The FTSE Finish Line - June 28 - 2023

The FTSE Finish Line - June 28 - 2023

Sage Leads Blue Chips Higher, BoE’s Bailey Notes Resilient UK Economy

The FTSE sended Wednesday's trading session on a modest positive note gaining 0.25%, following the overnight gains on Wall Street. Bank of England (BoE) Governor Andrew Bailey commented on the UK economy at the Sintra forum in Portugal, stating that it had turned out to be more resilient than anticipated. He noted that there were clear signs of persistent inflation and emphasised that the BoE would take the necessary actions to bring inflation back to its target. Bailey also mentioned that headline inflation is expected to decrease significantly this year. However, he acknowledged that the market does not believe that the BoE is close to completing its actions at the moment, suggesting that further measures may be implemented in the future.

On the positive side of today’s ledger shares of enterprise software firm Sage Group Plc surged to a more than 23-year high following an upgrade by JP Morgan. The stock climbed as much as 4.99%, reaching its highest level since March 2000. Analysts at JP Morgan raised their rating on the stock to "overweight" from "neutral" and increased the target price to 1,110p from 860p. JP Morgan believes that Sage is uniquely positioned to drive the automation of back-office software for small and mid-sized businesses in the next decade. They also expect Sage to sustain a double-digit organic revenue growth rate until 2025 and potentially accelerate further in 2026-30. As a result, Sage Group Plc emerged as the top percentage gainer on the blue-chip FTSE 100 index. The stock is currently up 4%, bringing its year-to-date gains to around 22%.

On the negative side of the ledger Ocado investors continue to get whipsawed, shares of the online grocer experienced a significant decline down 5.4% following a media report stating that U.S. e-commerce giant Amazon had denied any plans for a potential bid. The stock fell as much as 11.2%, making it the top percentage loser on the FTSE 100 index. Market participants attribute the drop to the news about Amazon's denial, which contradicted previous media speculation that had caused Ocado's stock to surge over 40% on June 22. The speculation had included potential interest from Amazon. However, Amazon declined to comment on the matter. Ocado's stock is down approximately 17%.

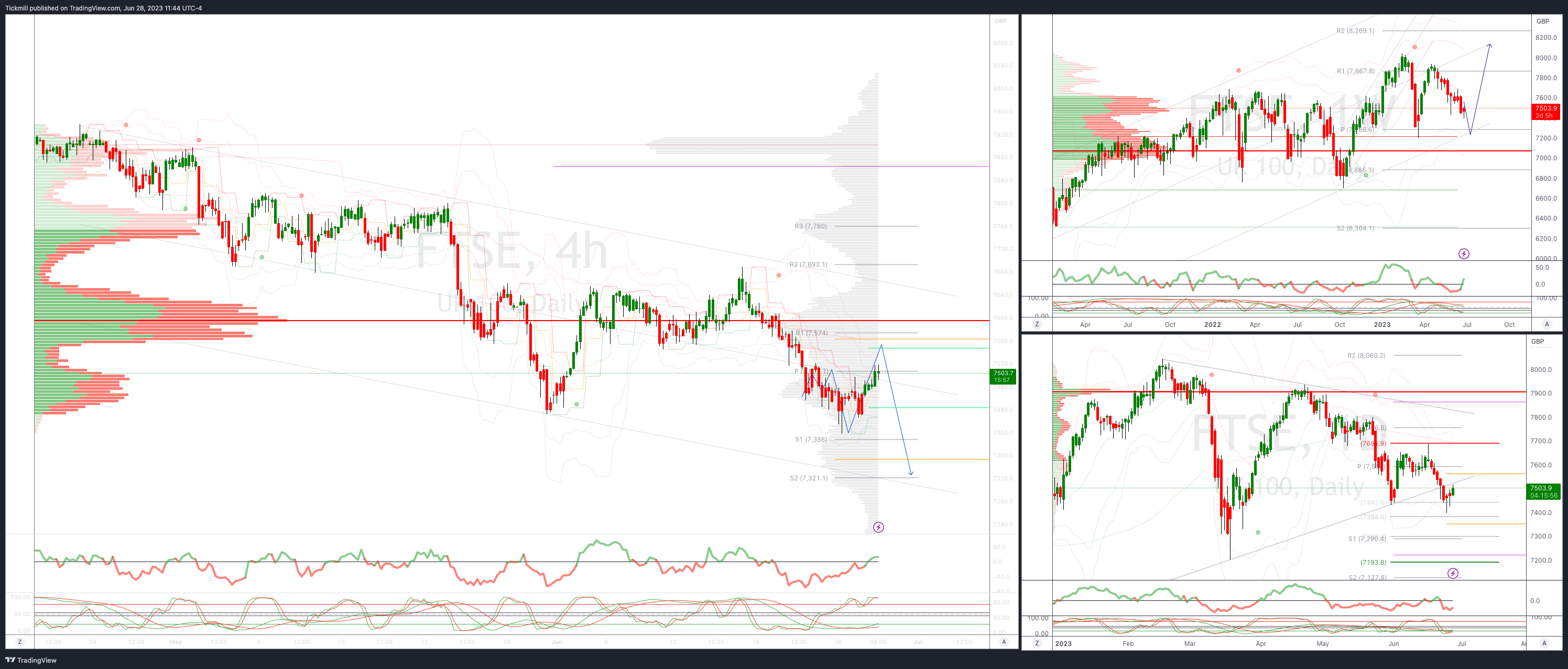

FTSE Bias: Intraday Bullish Above Bearish below 7510

Above 7550 opens 7660

Primary resistance is 7660

Primary objective 7330

20 Day VWAP bearish, 5 Day VWAP bullish

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!