Market Spotlight: Gas Prices Holding Near Lows

Gas Prices Slip From Highs

After dominating the first half of the year with record strength, gas prices have spent most of the last few months softening from highs. Indeed, natural gas futures on the NYMEX are now sitting almost 40% down from the YTD highs. Several factors have combined to weigh on gas prices over recent months. Notably, strength in the US Dollar had been a key downward contributor, with the recent sell off in USD allowing gas prices to bounce a little off the lows in recent weeks. However, a much milder autumn in Europe has seen a sharp drop in demand which has also allowed prices to settle down. This alongside the record build up in European storage facilities ahead of the winter has created the correct conditions for a sell off.

Winter Weather Key For Gas Prices

Looking ahead, the key for natural gas prices will likely be how the winter demand season in Europe plays out. If weather stays milder than usual, this will likely keep demand subdued against typical seasonal averages and with storage facilities well stocked, the need for fresh purchases will be reduced. However, if the weather takes a turn and demand creeps back up, gas prices might well start to rise again into the end of the year.

Technical Views

Nat Gas

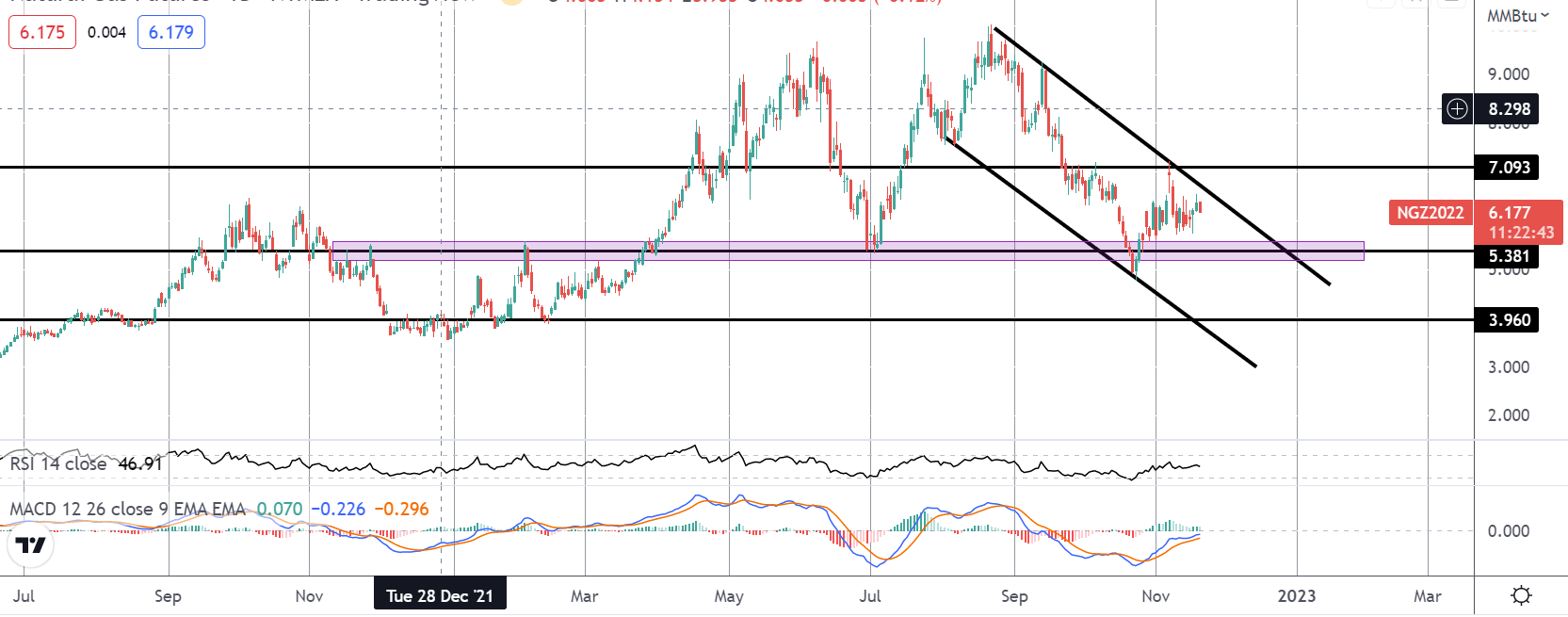

The correction from YTD highs has seen the market selling off within a clear bearish channel. Price recently bounced from the test of the 5.381 support. However, with the channel top holding, focus remains on a continuation lower near-term with a break of the 5.381 level seen opening the way for a move down to the 3.960 level next.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.