Gold Near Highs: Fed & Middle East on Watch

Middle East Impact

Gold prices are bouncing back on Monday, with the metal hovering just below the all-time highs seen in April. The pullback comes amid rising geopolitical tensions in the Middle East, which have driven investors toward safe-haven assets such as gold, JPY and CHF, notably Bitcoin too. The ongoing conflict between Israel and Iran, now on its fourth day, has intensified and is fuelling concerns over a potential wider regional conflict, supporting demand for gold as a safe-haven store.

FOMC Up Next

Traders’ attention is also focused on key central bank meetings this week, particularly the Fed which meets on Wednesday for the June FOMC. While the Fed is widely expected to leave interest rates unchanged, the focus will be on forward guidance, especially regarding the timing of any future rate cuts. Recent economic data, including last week’s soft inflation release, has stoked speculation that the central bank could ease policy as soon as September.

US Tariffs

Finally, investors this week are also closely watching developments around Trump's tariff plans, with new tariff rates on trading partners expected to be set in the coming weeks, adding another layer of uncertainty to global markets. If Trump goes ahead with tariffs this will be firmly bearish for global risk sentiment, driving gold prices sharply higher. However, if deals can be done to avoid a fresh rise in tariffs, this should see gold prices reverse lower as risk assets rally.

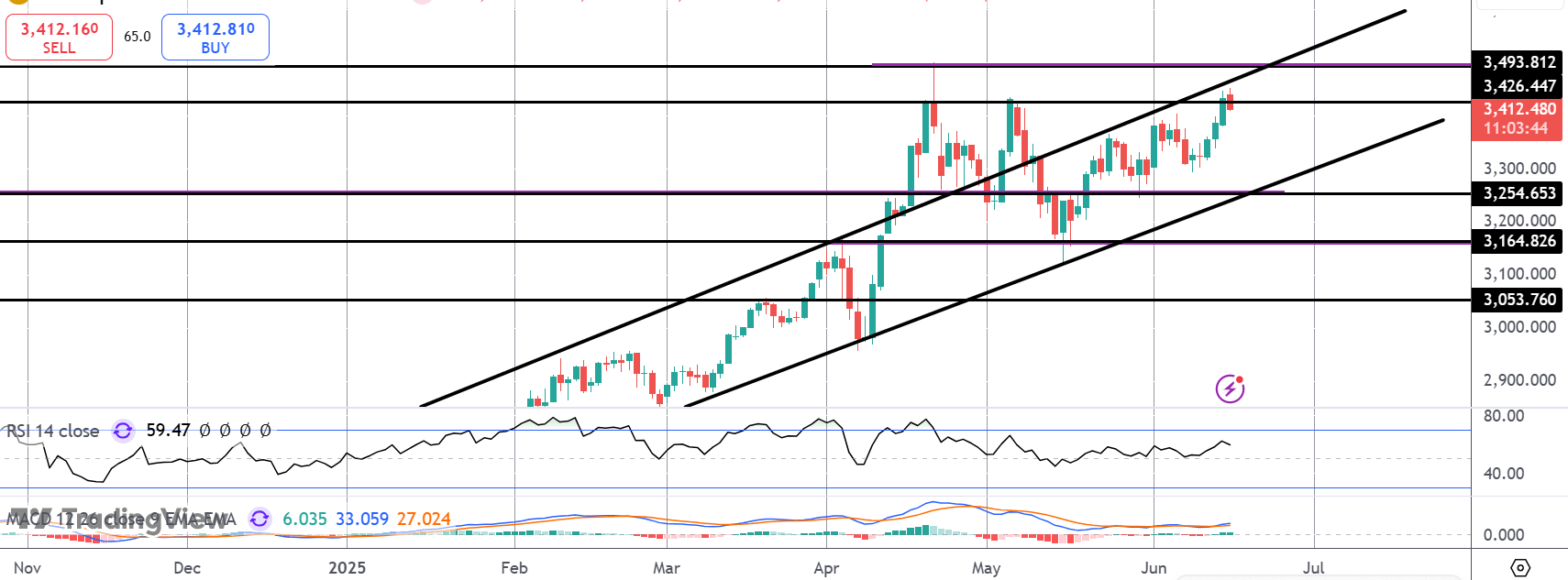

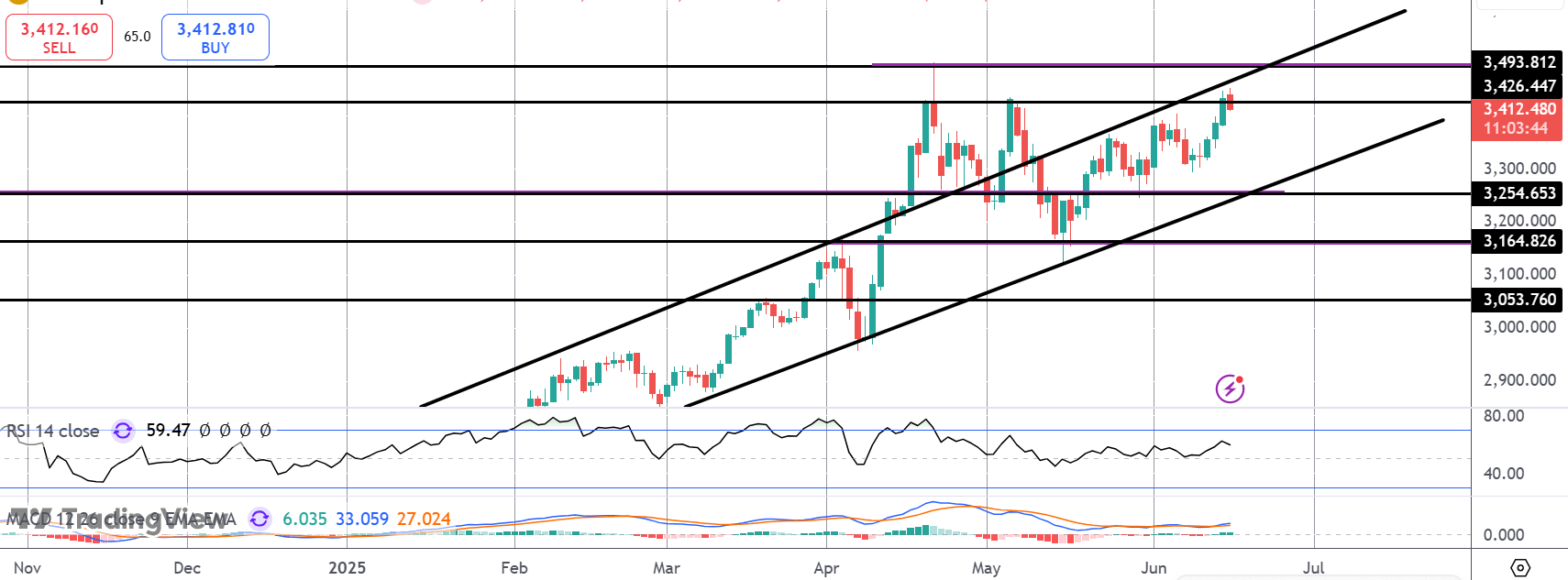

Technical Views

Gold

For now, the rally in gold has stalled into the 3,426.44 level, ahead of the 3,493.81 highs. With momentum studies bullish and price still within the bull channel, focus is on a fresh push higher near-term. The bull channel lows and 3,254.65 level remains the key pivot to watch with the bull view remaining intact while price holds that level.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.