The Crude Chronicles - Episode 109

Crude Traders Increase Longs

The latest CFTC COT institutional positioning report shows that oil trader increased their net long positions last week by a further 17,836 contracts. This latest increase in upside bets takes total long exposure back up to 373,814 contracts, its highest level in five weeks. Recently, crude prices have been on a firm upward trajectory as a result of the global energy crisis which has seen soaring fuel prices around many parts of the world. Supply chain issues have further exacerbated the crisis, leading to a cycle of higher prices. However, despite the recent uptick in long positions, crude prices have softened back a little this week with the market reversing back under the initial 2021 highs around 76.78.

US To Release Oil Reserves?

Oil prices reversed lower this week on speculation that the US government might release some of its oil reserves as a means of impacting fuel prices lower. The US energy secretary, Jennifer Granholm, this week said that “all tools are on the table”, when it comes to combatting soaring fuel prices. When asked about such an action, Granholm said that it is “under consideration”. The method was last used in 2011 under the Obama administration to help combat a similar period of elevated prices.

EIA Reports Further Inventories Build

Oil prices were also weighed upon this week by the latest report from the Energy Information Administration. The EIA reported a further build in US commercial crude stocks last week which rose by 2.3 million barrels. The move, which was in stark contrast to the 400k barrel drop forecast, marks a second week of inventory increases. The surplus is being linked to higher output levels as refiners up their output in a bid to help meet soaring demand and capitalise on higher prices.

The EIA report showed that US output jumped by 200k barrels per day last week. With this increase, output is now back up to 11.3 million barrels per day, around its highest levels seen over the pandemic.

