Fed’s Kaplan says “patience” should be extended, but who will take heed?

A few years ago, Dick Fisher, the former president of the Federal Reserve Bank of Dallas, insisted on the priority consideration of side effects of unconventional monetary policy. However, he wasn’t listened to back then as he addressed QE in decision-making. The current president of the bank, Robert Kaplan, decided to pick up his predecessor’s banner at a time when the Fed took a position, seemingly driven by market expectations. He stated that the Fed should not forget about the costs of accommodation policy, such as the high involvement of firms in share buybacks and takeovers using debt.

Kaplan wrote in his essay, published on Monday, that "monetary accommodation is not ‘free’. I am concerned that adding monetary stimulus, at this juncture, would contribute to a build-up of excesses and imbalances in the economy which may ultimately prove to be difficult and painful to manage".

According to the team of economists at the Dallas Fed, the issue of low inflation in current expansion is that the structural component of inflation overshadows cyclical one. It’s all about long, medium and short-term cycle interplay that hides the effect that we want to measure, right?

Under the cyclical component, we need to understand the well-known dynamics during expansion - labor shortages (low unemployment) boost wage growth, and wage growth leads to an increase in aggregate consumer demand. Firms, faced with rising sales, raise prices.

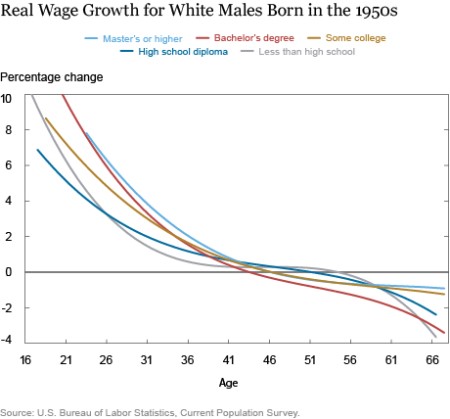

The structural component is somewhat more complicated, but it can be divided into two parts - the aging of workforce and the growth of technological solutions that eliminate market (price) power. According to empirical observations, the growth rate of wages in the United States is inversely proportional to the age of the employee:

The chart above shows the change in wage growth over time, for white men born in the 1950s with varied levels of education. This indicator is adjusted for cyclical factors, i.e., calculated under the condition of a neutral labor market, when the growth rate of new vacancies coincide with the growth rate of the working population. Obviously, with the predominance of older workers in the workforce, upward pressure in wages should naturally subside. In addition, it is known that with age, the share of consumption in disposable income decreases, which suppresses aggregated demand. Therefore, excess savings drive the cost of borrowing in the economy down.

With regard to technological solutions, we’re talking about reducing transaction costs and increasing the convenience of consumers in finding the best price for goods they want to buy. In other words, a company that decides to raise prices may face a flight of customers, as the search for a cheaper option becomes more accessible and cheaper over time… You may have established that we’re talking about the likes of Uber, Airbnb, etc.

Without any particular advantage, price power is leveled at the market, which limits the possible mark-up for companies, therefore putting pressure on wages (see price-wage setting relation). The cost of borrowing is at a historic minimum, companies providing technology solutions are seen as the only beneficiaries from eliminating price power in the market, it is not surprising that investors pour so much money into them, although at the initial stages they can burn cash (like Uber does).

Companies losing market power and having to pay more and more attention to minimizing costs may find it tempting to fund buybacks and M&A deals with debt. Low rates and the course for their reduction will lead to an increase of this burden on the economy. Kaplan repeatedly draws attention to this point of concern in his article and thus strongly supports the extension of the rate change pause until the economic picture becomes clearer.

