The IndeX Files 06-08-19

We're back again with the next episode of the The IndeX Files 06-08-19!

Trade War Concerns Explode

It’s been a volatile time for the equities market over recent sessions. The market was rocked late last week by President Trump’s announcement of fresh tariffs on Chinese goods. US and Chinese delegates had been meeting in Shanghai to resume trade talks following their earlier breakdown in May. However, at the close of the two day meetings, Trump announced on twitter that as of September 1st a further $300 billion of Chinese goods will be under tariff”.

The news took markets totally by surprise, fuelling a sweeping wave of risk aversion which has sent equities prices lower. While a further round of talks is scheduled for September, traders are fearful that the talks will collapse again. On Monday, USDCNH surged to its highest levels since the Global Financial Crisis in 2008, trading back above the 7 level. China has threatened to retaliate and this sharp currency weakening seems to be the first move. For now, traders wait to hear what further actions China takes and to see whether trade talks will continue or whether they will be discontinued once again. Earlier in the year, Trump had threatened to tariff the remaining $300 billion of Chinese goods at 25% meaning that we could still see a further increase in tariffs if China responds.

The Fed Disappoints

In the US, the Fed disappointed equities by bulls with a more composed tone at last week’s FOMC meeting, than many were expecting. Although the Fed cut rates by .25% (which was priced in) the central bank downplayed the prospect of further easing saying that this cut was just a mid-cycle adjustment and not the start of a lengthy easing process.

ECB Easing Expectations Grow

In the eurozone, expectations of ECB easing remain intact. Recent data weakness has compounded the view that the ECB will need to ease, to backstop the economy, in line with its own guidance. This latest escalation in the trade war will also be closely watched by the ECB and other global central banks.

BOE Highlights Recession Risk

In the UK, the BOE kept rates on hold last week though slashed its growth forecast. The bank cited the ongoing risks from Brexit, noting that the likelihood of a no deal Brexit has increased and with it, the chances of a recession in the UK. However, the bank is still split on which course of action such a situation might require as it also notes the risk of spiralling inflation, meaning that a rate hike could be just as likely as a rate cut.

