SP500 LDN TRADING UPDATE 13/1/26

WEEKLY & DAILY LEVELS

***QUOTING ES1! FOR CASH US500 EQUIVALENT LEVELS, SUBTRACT POINT DIFFERENCE***

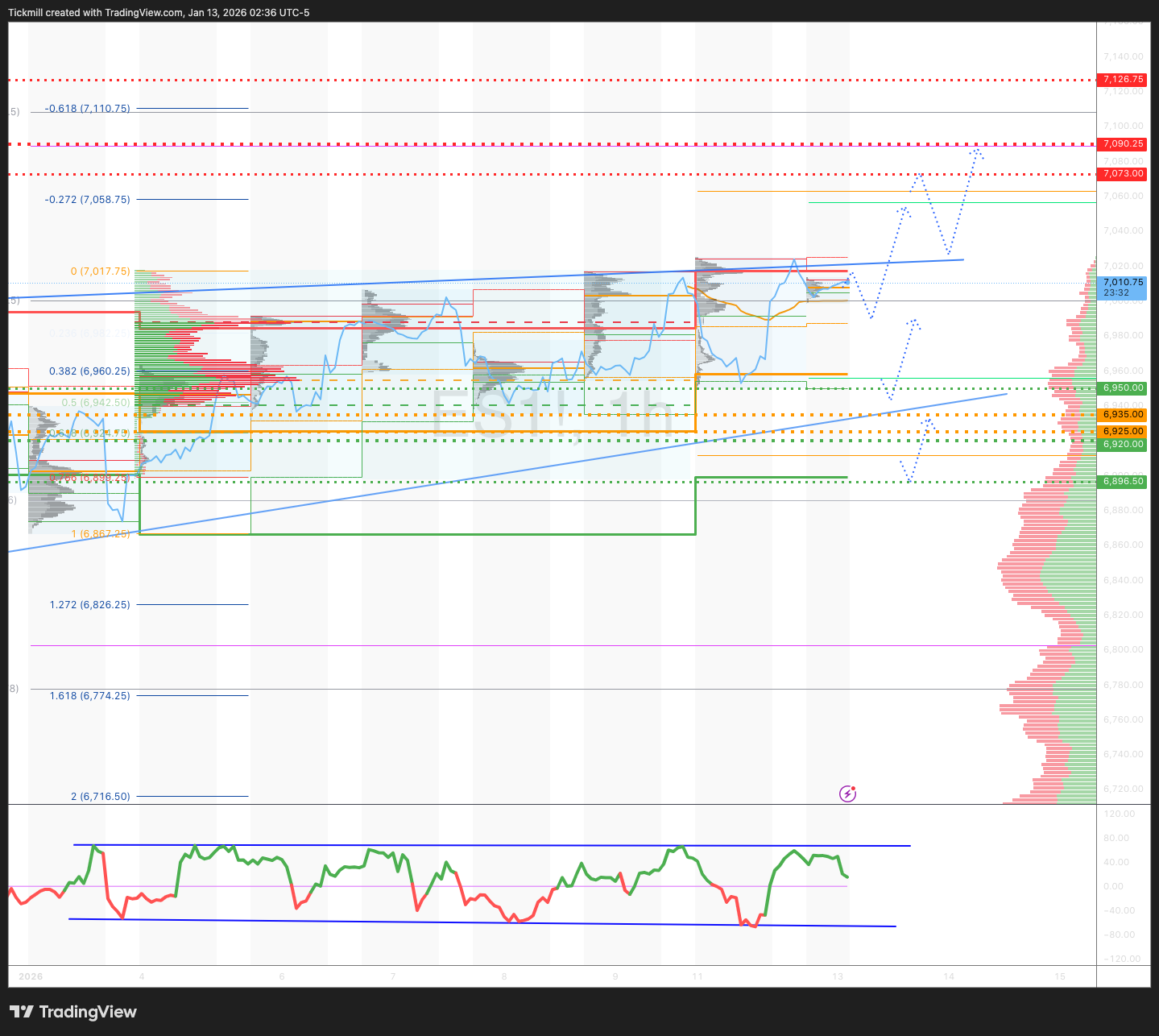

WEEKLY BULL BEAR ZONE 6925/35

WEEKLY RANGE RES 7090 SUP 6920

JAN OPEX STRADDLE 6661/7008

MAR QOPEX STRADDLE 6466/7203

DEC 2026 OPEX STRADDLE 5889/7779

WEEKLY VWAP BULLISH 6935

MONTHLY VWAP BULLISH 6861

WEEKLY STRUCTURE – ONE TIME FRAMING HIGHER - 6932

MONTHLY STRUCTURE – ONE TIME FRAMING HIGHER - 6775

The SPX aggregate gamma flip zone is around the 6880 level. There is a sharp increase in upside gamma starting at 6970 and above. Conversely, below 6770, the downside gamma becomes very steep.

