Kiwi Sinks As RBNZ Slash Rates

RBNZ Cuts Again

The New Zealand Dollar has come under heavy selling pressure through early European trading on Wednesday following the latest rate cut from the RBNZ overnight. The central bank cut rates by a further .5%, marking a second consecutive reduction after August’s .25% cut. Alongside the cut, the RBNA struck a more dovish tone in the meeting statement, removing language referring to the need to keep rates in restrictive territory for some time. The bank now signals that further rate adjustments will be dependent on the path of the economy.

November Expectations

Following the meeting, market pricing for a further .5% cut in November is sitting around 80%. Given the limited scope of forward guidance at the meeting (no press conference and no updated forecasts). The market will now be looking to incoming data ahead of that meeting to guide expectations. If data continues to trend lower, this should underpin expectations for further easing, keeping NZD skewed lower near-term.

Fed/RBNZ Divergence

Given that Fed easing expectations have grown less dovish on the back of last week’s NFP results, the divergence between the Fed and RBNZ should keep NZDUSD heading lower for now. Looking ahead, tomorrow’s US CPI print will be key for the pair. Any stickiness around prior levels, or a fresh uptick, should further bolster USD while it would take a downside surprise tomorrow to help pull the greenback lower again.

Technical Views

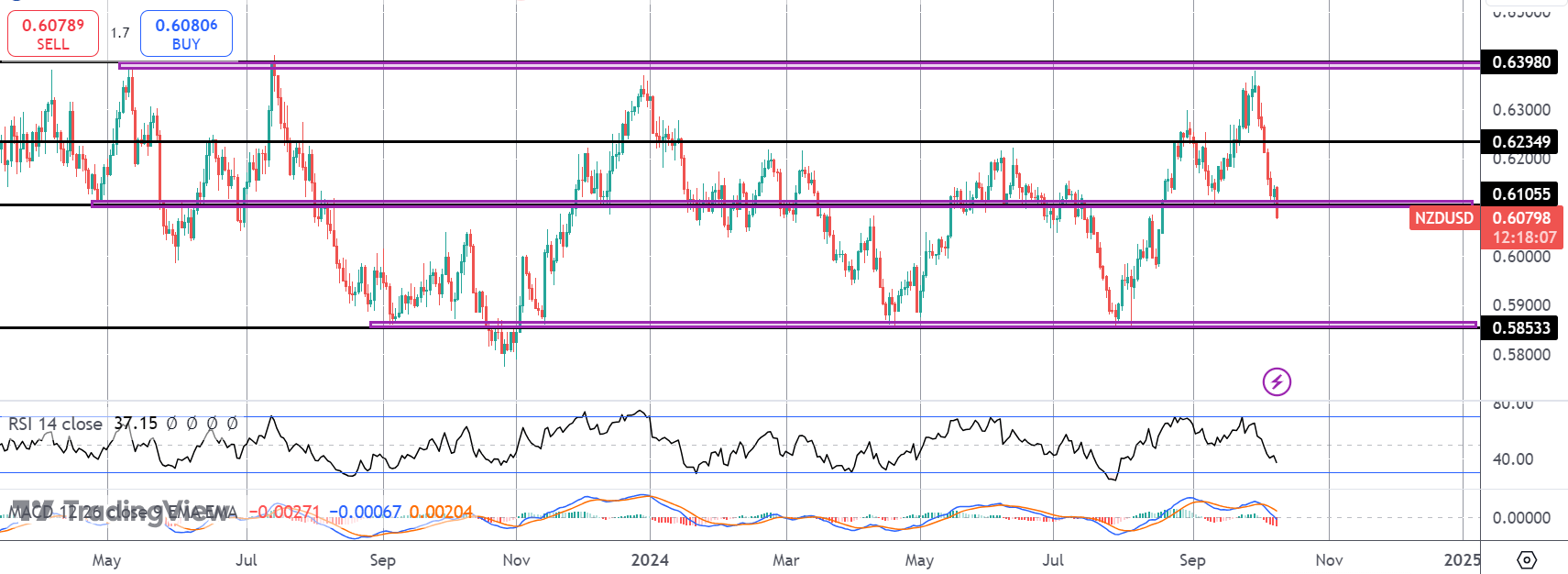

NZDUSD

The failure at .6398 has seen the market reversing heavily lower. Price is now testing below the .6105 level and with momentum studies bearish, focus is on a continued to push down towards .5853 over the coming weeks.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.