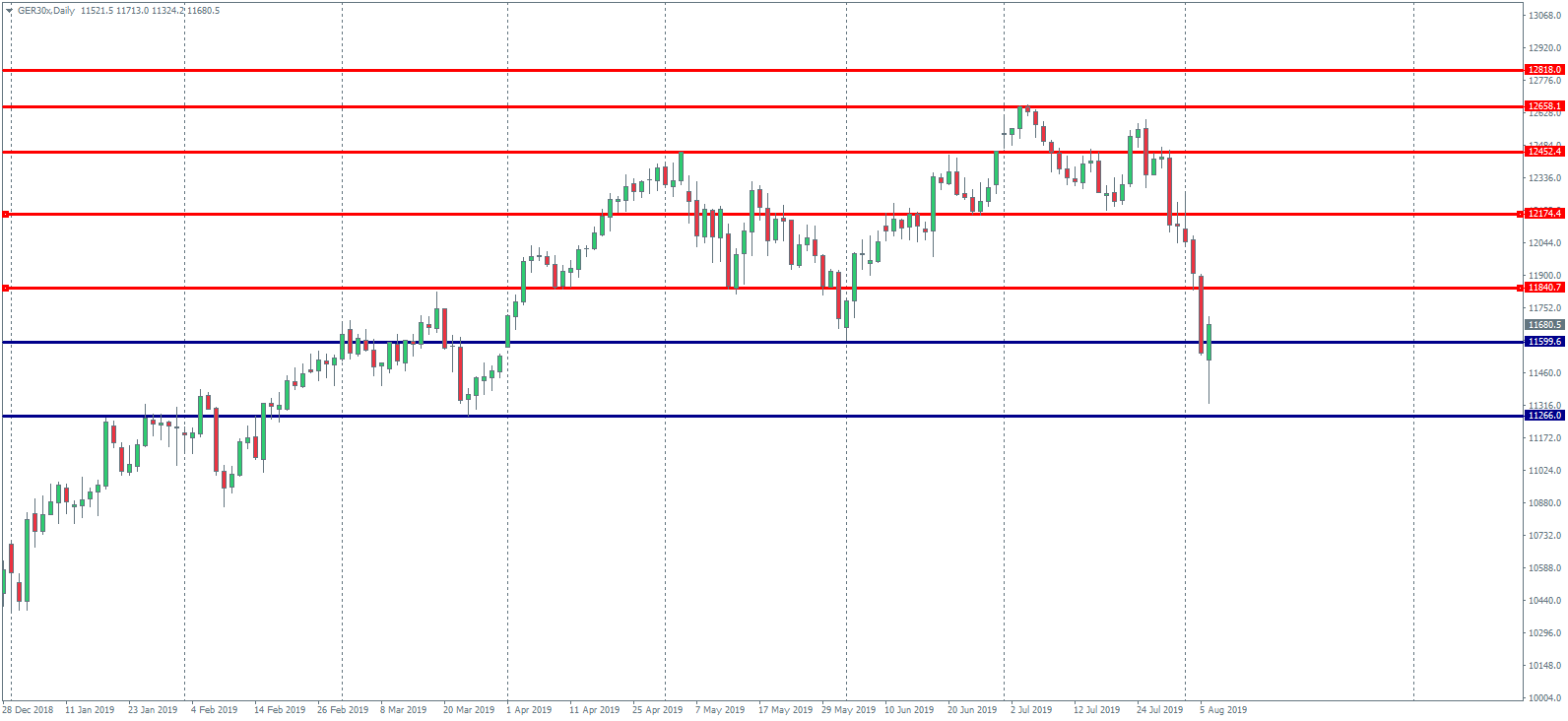

DAX

The sell off in the DAX has seen the index breaking through several key levels to trade its lowest price since March. From trading highs of 12658.1 just a month ago, the DAX has since reversed to trade current lows of 11324.5, having broken below the key 11599.6 level. Over the last 12 hours however, we have seen a strong reversal with price now fighting to hold above that level. To the downside, 11266 is the next key level to watch.

