The FTSE Finish Line - June 27 - 2024

The FTSE Finish Line - June 27 - 2024

FTSE Another Modest Decline Ahead Of US Data & UK Elections

The FTSE 100 benchmark experienced a 0.19% decline. The pharmaceutical and biotech industry was negatively affected by a 6.5% decrease in the stock of drugmaker GSK following the U.S. CDC's decision to narrow its recommendation for the use of respiratory syncytial virus vaccines in older adults and withhold their recommendation for adults under 60. Investors are closely monitoring the upcoming U.S. personal consumption expenditure (PCE) numbers, scheduled for release on Friday, as they could impact the Federal Reserve's approach to interest rate cuts for the year. Investors are also exercising caution ahead of the parliamentary elections in Britain on July 4.

The prices of gold and copper stabilised near weekly and monthly lows, leading to a marginal 1.1% decrease in precious metal miners and a 0.8% decline in industrial metal miners. The automobile and parts sector also saw a 1.5% drop after industry data revealed an 11.9% year-over-year decrease in Britain's car output for May, marking the third consecutive monthly decline.

Currys, a UK-based retailer, experienced a significant decrease in sales, causing their shares to drop by as much as 7.9% to 70p, making them one of the top percentage losers on the FTSE midcaps index. The company reported a 4% fall in revenue to 8.48 billion pounds, with like-for-like sales in the UK and Ireland division as well as in the Nordics also declining. This decline was attributed to consumers avoiding discretionary purchases due to high inflation and rising interest rates, resulting in a 2% decrease in UK-Ireland sales and a 3% decrease in the Nordics. Despite these challenges, the company remains optimistic about the potential of AI-powered gadgets to drive profit growth in the coming year. Despite the recent setback, the company's stock has seen a significant increase of approximately 45% so far this year.

DS Smith's stock price has surged by 6% to 391p, making it the top gainer on London's FTSE 100, following the news that Brazilian pulpmaker Suzano has ended discussions to acquire International Paper. This decision by Suzano has removed the uncertainty surrounding DS Smith, which had previously agreed to be purchased by International Paper for $7.2 billion in April. Sources have revealed that a potential deal between Suzano and International Paper would have been contingent on International Paper withdrawing its bid for DS Smith. Notably, DS Smith's shares have seen a 27% increase this year, outperforming International Paper's 29% rise and Suzano's 8% decline.

GSK's shares fell by 6% to 1,498pence, the lowest since Jan 2, after the U.S. CDC narrowed its recommendation for the use of RSV vaccines in older adults and did not recommend their use for adults under 60. Jefferies analyst Peter Welford stated that this decision raises the risk for GSK's Arexvy vaccine sales. GSK received FDA approval earlier this month to expand the use of its vaccine to adults ages 50 to 59 years, but the committee postponed endorsing its use in that age group. Analysts at JPMorgan noted that this decision is negative for GSK, which makes the Arexvy RSV vaccine. Despite this, the stock is up about 3% year-to-date.

