Market Spotlight: Downside Risks Into Alibaba Earnings Release

Alibaba Earnings In Focus

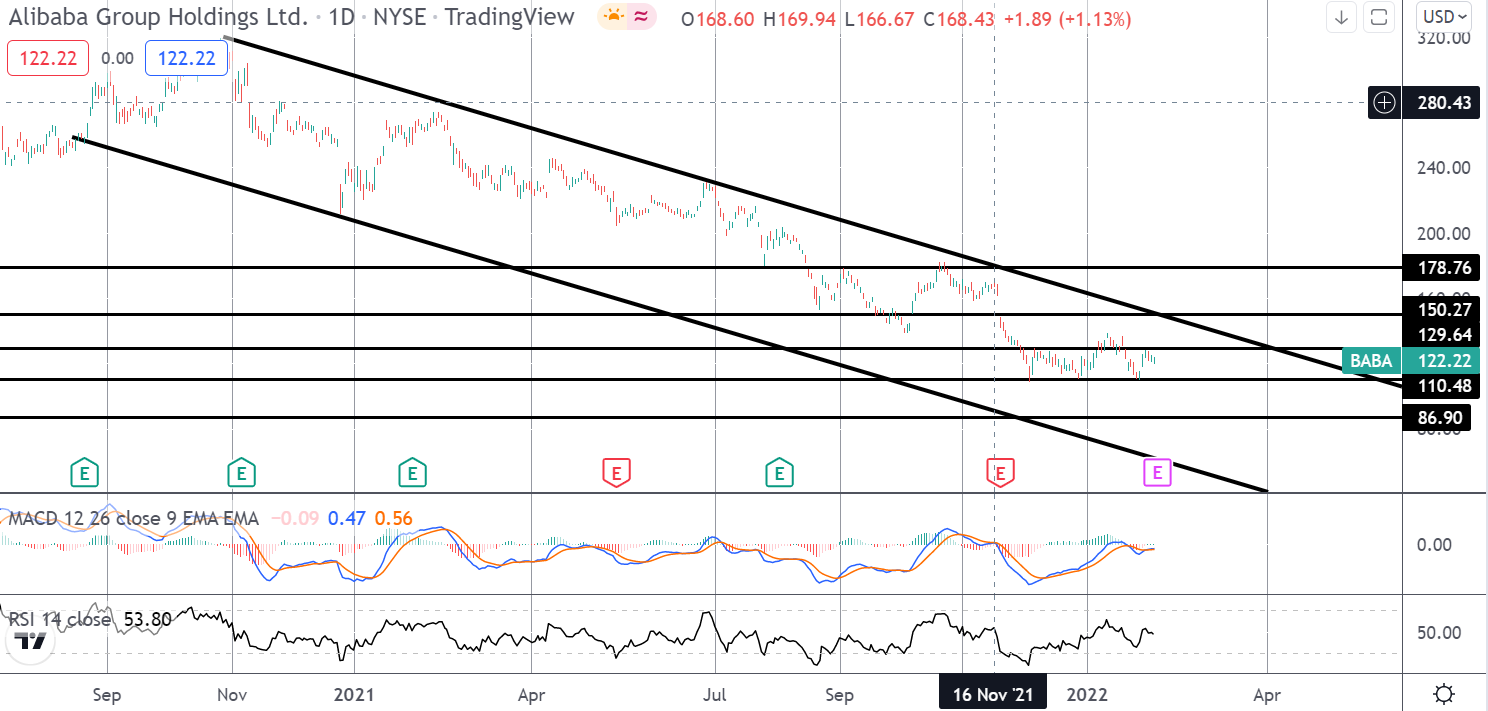

Chinese tech behemoth Alibaba is due to report earnings today for the 4th quarter and there is a great deal of focus on how the company’s share price will respond. Alibaba has been trading in a well defined bear channel since the 2020 highs recorded during the height of the pandemic. Since those peaks, the company has shed over 60% in share value with price now sitting on support around the 113.31 level, down from highs around 320 in Q2 2020.

Looking ahead to today’s release, the market is looking for earnings per share of $2.52, with revenues of $38.813 billion. This would mark a sharp uptick from the prior quarter’s $0.31 EPS and revenues of $31.123 billion. The question is, whether it will be enough to help Alibaba shares reverse their bearish run and breakout higher. On the other hand, if earnings miss today, we could see shares break through the lows, continuing the bearish channel down to its next target.

Technical Views

Alibaba

Alibaba shares have pause din their decline recently, with price holding in a block of consolidation broadly between the 110.48 and 129.64 levels. While indicators have flattened, the focus remains on further downside near term ( 86.90 next on a break of 110.48 lows) unless price can break out above the bear channel top and 150.27 level, putting focus on 178.76 thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.