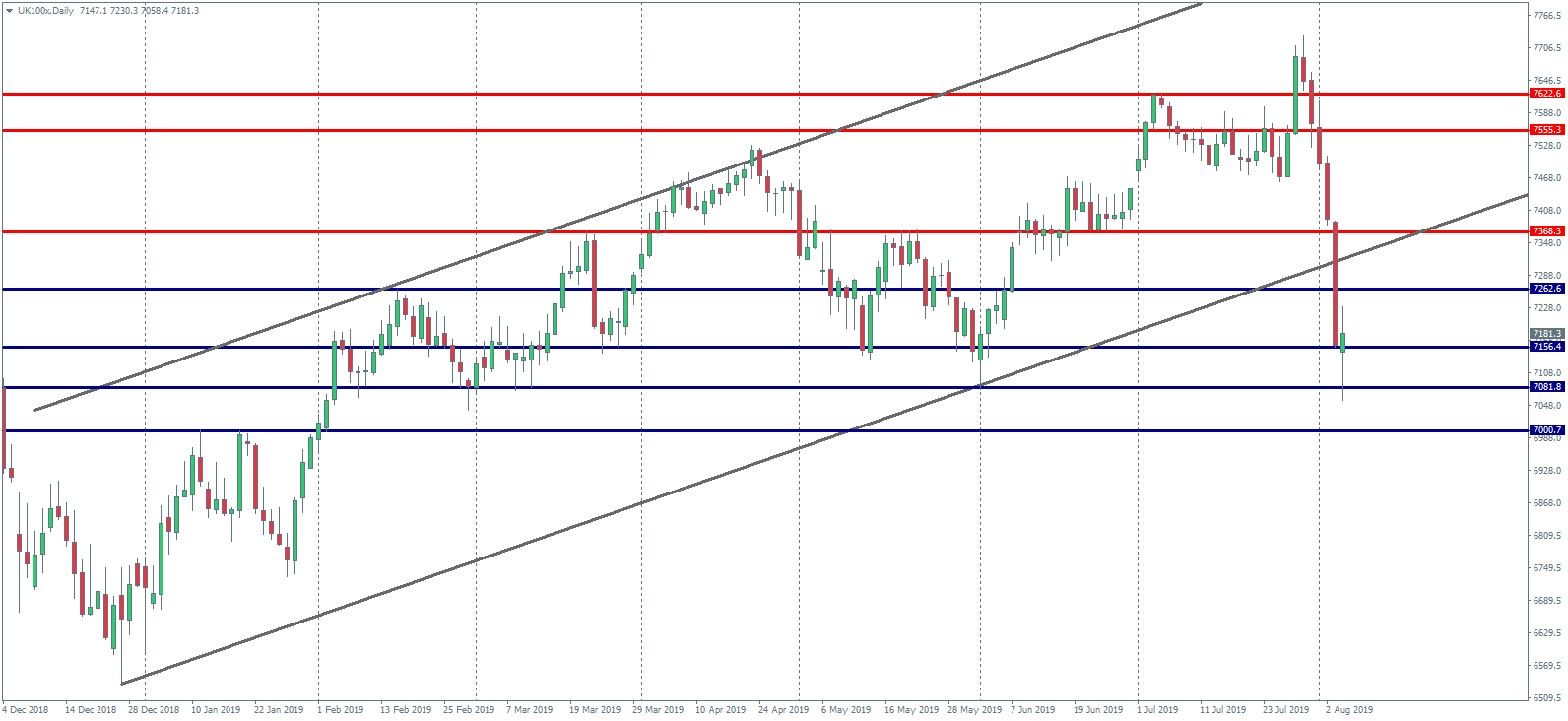

FTSE 100

The collapse In the FTSE over the last week has seen price breaking down through the bottom of the rising channel running from last year’s lows. The decline has run as low as 7058 before buyers stepped back into take price back up off lows. The market is currently fighting to hold back above the 7156.4 level. Below here focus remains on further downside unless we see price quickly back above the 7368.3 level.

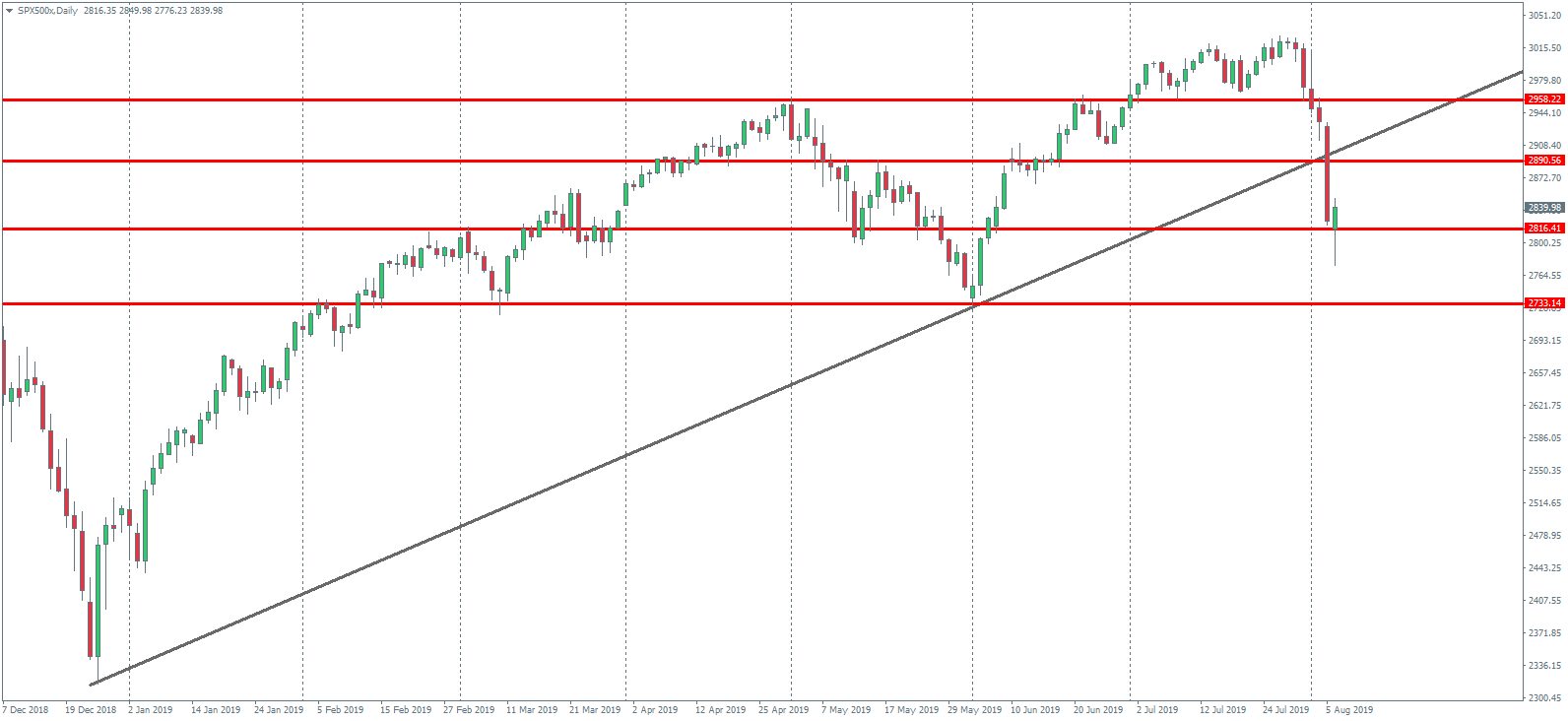

S&P 500

The breakdown in the SPX500 has seen price trading below the rising trend line from last year’s lows. Price has also broken below the structural level of 2890.56 and is currently testing deeper support at the 2816.41 level. Below here, the next level to watch is the May 2019 low around 2733.14 which will be a major pivot for the index.

