Soft Start for Crude Oil - What to Watch This Week

Oil Slips on Russia-Ukraine Peace Prospects

Oil prices are seeing a more muted start to the week with the futures market still trading within Thursday’s range for now. Uncertainty over the prospect of an end to the Russia-Ukraine war is making it difficult for traders to get a read on near-term direction. Indeed, price action certainly reflects a market that is awaiting clarity and fresh directional drivers. Ultimately, an end to the war between Russia and Ukraine should have a bearish impact on oil prices with the anticipating of fresh supply re-entering the market.

US Data on Watch

Sentiment among crude traders remains weak on the back of Friday’s softer-than-forecast US consumer confidence reading. Recent data weakness in the US is feeding into a weaker demand outlook, reflected by the recent uptick in EIA inventories readings we’ve seen. Looking ahead this week, traders will be watching incoming US jobs data on Friday. If we see any undershooting of forecasts, this should keep crude prices pressured for now, particularly given the expected impact of Trump’s trade tariffs this week.

Trade War Impact

Trump plans to press ahead with levies on Mexico, Canada and China tomorrow when the month-long suspension order expires. With the risk of tit-for-tat trade actions seen, demand for crude is expected to suffer on a decline in global trade activity. As such, traders will be watching incoming news flow around trade this week with any countermeasures from US trading partners likely to weigh on crude prices.

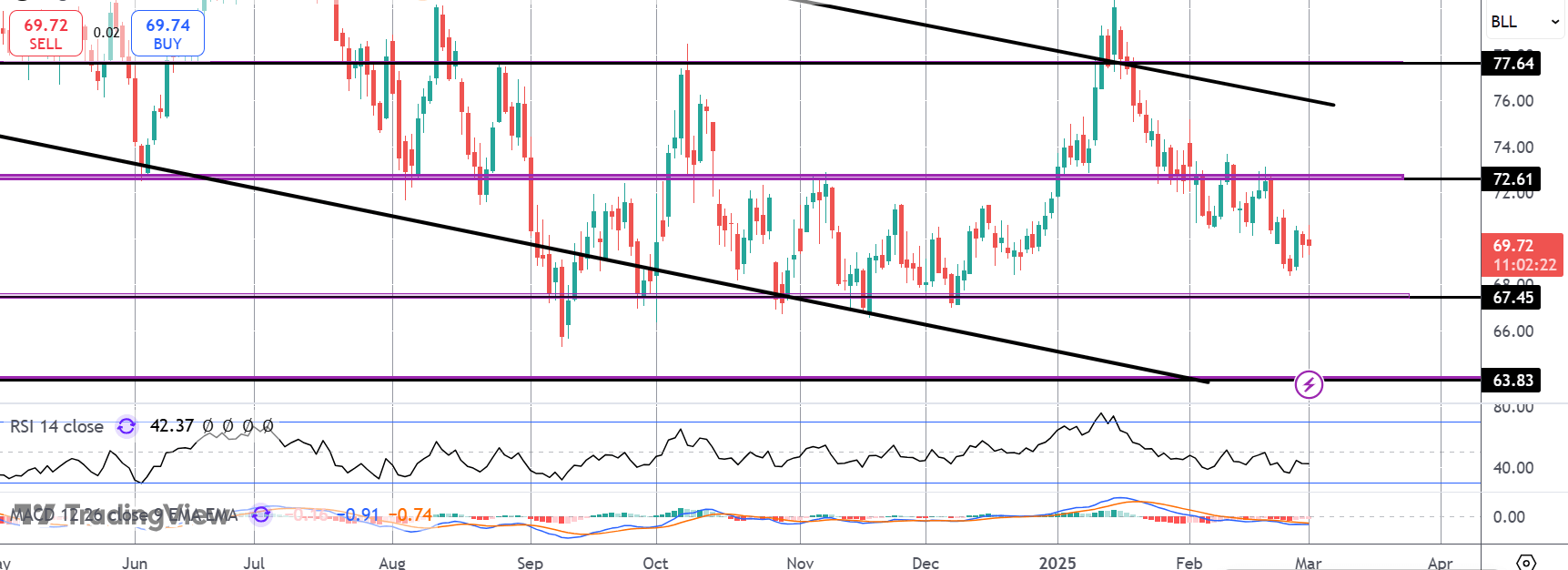

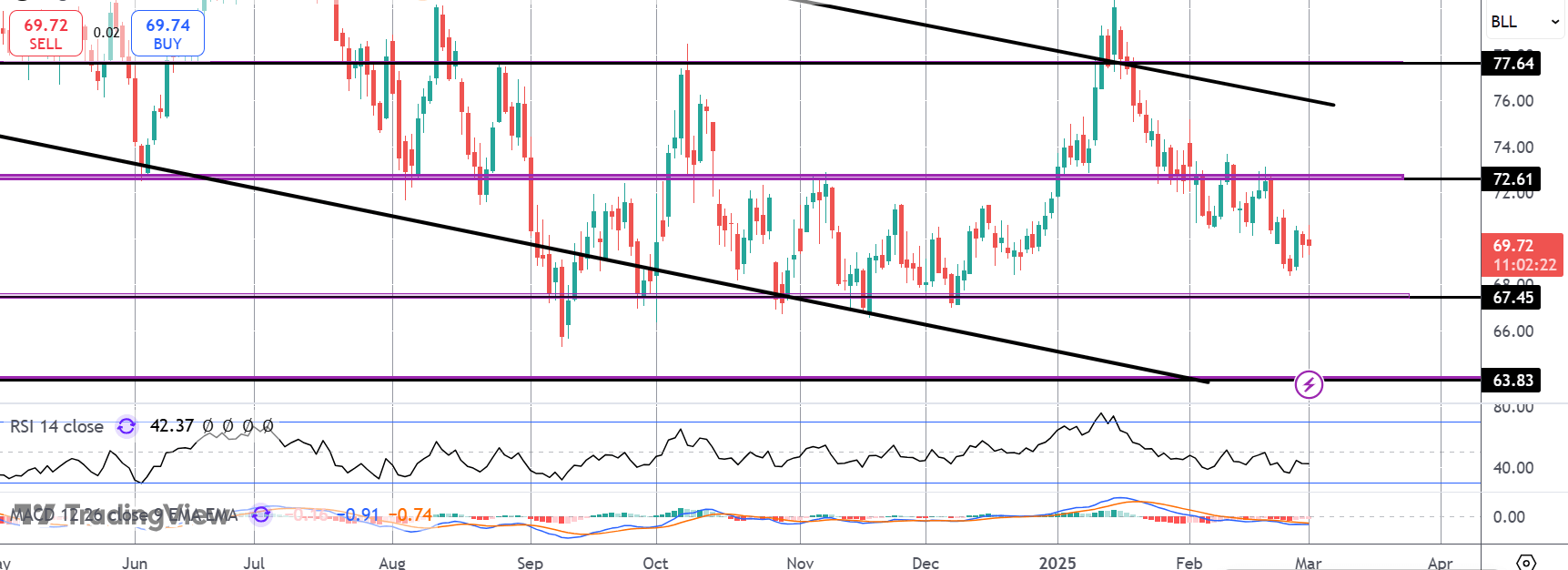

Technical Views

Crude

The recent failure at the 72.61 level has seen the market turning sharply lower again. However, for now, crude prices remain above the 67.45 level which is seen as key support and while this level holds, a recovery higher cannot be ruled out. Below there, 63.83 is the next support to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.