Will BOE Spark FTSE Rally?

BOE in Focus

The FTSE is trading a little higher today ahead of the BOE meeting. Price action has been muted this week as traders wait to hear the latest outlook and assessment from Bailey and co. Yesterday, UK inflation was seen falling back to the BOE’s 2% target for the first time in three years, down from the 11.1% highs recorded in 2022. On the back of the data traders will now be keen to see whether the BOE strikes a more dovish tone. No policy change is expected this month, ahead of the UK general election in July, so all focus will be on the voting split and forward guidance.

Guidance & Voting Key

The market is now widely expecting the BOE to begin easing in August and will be looking for a clear signal today. If seen, this should help drive FTSE higher near-term, weighing on GBP. Along with the guidance given, traders will be scrutinising the voting split. If we see any policymakers showing support for a cut this month, this will be firmly bullish for the FTSE as a sign of growing dovish sentiment within the bank. On the other hand, if the BOE plays its cards close to its chest today, with no shift in voting, and no clear timing signal in the outlook, GBP is likely to continue higher near-term creating headwinds for the FTSE.

Technical Views

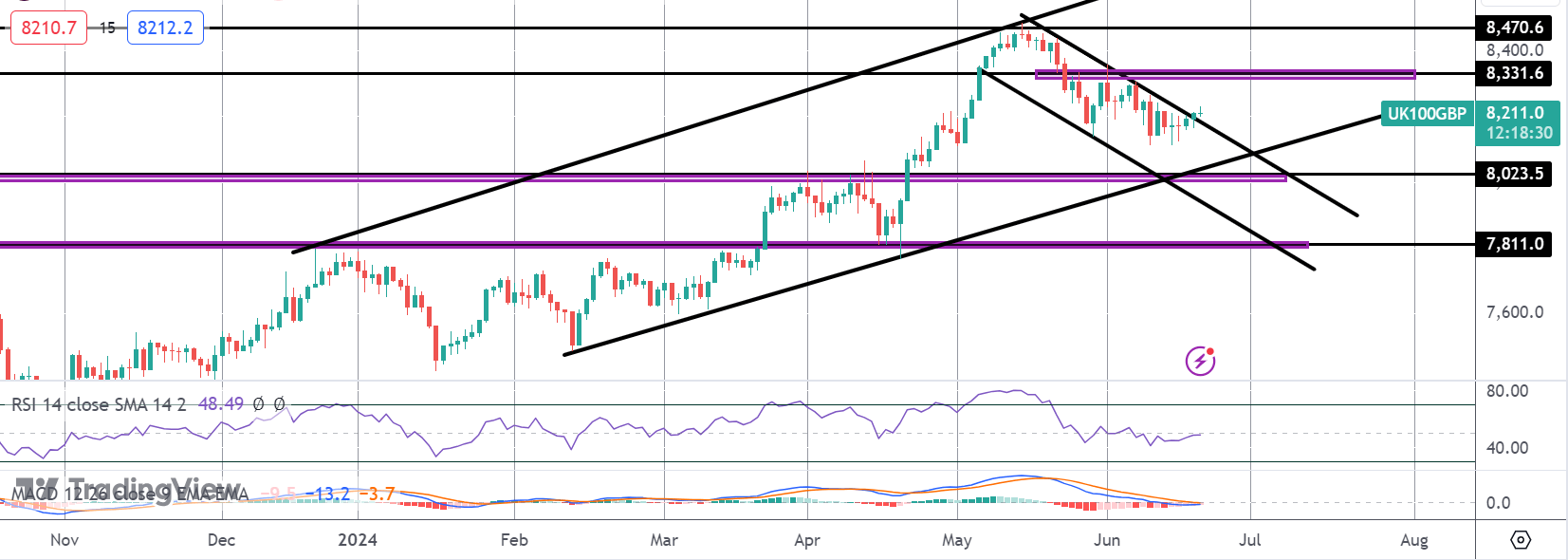

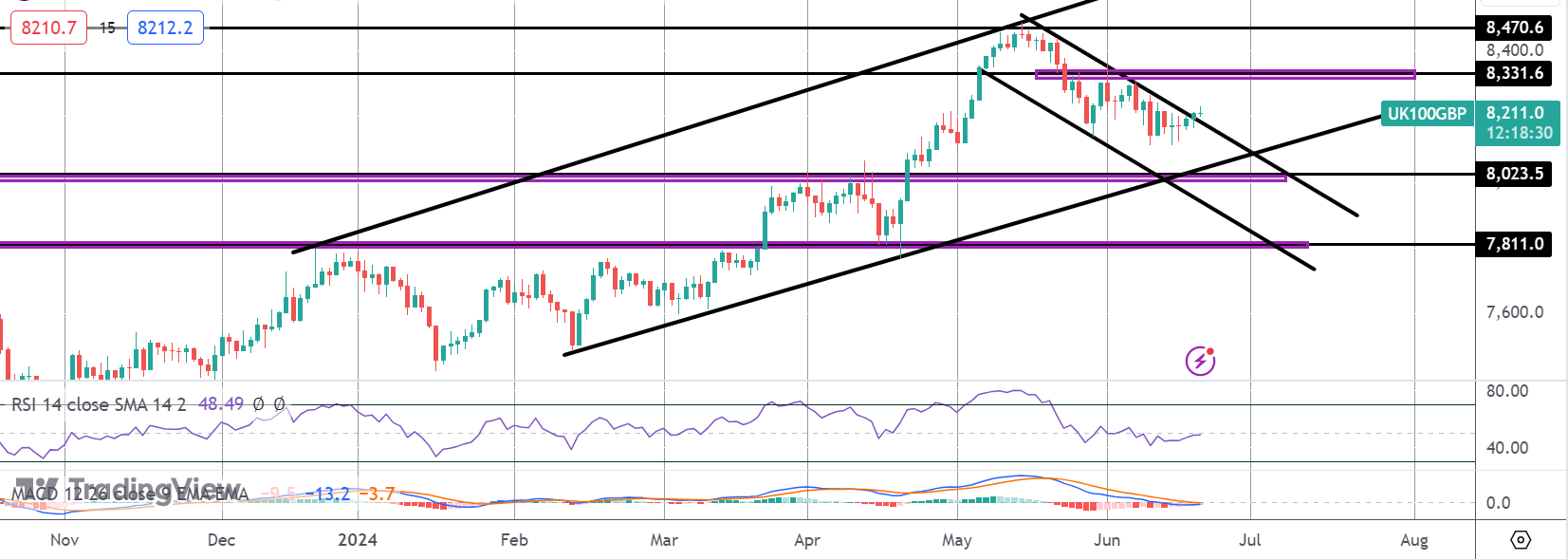

FTSE

For now the FTSE sits in the lower half of the bull channel off last year’s lows. Price is testing above the corrective bear channel highs and with momentum studies turning higher, focus is on a fresh test of the 8,331.6 level and a continuation higher. To the downside, the bull channel lows and the 8,023.5 level remains the key support area to note.

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

With 10 years of experience as a private trader and professional market analyst under his belt, James has carved out an impressive industry reputation. Able to both dissect and explain the key fundamental developments in the market, he communicates their importance and relevance in a succinct and straight forward manner.