FTSE 100 FINISH LINE 12/1/26

London's FTSE 100 faced early pressure on Monday, slipping as a stronger pound weighed on the export-heavy index. This downturn coincided with rising tensions between the Trump administration and Federal Reserve Chair Jerome Powell, alongside a slump in banking stocks triggered by President Trump's unexpected proposal to cap credit card interest rates. The pound advanced 0.4% against the dollar, buoyed by reports that the Trump administration had threatened Powell with a criminal indictment. This development raised concerns over the U.S. dollar's reliability as a safe-haven currency, further unsettling global markets. However, U.S. markets rebounded at the start of trading, boosting risk sentiment among UK investors and helping the FTSE 100 return to positive territory by the close.

Banking stocks bore the brunt of the market's uncertainty, with Barclays sliding 3.3% and Close Brothers Group dropping 1.2%. The declines followed Trump's Friday proposal to impose a one-year cap on credit card interest rates at 10%, set to take effect on January 20. The lack of specific details surrounding the proposal left investors uneasy. Amid this volatility, investors turned to safe-haven assets, driving precious metal miners up by 4.3%. Gold prices surged to a record-breaking high of over $4,600 an ounce, reflecting increased demand for stability.

In other developments, the UK job market showed signs of cooling in December, marking the 39th consecutive month of declining hiring activity. While starting salaries rose, the trend kept the Bank of England focused on potential interest rate cuts following its December decision. Despite the broader market's challenges, certain individual stocks stood out. Semiconductor wafer maker IQE soared 34.6% after announcing that its revenue and adjusted core profit for fiscal year 2025 are expected to reach the upper end of its forecasts. Similarly, biotech firm Oxford Nanopore Technologies gained 7% after projecting annual revenue growth ahead of expectations.

TECHNICAL & TRADE VIEW - FTSE100

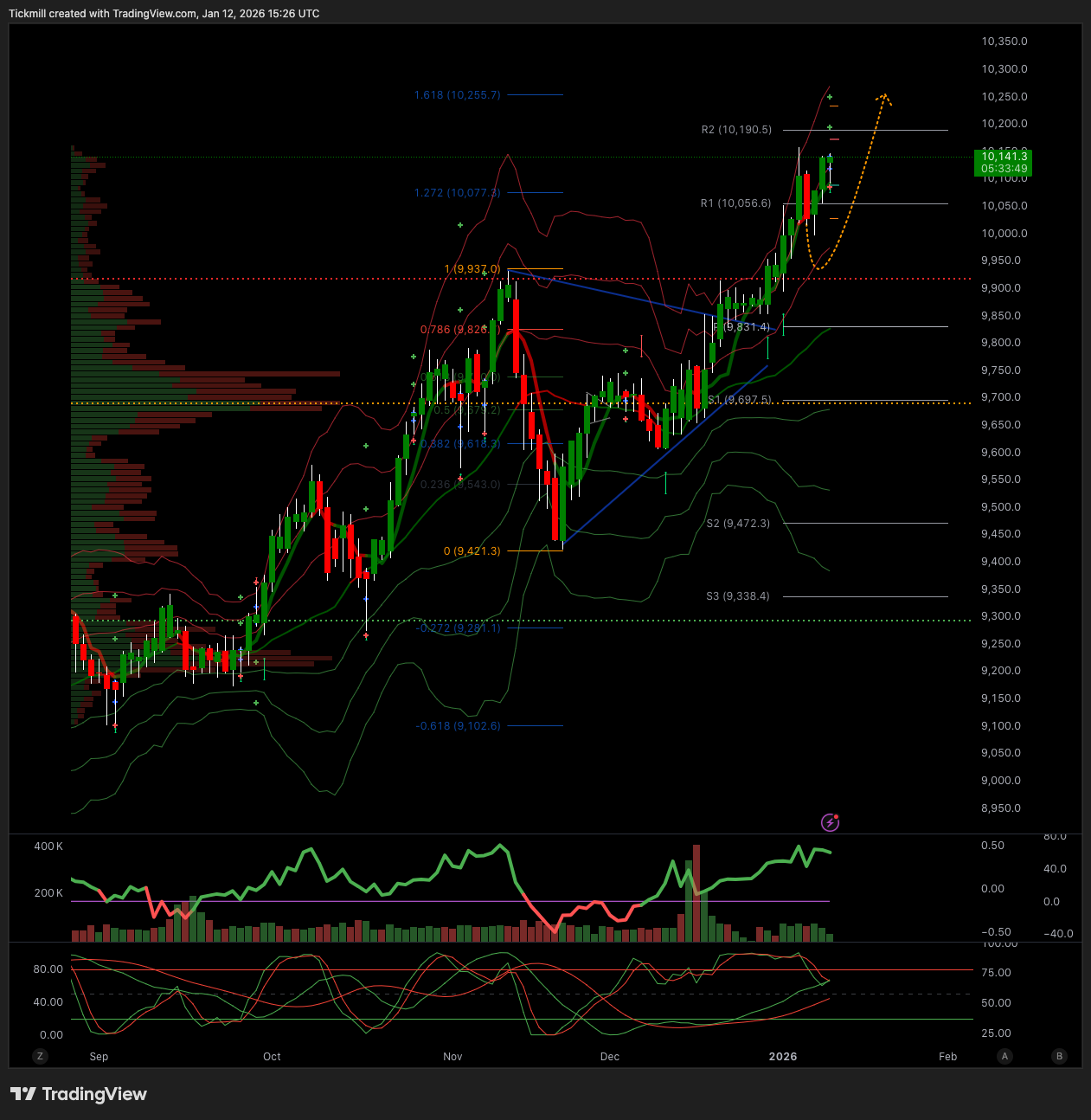

Daily VWAP Bullish

Weekly VWAP Bullish

Above 10050 Target 10250

Below 9930 Target 9800

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!