Gold Testing Bull Channel Lows

Weaker Safe-Haven Demand

Gold prices are ending the weekly firmly lower as a broad improvement in global risk sentiment fuels a sharp drop in safe-haven demand. The ongoing ceasefire between Israel and Iran remains the key driver of the recovery in risk sentiment. The week began with elevated fears of an all-out war in the Middle East following the US airstrike on Iran. However, the subsequent announcement of a ceasefire between the two sides has seen risk assets rebounding sharply over the week, with both USD and gold falling amidst reduced safe-haven inflows.

US-China Trade

Alongside reduced risks from the Israel-Iran conflict, risk sentiment has also improved this week in response to news of a US-China trade agreement aimed at expediting US imports of Chinese rare-earth materials. The news has been seen as a further step towards a broader trade agreement between the two and a sign that relations are improving following the revival of trade negotiations earlier this month.

Bearish Gold Risks

Looking ahead, gold prices look likely to continue lower near-term while the current narrative around reduced Middle East risks remains. Provided the ceasefire holds, risk sentiment should continue to improve near-term though incoming news will be crucial to monitor as any breakdown in the ceasefire will likely fuel a sharp shift in market sentiment, seeing gold prices firmly higher near-term.

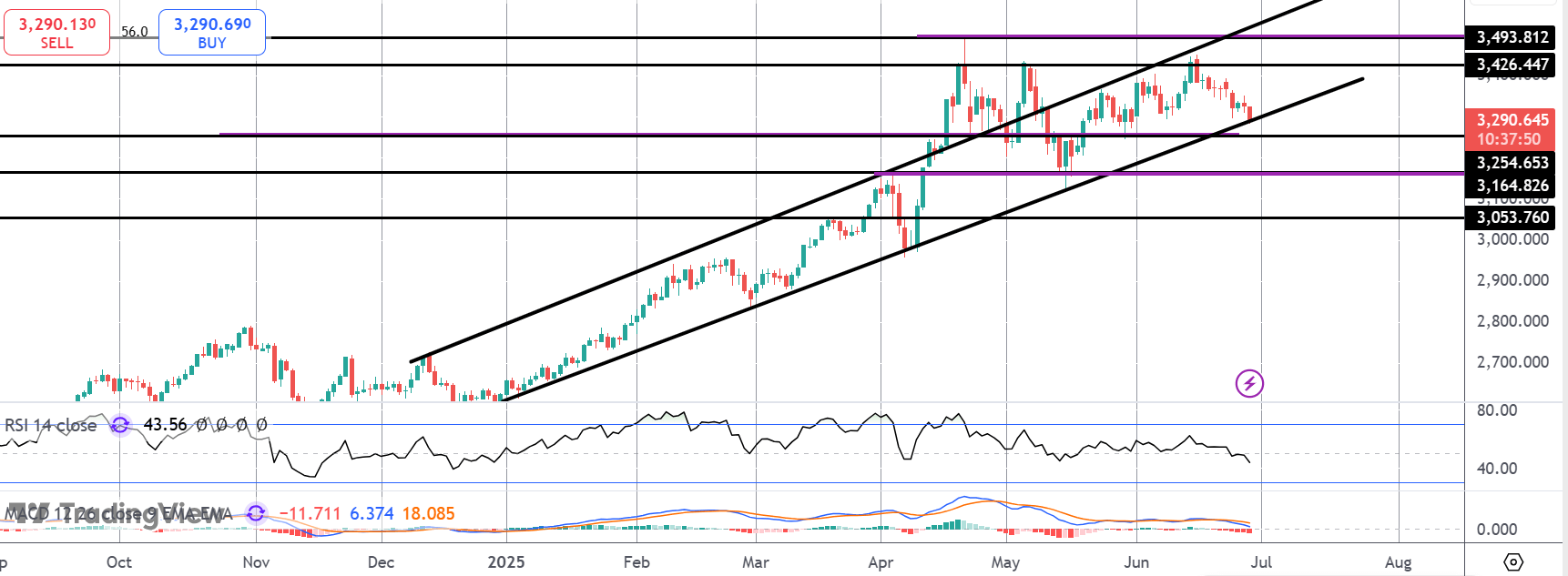

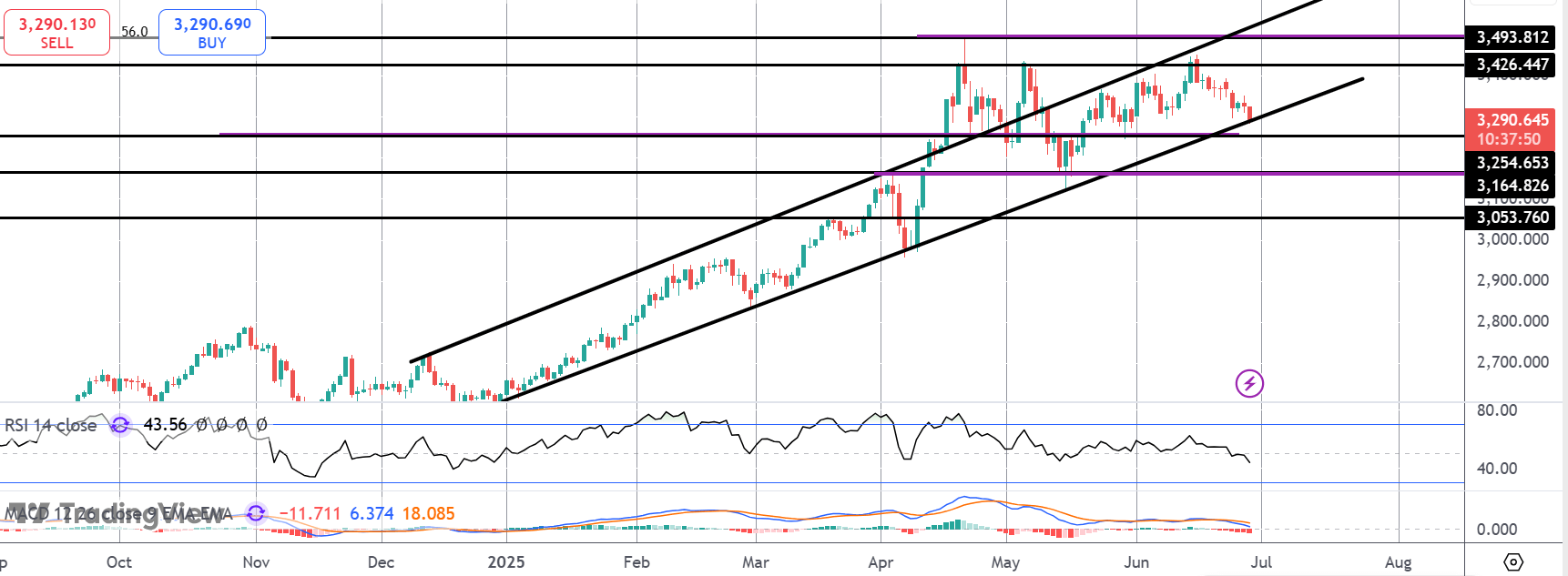

Technical Views

Gold

The reversal lower in gold has seen the market trading down to test the bull channel lows. Below here, 3,254.65 and 3,164.82 will be the next support levels to watch. Weakening momentum studies readings suggest bearish pressure is building with 3,053.76 the deeper target for bears if price breaks the channel lows.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.