Technical Views

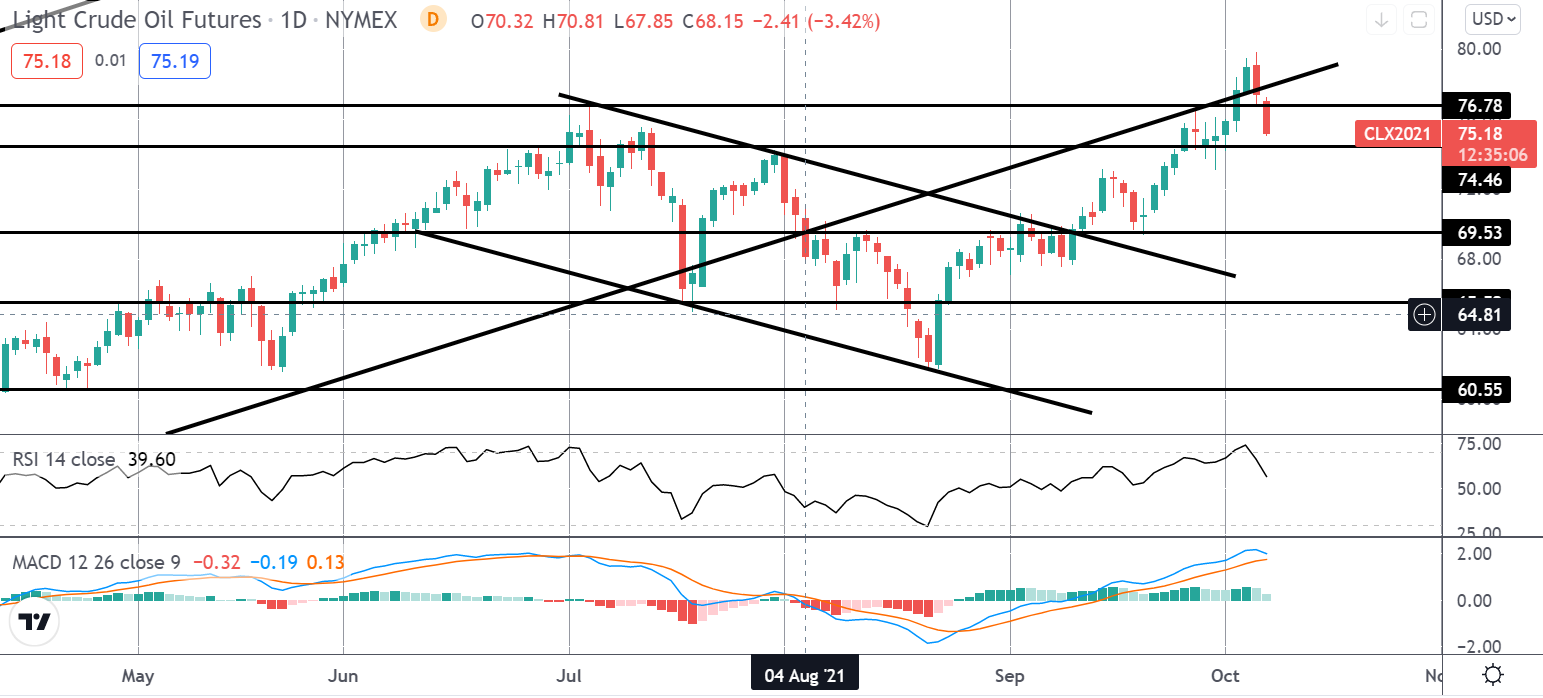

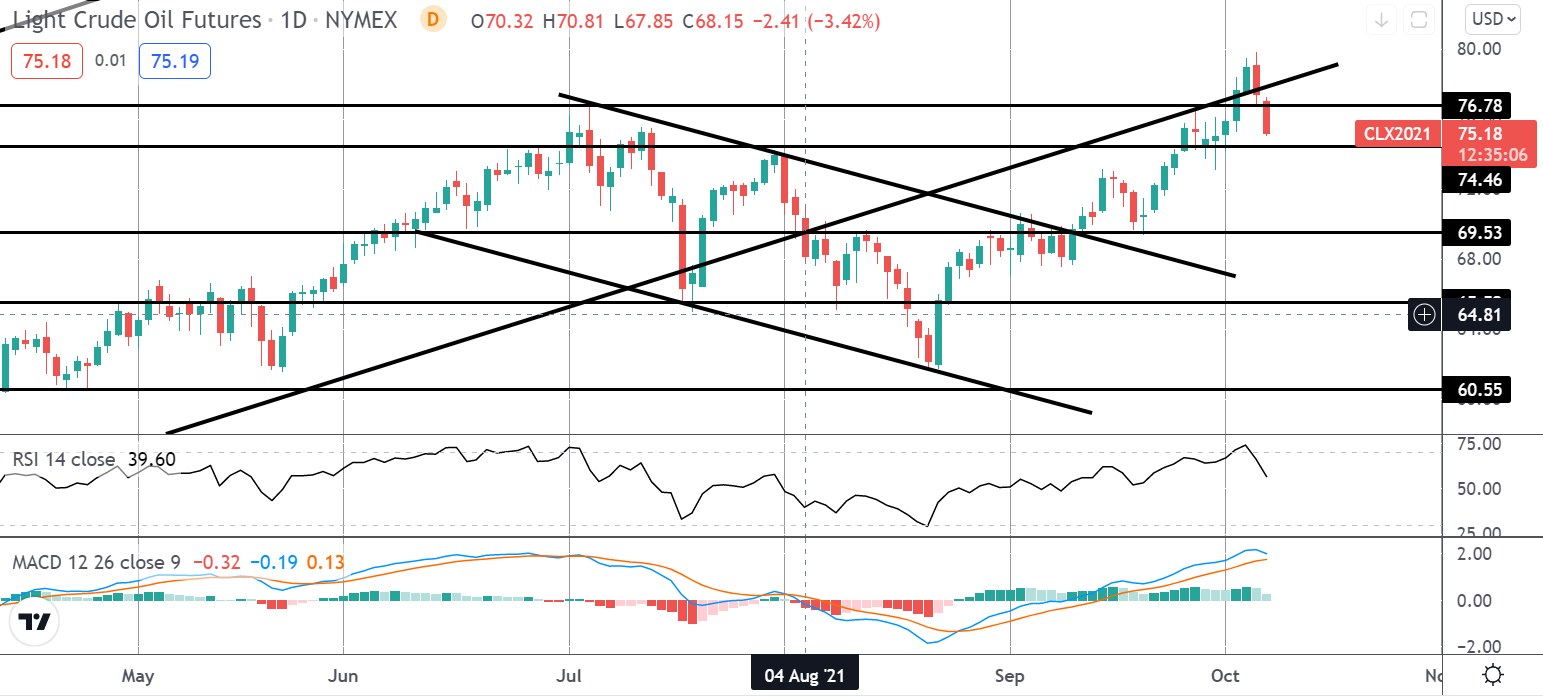

Crude Oil

Following a brief break back above the rising channel low, oil prices have since reversed and are now trading back below the initial 2021 highs around 76.78. With MACD and RSI coming off sharply, there is room for the move to gather pace on a break below the 74.46 level, putting the 69.53 level in focus. While 74.46 holds, however, the focus is on further upside in the near term.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.