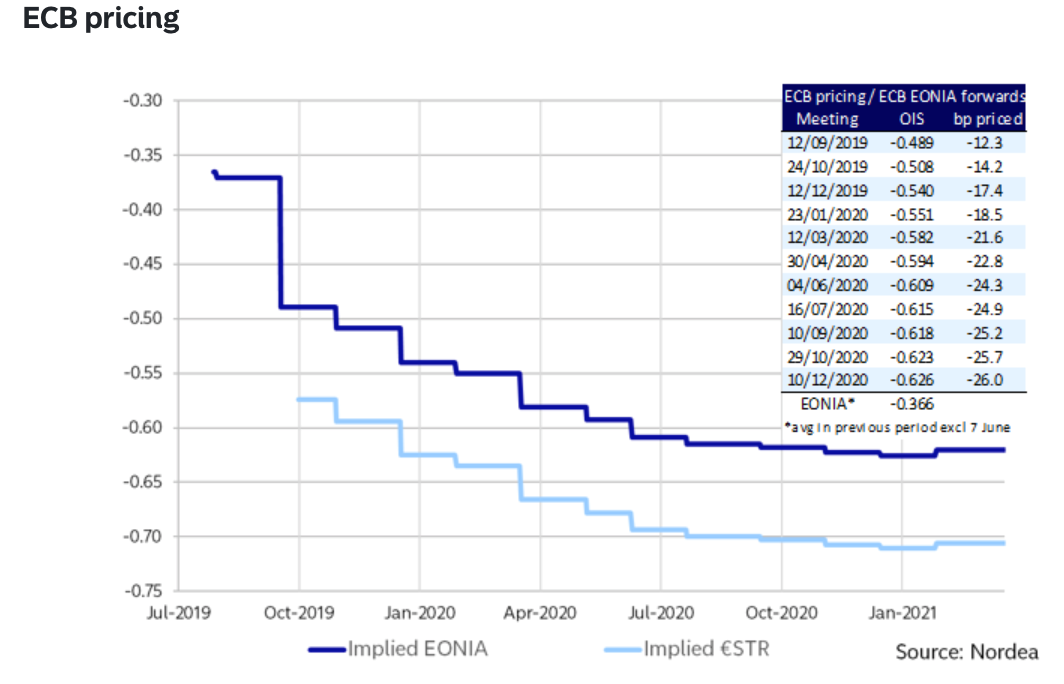

As a result, the market prices in a rate cut by 10 basis points in September and almost 25 basis points at the end of next year:

“Diverse” package of easing measures, which Draghi promoted to our attention, gives rise to a very wide rumors in the market about the extent of the bearish surprise in September. Even in the absence of weak economic and sentiments data, considerable moral effort will be required to rely on the rise of the euro. If, of course, the Fed won’t surprise us next week, cutting rate by 50 basis points and urge to prepare for the worst, which is unlikely.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.