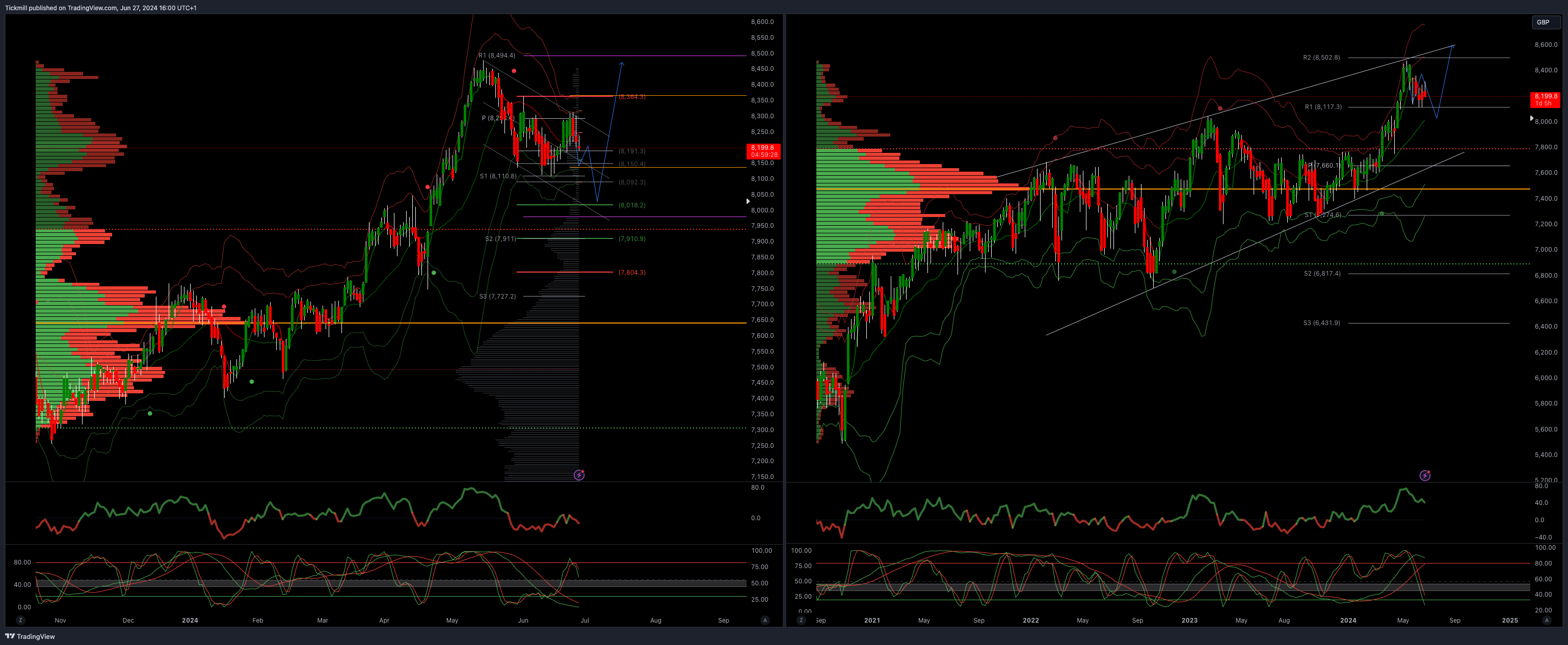

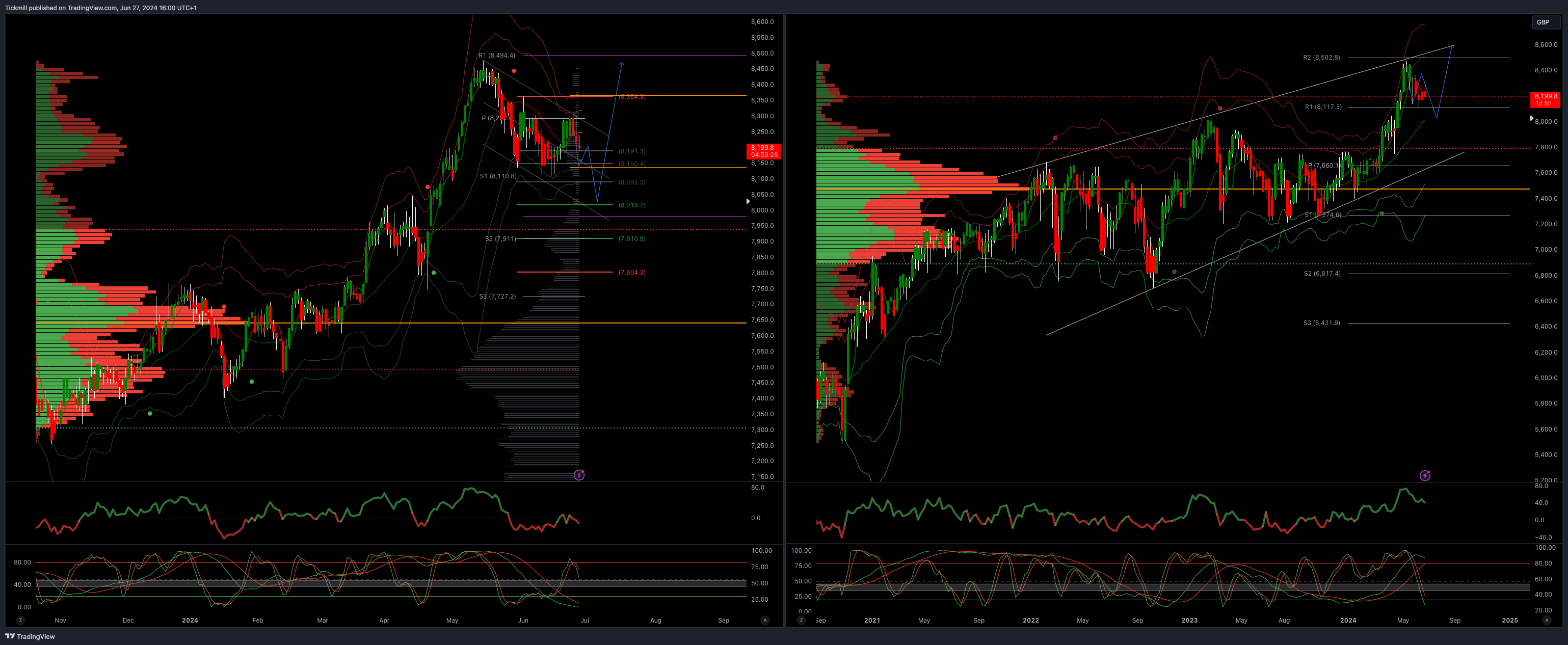

Technical & Trade View

FTSE Bias: Bullish Above Bearish below 8300

Above 8363 opens 8500

Primary support 8000

Primary objective 8023

5 Day VWAP bearish

20 Day VWAP bearish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!