EURJPY Testing Key Level As EZ GDP Comes in Flat

EUR Under Pressure

The Euro is seeing fresh selling pressure on Tuesday as traders digest the latest data out of the eurozone. One of the big themes which has developed at the start of 2024 is central bank pushback against rate-cut expectations. The Fed, BOE and ECB have all been active in trying to steer investors away from pre-empting rate cuts in coming months. The message is essentially that the battle against inflation is not yet over and rates will need to remain at restrictive levels for much longer than the current market projections suggest.

Market Vs ECB

While this messaging has fuelled a scaling back of near-term rate cut expectation, some players judge the guidance to merely be an attempt at avoiding rapid currency devaluations which can in turn feed into an uptick in inflation. Indeed, the bigger focus for many is the growth prospects in respective regions. While data has been holding up surprisingly well in the US, with GDP, labour market data and consumer data all beating forecasts recently, the story has not been the same elsewhere.

Prelim Flash EZ GDP Flat Q/Q

In the eurozone, for example, today’s prelim flash GDP came in at 0%, highlighting how vulnerable growth remains in the block. Against this backdrop, the market is likely to maintain a sense that rate cuts are coming sooner than the ECB says they are, keeping EUR vulnerable to further downside near-term.

Technical Views

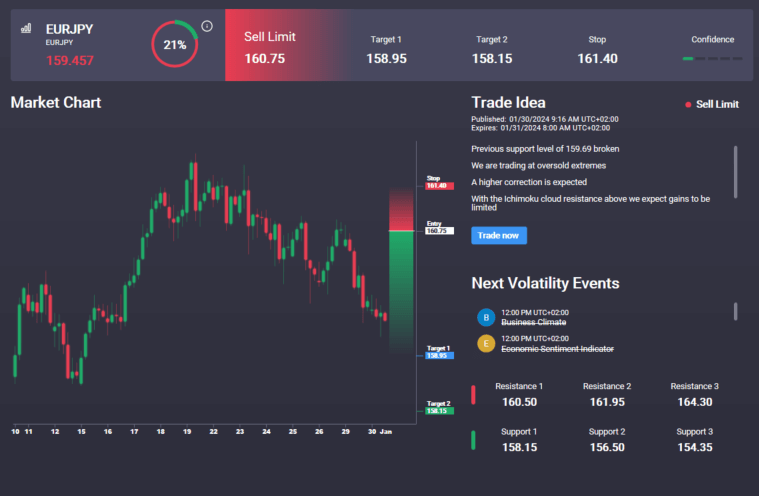

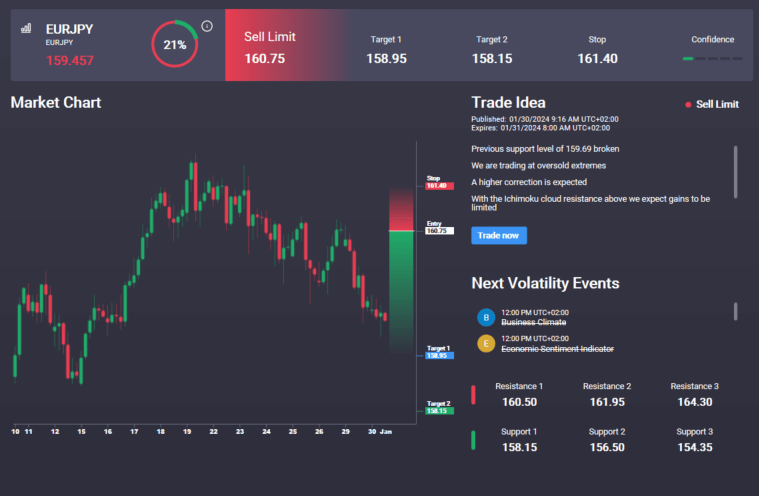

EURJPY

The rally has stalled for now ahead of the 162.29 level with the market now correcting lower within the bull channel. Price is currently testing the key 159.35 level. Should we break below here, focus will shift to a test of the 155.40 level next, with the bull channel lows coming in ahead of that level as interim support. Interestingly, we have an active sell signal in the Signal Centre today set above market at 160.75, suggesting a preference to fade any rallies for a continuation lower.

.png)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.