Post-FOMC Dollar Bounce Fading

DYX Softer Mid-Morning

Despite some initial strength, DXY is softening now as we move through the European morning session on Monday. DXY had bounced firmly off the post-FOMC lows with the index recovering from mid-96 to highs 97s before selling kicked in today. The FOMC was an interesting event with some clear dovish developments tempered by some hawkish details. On the one hand, the Fed cut rates by .25% while signalling furtehr cuts to come this year. However, upwardly revised growth forecasts and concerns expressed over continued inflation risks mean that there is still uncertainty near-term. Powell was keen to stress that future adjustments would be made on a meeting-by-meeting basis, in consideration of the latest data.

US Data in Focus This Week

As such, traders will be now be closely watching incoming data this week with any fresh weakness likely to feed into increases dovish expectations, pushing USD lower. Similarly, any upside surprises should see near-term easing expectations cooling a little, fuelling an uptick in USD as traders square short positions. This week we have a slew of US data to watch with PMIs due on Tuesday, weekly jobless claims and final quarterly GDP on Thursday before the headline core PCE data due on Friday. Given the focus on inflation risks, Friday’s data could be pivotal for USD near-term.

Fed Commentary on Watch

Alongside that data, we have a raft of Fed members due to speak this week kicking off later today. This will be the first set of insights into Fed sentiment after the FOMC and there is plenty of potential for comments to drive USD volatility as traders focus now on October easing chances.

Technical Views

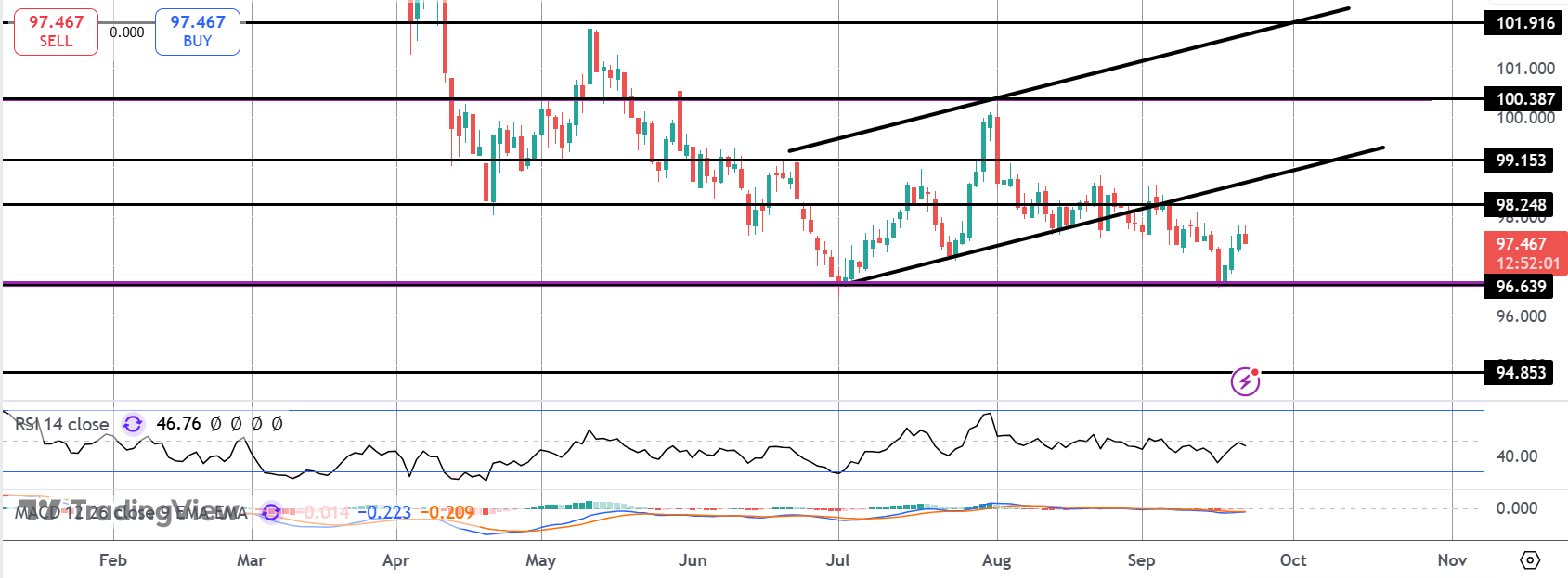

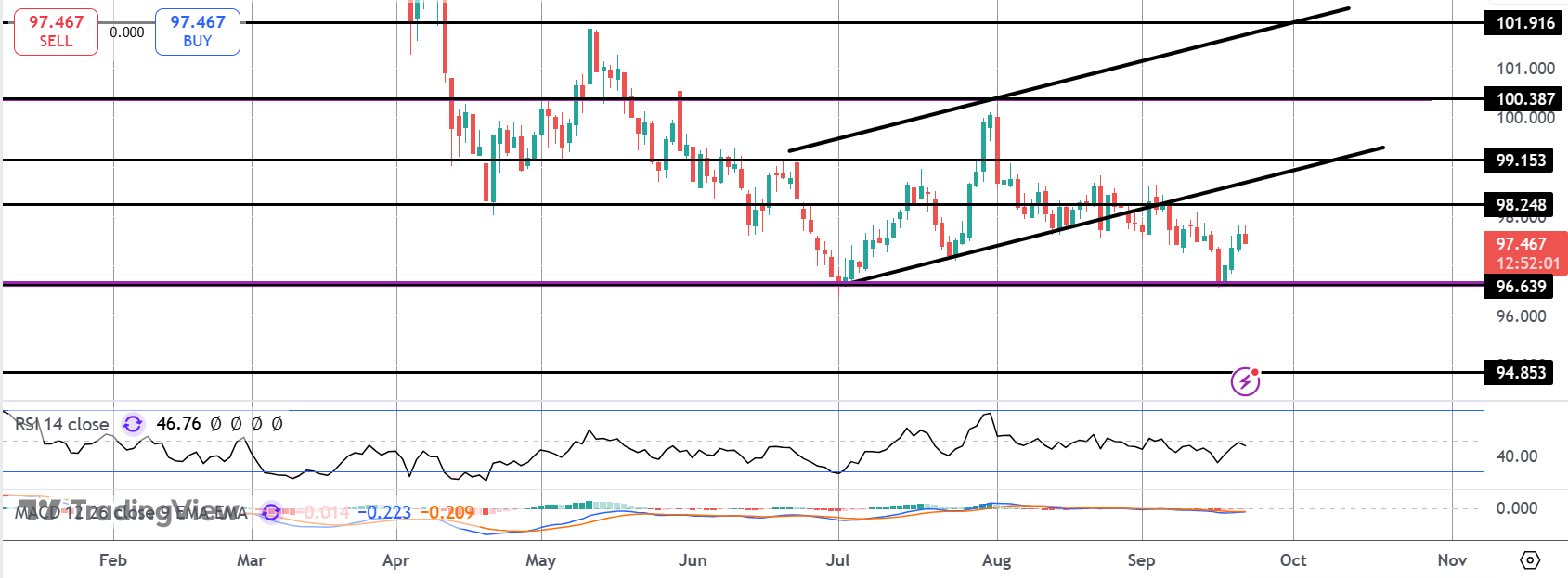

DXY

The sell off in DXY has stalled for now into the 96.63 level. However, the rebound off that level his fading with downside risks growing again. If 96.63 breaks, 94.85 is the deeper level to watch. Meanwhile, bulls need to see a break above the 98.24 level to alleviate near-term bearishness.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.