Market Spotlight: IAG Pause Offers Opportunities

IAG Up on The Year

Shares in British Airways parent company International Consolidated Airlines Group are seeing a mild pullback on Tuesday. IAG stock has been one of the best performers so far in 2023, rising over 11% from the January open. With shares now sitting just off yesterday’s highs, the current price might be a good opportunity for bulls to get in ahead of a fresh leg higher in coming sessions.

IAG shares have been on a recovery rally since the October 2022 lows and despite the pullback from the November highs, the stock looks to be turning higher again now. The post-pandemic recovery is still ongoing in the aviation sector and with China now reopening its borders for the first time since the pandemic began, travel projections for the year ahead are lifting. While the cost of living crisis is creating some headwinds to customer demand, the outlook for travel in 2023 broadly is positive with IAG forecasting customer number to return to 95% of pre-pandemic levels over Q1.

Investment Banks Turned Bullish

Goldman Sachs appear to buy into this view with the US bank issuing a fresh upside target this week of 150 on the company’s stock. This comes on the back of UBS issuing a higher target of 165 and Deutsche Bank hitting the mid-point around 155. The prevailing view seems to be that cheaper fuel prices, a weaker US Dollar and an uptick in global travel linked to China reopening will help drive the stock higher from here.

Technical Views

IAG

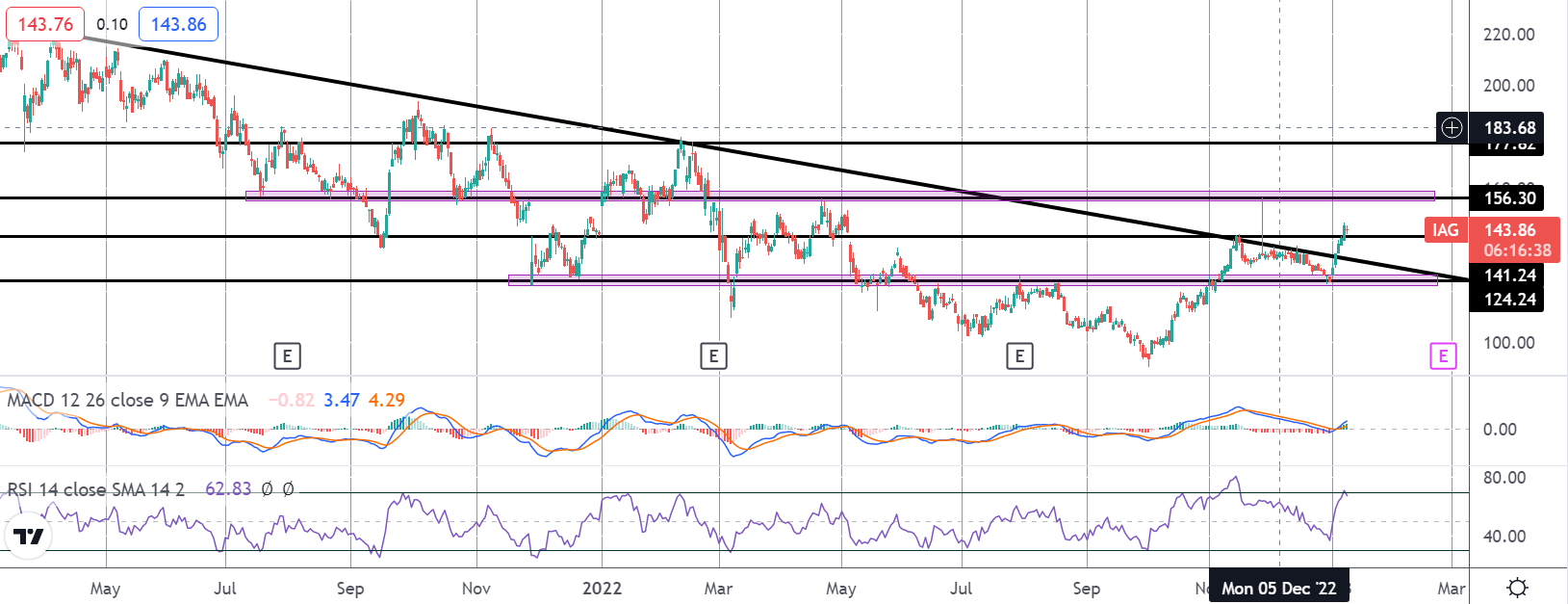

The correction lower from the 156.30 level found firm support into the 124.24 level with price now moving back above the bearish trend line and above the 141.24 level. With momentum studies turned bullish here, the focus is on a continuation higher. With that in mind, 156.30 is the key level for bulls to break, opening the way for a 177.82 move thereafter.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.