UK Retail Sales Rise

GBPUSD is rallying today, now testing August highs, bolstered by a combination of better UK economic data and a weaker US Dollar. The BRC retail sales monitor in the UK was seen rising to 2.9% last month, annualised, up from 1.8% prior and well above the 2% level the market was looking for. At this level, the reading marks its strongest level in four month’s and has been attributed to warmer weather over the period which helped boost consumer activity. However, looking at the breakdown of the data, the recent jump in food prices was the main driver of the increase, echoing what we saw in the recent UK CPI report. Indeed, the BRC noted that while data was encouraging, there is still concern around weaker consumer confidence ahead of the upcoming pre-Christmas trading period.

Weak USD

Alongside better UK data, the pair is also benefiting from a weaker US Dollar today. Dovish Fed expectations have been rising on the back of Friday’s US NFP miss. Following on from the big downward miss and prior revisions we saw in August, the data has fuelled an uptick in easing forecasts through year end. Traders will now be looking to incoming US inflation data this week. Any downside surprises should further lift easing expectations, subduing USD and allowing GBPUSD room to push higher near-term.

Technical Views

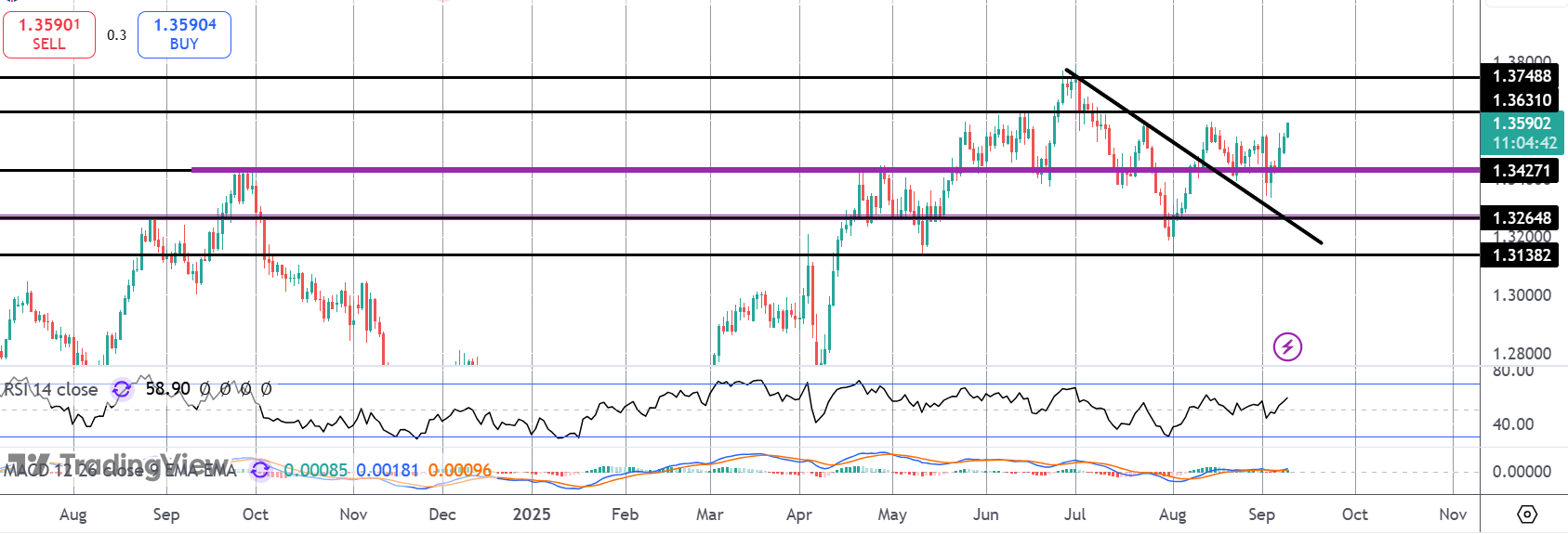

GBPUSD

The rally in GBPUSD has seen the pair moving back above the 1.3427 level with price now fast approaching a test of the 1.3631 level. With momentum studies pushing higher, focus is on continued upside here with the YTD highs now the main objective for bulls while price holds above the 1.3427 level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% and 72% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.