DAILY STRUCTURE – ONE TIME FAMING HIGHER - 6968

DAILY VWAP BULLISH - 6984

DAILY BULL BEAR ZONE 6995/85

DAILY RANGE RES 7073 SUP 6950

2 SIGMA RES 7128 SUP 6896

VIX BULL BEAR ZONE 17.7

PUT/CALL RATIO 1.23

TRADES & TARGETS

PRIMARY PLAY - LONG ON REJECT/RECLAIM DAILY BULL BEAR ZONE TARGET DAILY RANGE RES

LONG ON REJECT/RECLAIM DAILY RANGE SUP TARGET DAILY BULL BEAR ZONE

SHORT ON REJECT/RECLAIM DAILY RANGE RES TARGET 7025 (ATH)

(I FADE TESTS OF 2 SIGMA LEVELS ESPECIALLY INTO THE FINAL HOUR OF THE NY CASH SESSION AS 90% OF THE TIME WHEN TESTED THE MARKET WILL CLOSE ABOVE OR BELOW THESE LEVELS)

GOLDMAN SACHS TRADING DESK VIEW - “CHOPPY (CONT’D)”

S&P rose 16bps, closing at 6,977, with a Market on Close (MOC) imbalance of $1.45bn to SELL. NDX gained 8bps to 25,788, R2K increased 44bps to 2,636, and the Dow climbed 17bps to 49,590. A total of 17.24 billion shares traded across all U.S. equity exchanges, compared to the year-to-date daily average of 16.96 billion shares. VIX surged 435bps to 15.12, WTI Crude added 69bps to $59.53, the U.S. 10YR yield rose 2bps to 4.19%, gold jumped 184bps to 4,593, DXY dipped 22bps to 98.91, and Bitcoin advanced 82bps to $91,372.

HEADLINE AFTER THE BELL:

Trump Announces 25% Tariff on Trade with Iran

@realDonaldTrump: “Effective immediately, any country doing business with the Islamic Republic of Iran will pay a 25% tariff on all business conducted with the United States of America. This order is final and conclusive. Thank you for your attention to this matter!”

Market Recap:

The session started off busy, with the Consumer Finance sector sharply lower (GSFINCON -540bps, a 2.7 sigma move) following President Trump's announcement of a one-year 10% interest rate cap on credit card loans. Credit card exposure breakdown: BFH, SYF, AXP (95%-100%), COF (~60-65%), C (~25%), JPM (high teens), BAC (high single digits), WFC/USB (high single digits), and other regional banks (low single digits). Early trading saw short supply, but flows stabilized later in the session. The market is now focused on the next developments, with January 21 flagged as a key risk date.

Tomorrow marks the start of Financials’ earnings season, with JPM and BK reporting in the morning, followed by BAC, C, and WFC on Wednesday. Consensus estimates S&P 500 EPS growth of 7% year-over-year for Q4 2025, though we project 12% growth, reaching $305, driven by 7% sales growth and 70bps margin expansion.

Consumer Discretionary stocks rebounded despite lackluster updates from ICR and some rotation back into defensive names. Positioning remains light, preventing significant downside for the sector, while the upcoming tariff deadline on Wednesday may also be discouraging short selling. Housing and other defensive sectors outperformed (e.g., consumables, broadlines, discounters, auto parts, grocers, staples), while softlines (impacted by ICR updates) and credit card-exposed names (hotels, airlines, department stores) underperformed.

Trading Desk Activity:

Our floor activity was moderate, rated a 5 out of 10. The floor ended the session +97bps to buy versus a 30-day average of -55bps. Outside of the key news areas, flows were relatively calm. Long-only funds were slight net sellers (mainly in macro products), while hedge funds were net buyers (~$1.5bn), driven by covering in financials and macro, offset by supply in communication services.

Economic Data Preview:

CPI data is due tomorrow. We forecast a 0.35% increase in December core CPI (vs. +0.3% consensus), corresponding to a year-over-year rate of 2.78% (vs. +2.7% consensus). Headline CPI is expected to rise 0.37% (vs. +0.3% consensus), reflecting higher food (+0.55%) and energy (+0.2%) prices. Our projections align with a 0.30% increase in December core PCE. GS Economics now anticipates two 25bp Fed rate cuts in June and September (previously March and June), bringing rates to 3-3.25%.

Derivatives Market:

Flows were steady ahead of tomorrow's CPI and Wednesday's PPI and potential IEEPA ruling. Volatility eased as markets bounced off the lows and futures turned positive. Despite Powell's negative overnight commentary, there was little appetite for hedging. Dealer gamma remains significantly long at current levels, with exposure shortening on a ~1% market move up or down. The straddle for tomorrow priced at ~45bps, extending to ~98bps by the week's end. (h/t Shayna Peart)

Disclaimer: The material provided is for information purposes only and should not be considered as investment advice. The views, information, or opinions expressed in the text belong solely to the author, and not to the author’s employer, organization, committee or other group or individual or company.

Past performance is not indicative of future results.

High Risk Warning: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 72% and 73% of retail investor accounts lose money when trading CFDs with Tickmill UK Ltd and Tickmill Europe Ltd respectively. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Futures and Options: Trading futures and options on margin carries a high degree of risk and may result in losses exceeding your initial investment. These products are not suitable for all investors. Ensure you fully understand the risks and take appropriate care to manage your risk.

Patrick has been involved in the financial markets for well over a decade as a self-educated professional trader and money manager. Flitting between the roles of market commentator, analyst and mentor, Patrick has improved the technical skills and psychological stance of literally hundreds of traders – coaching them to become savvy market operators!