Eurozone Inflation Plummets: Euro and Pound Drop Amid Elevated ECB Rate Cut Expectations

The Dollar Index rose at the beginning of the European session, gaining about 0.3% in a short period, attempting to consolidate above the 103 level. The primary surge was driven by a decline in the Euro – EURUSD depreciated by approximately 0.5%. The pair is approaching the 1.09 level, having tested the 1.10 level yesterday but failed to hold. In the short term, the downward momentum is likely nearing exhaustion as the price approached the lower boundary of a recently formed channel. Additionally, the RSI momentum indicator dipped into oversold territory:

However, upcoming reports from the U.S., particularly the Core PCE and initial unemployment claims, could bring surprises given the recent increased volatility. It's advisable to await their release before relying solely on the technical picture.

On Thursday, data on China's manufacturing sector activity was released. The PMI indicator fell, contrary to expectations, with a slight worsening in industrial conditions; the corresponding indicator dropped from 49.5 to 49.4 points against a forecast of 49.7 points.

Data from the Eurozone on Thursday was mixed. Preliminary estimates for November showed a slowdown in inflation in France to 3.8%, below the forecast of 4.1%. However, October consumption dropped by 0.9%, contrary to the expected -0.2%. Unemployment in Germany increased by 0.1% to 5.9%, against an expected 5.8%. Headline inflation in the Eurozone slowed from 4.2% to 3.6%, and core price growth decelerated from 2.9% to 2.4%, surprising the market with a lower-than-expected figure than the 2.7% forecast. These inflation figures prompted a reassessment of expectations for the timing of the ECB's interest rate cuts, with the possibility of an earlier policy easing cycle. This, in turn, increased the attractiveness of the Euro against the Dollar, as expectations on Fed policy are a little bit less dovish. Some U.S. central bank officials even hinted yesterday at the possibility of another rate hike if incoming data necessitates it.

The weakened Euro also affected the British pound, as expectations for the British economy shifted towards a faster slowdown in inflation. The pound fell against the dollar by approximately 0.5%.

Later today, the Core PCE indicator will be released, and it could influence the position of European currencies if it indicates a faster-than-expected decline in inflation. The expected baseline is 3.5%, which is 0.2% lower than the previous value.

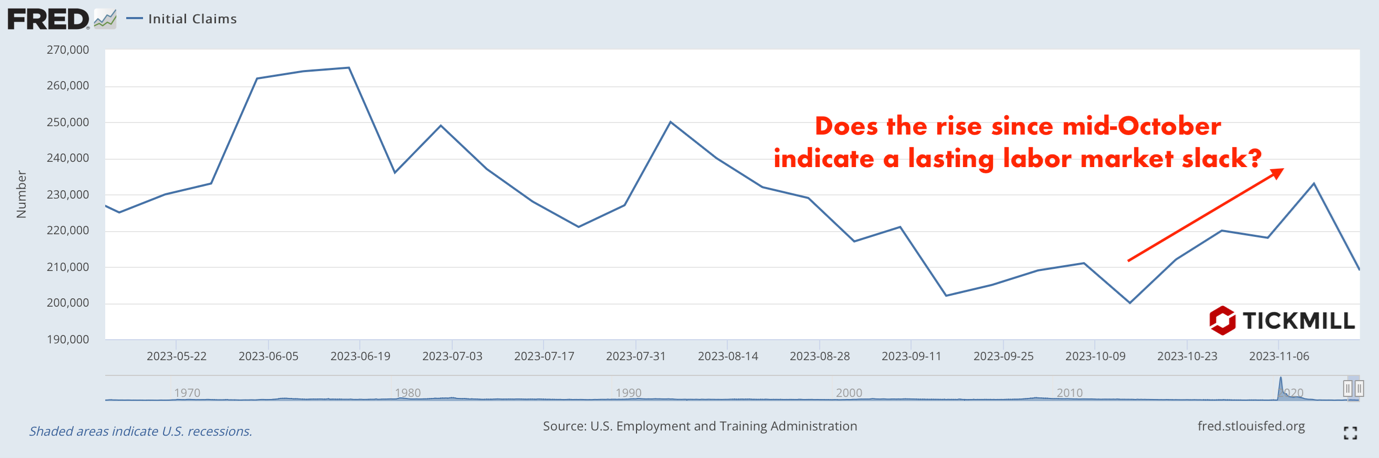

The market should also pay attention to initial unemployment claims, a key U.S. labor market indicator at the moment. An increase from 209K to 220K is expected. Last week, this indicator sharply declined against expectations of further growth, supporting the dollar as markets factored in inflationary consequences and a slower shift in the hawkish stance of the Fed towards a more dovish one. This week's figure will show whether the surprise of the previous week was significant or if the trend of rising unemployment in the U.S. is gradually gaining momentum.

During the New York session, Federal Reserve official Williams will attempt to influence the market, and increased volatility may be observed during the release of U.S. Pending Home Sales data, with an expected 2% decline in monthly terms.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.