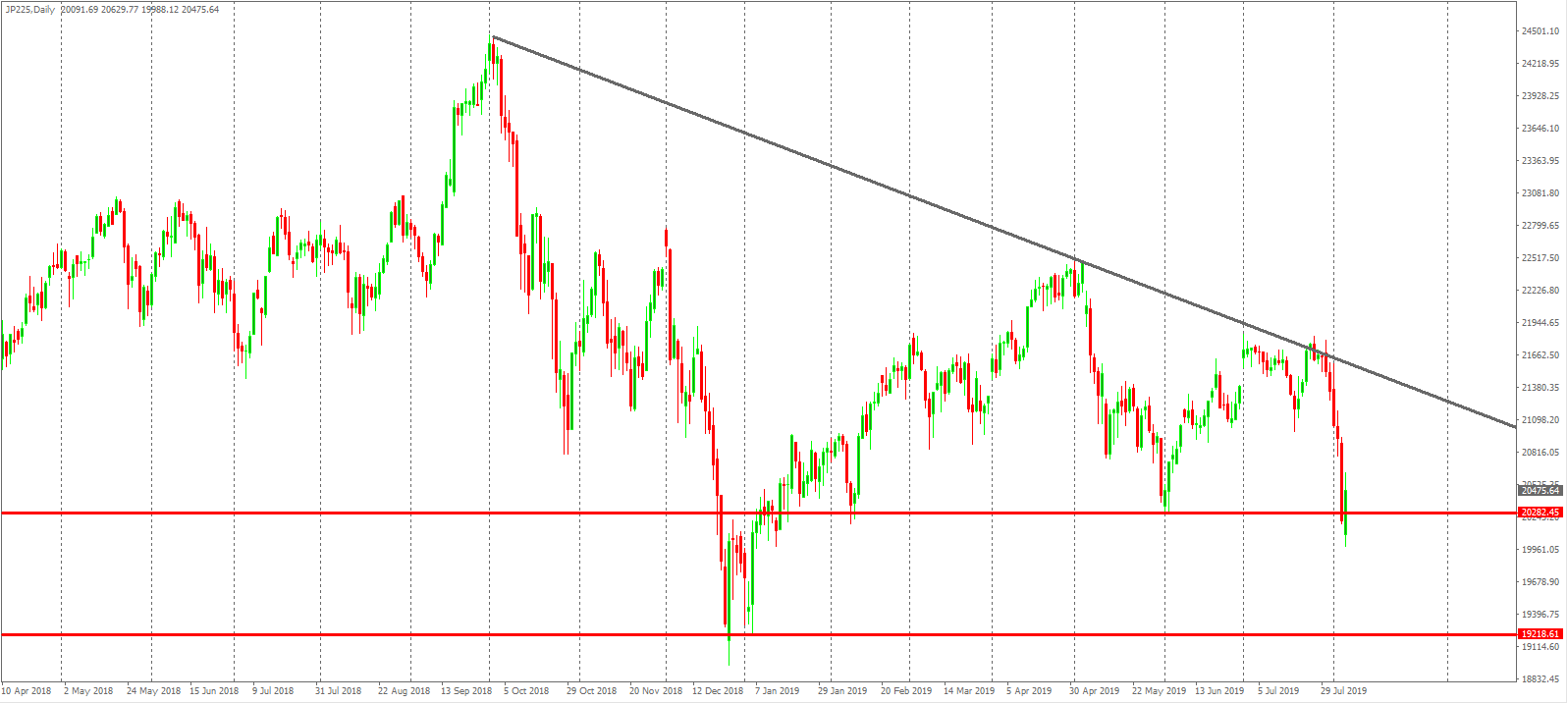

Nikkei 225

The collapse in Nikkei 225 has seen the continuation of the rejection from the bearish trend line from last year’s highs. Price briefly pierced below the 20282.45 level before reversing sharply to sit back above the level for now. If price breaks below here, the next key support is down at 19218.61.

Please note that this material is provided for informational purposes only and should not be considered as investment advice. Trading in the financial markets is very risky.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.