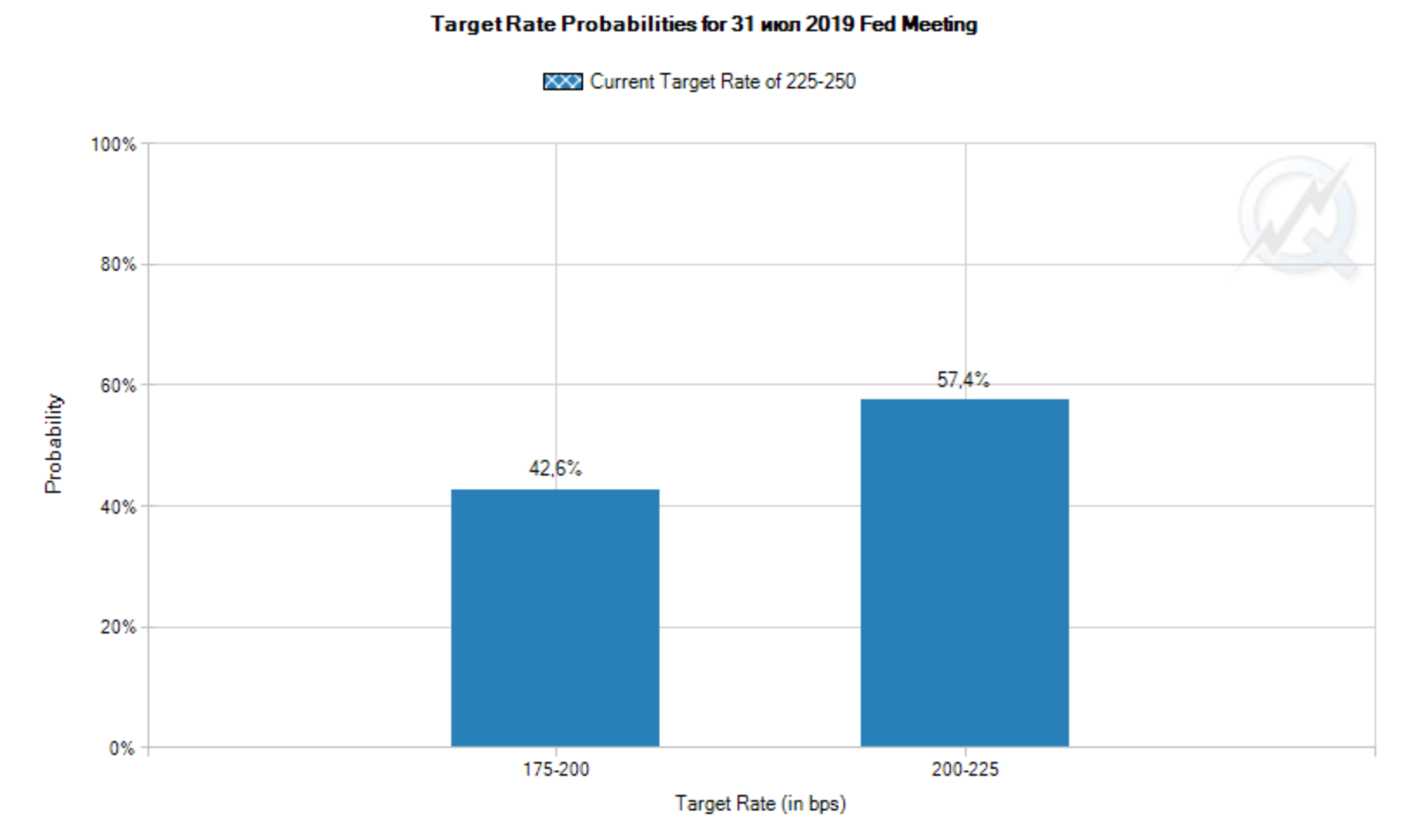

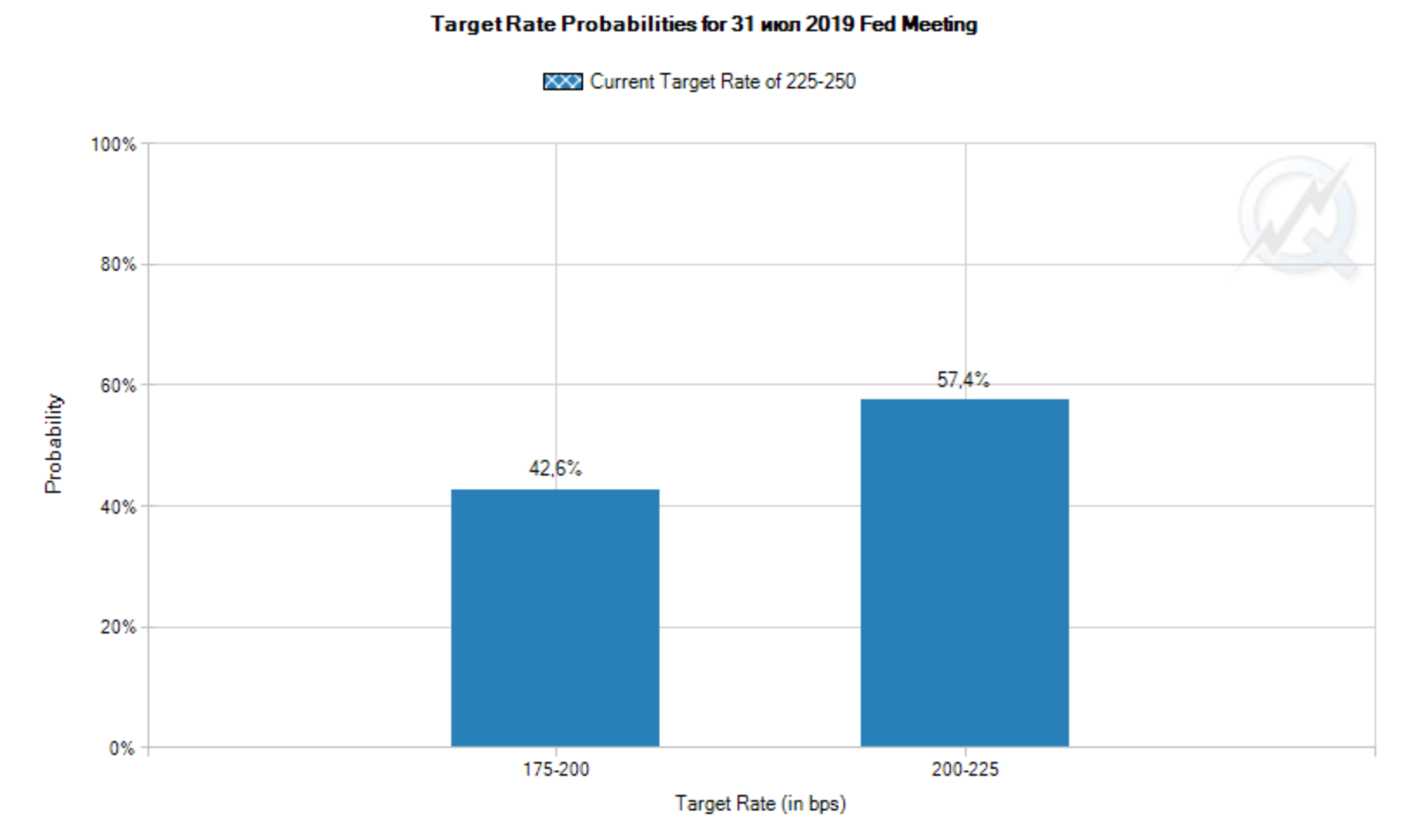

However, who will take heed when the Fed is already behind market expectations, forced to lower rates, as the market prices in a 0(%) chance of keeping the rate at the current level in July:

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.